I spend a lot of time looking through technology news. It comes with the territory of being a financial newsletter writer. It’s even more important when talking about looking to the future to find your next triple bagger gain.

I for one didn’t need any more convincing that technology would not only be the cornerstone of future life, but a great way to make money in the stock market going forward. But, for anyone that did, those doubts should be more than quashed by the state of society the past twelve months.

I have readers all over the globe and of all walks of life. Some of you are still experiencing shutdowns or new rounds of restrictions. One thing for sure is that each and every one of you has seen technology use explode even when parties involved are resistant. And in turn, those stocks have done extremely well.

I’ve been pounding the table about new and exciting technology, and you all have seen the gains. But today, we’re taking a step back to the essentials. We’re looking at a cornerstone to our society. Without them society would collapse. And this cornerstone is in desperate need of an upgrade.

I’m talking about mission-critical communication networks. The backbone to monitoring rail or sky, protecting citizens (first responders) and responding to disasters. Even something as “simple” as utilities. These systems cannot afford downtime or interference.

These functions require security and performance restriction and in turn require private wireless networks that are separate from the public internet.

These private mission-critical networks have continued to evolve at the same rapid pace as the rest of technology. This has all caused a strain on the capacity of many existing infrastructures. Just take a look at a few examples from last year.

In June, several emergency service systems went offline including Arizona’s 911 system. In September, there were 911 outages across 14 states for about an hour. In the same month, service on the San Francisco area BART was shut down for about four hours because of a failure of one of a dozen field network devices.

Faulty communication was the cause of a handful of train accidents. And at one-point last year T-Mobil introduced a new network router and caused 23,621 emergency calls not to connect to 911.

That doesn’t even cover the smaller instances that don’t make the news. A glitch in a utility network might only cause an outage for a small geographical area. But even a small glitch could cause catastrophe and even casualties.

Think about the downtime and latency that you sometimes experience on your cellular device. Although it’s inconvenient when you can’t see the exact location of your UberEats driver, it won’t result in mass fatalities as latency in a trail monitoring system might.

The global mission-critical communication market was worth $13.6 billion in 2018. By 2025 this market is expected to reach $26.6 billion. However, this market is seeing the same issues that other network providers are.

You’ve probably seen me talk about the spectrum auctions associated with the expansion of 5G integration. I’ve mentioned that full integration of 5G will improve both speed and latency, but the only way to do that is to procure certain bands.

The oversubscribed LTE 4G/ 5G/ WiFi based consumer wireless networks are actively fighting over new spectrum bands and the winners from the most recent round will be announced soon. The most recent round of auctions resulted in bids totaling over $81 billion.

Sure, Verizon might be able to keep shelling out that kind of money, but many private networks can’t.

These mission-critical networks are actually limited to very low bandwidths and often capped at serial modem data rates of 9,600 bits per second. They are slow and narrowband. This creates a significant bandwidth gap for the advanced data applications needed.

That means, there is a critical need in society…and it turn the markets for a company that can solve this problem that’s only going to get worse as data demand increases. Take a look at the potential here:

These private networks are large and established. And the company that I have for you today has the first and only software solution for the problems arising in this industry. It can take theses already existing narrowband networks and can enable them to support mission-critical Internet of Things applications. All without hardware upgrades or procuring more spectrums.

No, I didn’t make that catchy phrase up. That’s the slogan of Ondas Holdings Inc (NASDAQ: ONDS).

The company was founded in Silicon Valley by highly experiences telecommunications executives and was formerly known as Full Spectrum Inc. It is a wireless networking company that designs and manufactures its software defined radio (SDR) platform for mission critical applications.

This technology supports IEEE 802.16s which is the worldwide standard for private licensed wide area networks.

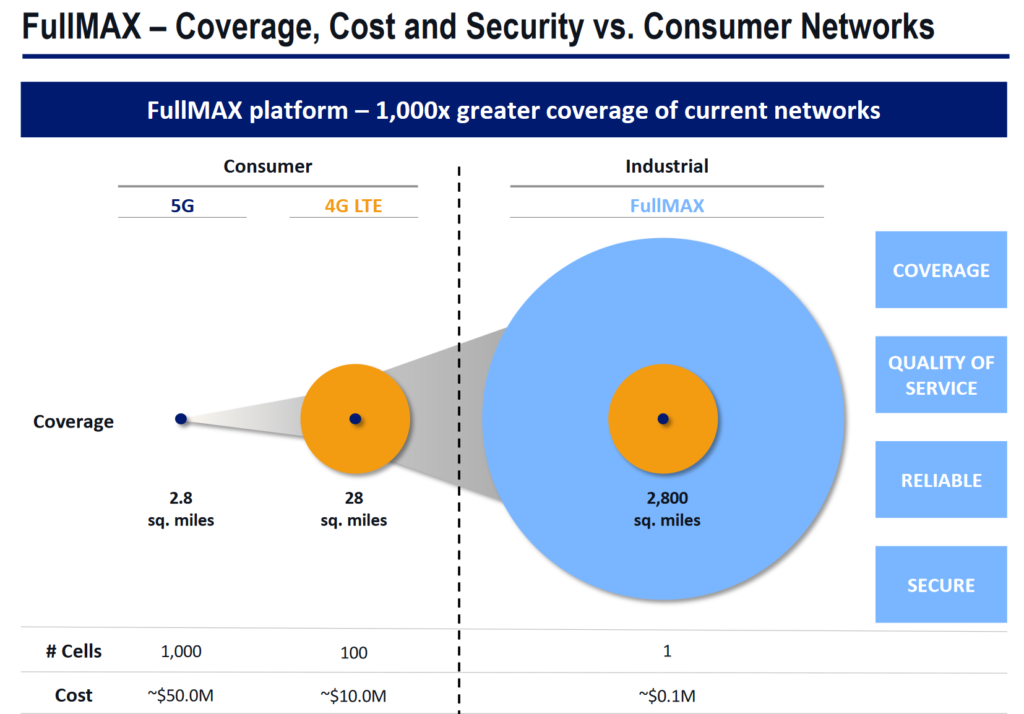

Ondas uses its FullMAX Software Platform to utilize existing networks and lower cost radio spectrums. The result is broadband that can handle mission critical IoT applications for these key markets. The bonus is that the result is more reliable and has better coverage.

Ondas has 6 patents already issues in the US and 7 more pending. Plus, it has 1 pending internationally. This means that its working to have the stranglehold on this market and it’s already grabbing the strategic partners to launch it into reality.

Siemens Mobility has already entered into an exclusive partnership with Ondas Networks to bring a Siemens-branded portfolio if its wireless radio communication systems to the North American rail market.

The North American rail network consists of 140,000 miles of track and over 25,000 locomotives. Plus, the FCC has set forth a requirement that their networks be upgrades by 2023.

Siemens Mobility is a managed company of Siemens AG that enables mobility operators worldwide through digitalization. This partnership will play a key role in building up rail’s intelligent infrastructure and validates the potential of this technology.

This mission-critical Internet of Things architecture is designed to meet the demands of low latency, high reliability, availability, and security. This plays a key role in building up rail’s intelligent infrastructure. And the results can be faster trains while still having safer rails. That gives railroads the ability to increase productivity by over 5% which could mean $4.5 billion in additional revenue.

The software also has the potential to unlock the full potential of the commercial drone markets. By 2025 the commercial drone market is expected to generate over 12.5 billion in global revenue.

When it comes to the integration of drones into the economy, the real roadblock is the FAA. Aura Network Systems is working to develop and manage an FAA- approved nationwide drone navigation platform. And it has chosen to partner with Odnas. Its software is the ideal solution to support the needs of a commercial network while being efficient with every piece of spectrum being used.

This utilization of the Odnas software is the differentiation that has positioned Aura Networks to potentially be the first nationwide commercial drone network.

On top of all of these practical everyday applications, the company also has Ondas Mobile Van solution which can provide temporary private wireless network for emergency communications.

It’s clear that there is a clear problem and that Odnas has the unique. Now it’s just a question of can we make money as investors.

Odnas has three main streams of income. First, we’ve got actual system sales. The company has already proven that is can secure large deals with big blue-chip customers. Also included in system sales is the lucrative, high margin world of post-deployment expansion.

Next, is the SaaS (software as a service) and system maintenance portion of revenue. Since these networks are mission critical, they tend to have a long life of at least 15 years. Last, is annual licensing to ecosystem platforms.

This monetization model ensures that the company is set up to profit as the adoption cycle is accelerating. And that will be gains for investors…in the future.

I do want to be completely transparent about this pick before you add it to your portfolio. The company lacks meaningful revenue.

For the quarter ending September 30, the company saw revenue of $614,026. That was up 596% compared to the same quarter of the previous year. After cost of goods sold, that $614,026 was only a profit of $248,163.

Take out administration, sales, marketing, R&D. And the result was an operating loss of $2,733,111. The positive is that is an improvement over the previous year. In reality this is exactly what we would expect from a company at this point.

Investors are going to expect these numbers to keep improving every quarter. If there’s even the slightest hint that revenue isn’t progressing forward, we could see large gyrations in share prices.

Shares are currently trading around $12.70. That’s up 9% in the past 60 days. Over the past two years shares have been as high as the $19.50 and as low $3.75 once adjusted for splits.

I don’t think that we’re going to see movement of that much these days. But it might not be a straight ride up. All that being said, now is the perfect time to add Ondas Holdings Inc (NASDAQ: ONDS) to your portfolio.

Action to Take: Buy Ondas Holdings Inc (NASDAQ: ONDS)