When it comes to using 5G, the upgrade will be unlike anything we’ve ever seen before.

At 600 times faster than what currently exists, the new system will allow you to download a movie while you stand in line at the store in a matter of three seconds instead of the six minutes it takes now.

And yet all of that instant connectivity is just a nice preview to what 5G is really making possible.

I’m talking about the realization of lifelong technological ambitions here and the formation of new dreams that will utterly transform how we live.

Right now, there are 25 billion 5G smart sensors being embedded in streets and buildings to prepare the way for the new standard.

These tiny sensors gather and report small amounts of data – say, to track car parking, enhance traffic flow on crowded city streets, or detect brush fires in national parks. And they’ll be key to living a more connected life enabled by smart devices like those necessary for connected cars, homes, and even cities.

But this upgrade is not just about speed and connectivity.

It’s also about latency, the time it takes for your data request to reach a server and then come back to you.

When it’s slow, you wind up getting that loading symbol on your phone… and wait… and wait for a connection.

With 5G, you’ll be able to get an instant Wi-Fi connection almost anywhere. The tech will reduce latency from a 100 millisecond lag to one millisecond.

That frees up instant access while you’re on a train, out at sea on a boat, in a packed football stadium, or on a plane soaring overhead.

Imagine communicating live and in person through 3D hologram video calls – the very stuff of Star Wars movies.

Or what about recruiting a big-city physician to perform surgery on a patient located thousands of miles away in a remote, rural area in real time?

The U.S. government recognizes the critical importance 5G technology will have to our nation’s future competitiveness, and has allocated $20 billion to make it happen.

Apple just spent $1 billion to buy Intel’s 5G modem business so it can build its own 5G phones.

And big-league investors, even billionaires like Bill Gates, are jumping into the 5G infrastructure plays that could turn into the tech giants of the future. Gates just bought himself 5.3 million shares of a little-known 5G cell-tower company because he, too, sees the future is with this tech.

Make no mistake. This is shaping up to be the biggest wealth grab since the lightbulb. Even a small stake of $500 or $1,000 could turn into the biggest gains you’ve seen in your life.

Of course, 5G is happening around the world and set to soar on the international stage.

That’s because the 5G rollout is not just in the U.S. It’s happening right now in South Korea, China, Japan, Canada, Mexico, and Europe. They’re spending hundreds of millions, at the low end, on 5G.

The opportunities for investors are absolutely astounding if you know the right plays to make.

What I’m about to show you is a comprehensive analysis of the best stocks for the final phases of the 5G Boom.

These are pure-plays that could reap 1,000% or higher windfalls to investors getting in on the ground floor.

This revolutionary technology is making real technologies that could only be dreamt of a few decades ago.

Then there are the firms that are delivering a new “smart world.” I’m talking about the company setting up the “Internet of Things” with connected cars, smart homes… even the connected cities and airports of the future. As 5G gets underway, these stocks could explode 1,000% or more. For these final phases, you’ll want to get in right before the profits — and no sooner.

Phase 2 Profits will go the companies that help make the new phones, and this company I’m going to reveal has a unique proprietary technology that will be inside every single 5G phone.

What to Know: Marvell Technology Group Ltd.is a leading supplier of infrastructure semiconductor solutions.

In other words, the company’s new “system on a chip” will be inside almost every new 5G phone on the planet.

It already has clients that are a “who’s who” of the 5G world, like Apple, Comcast, Cisco, Qualcomm, Sprint, T-Mobile, AT&T, IBM, and Twilio.

And the upside looks bright for Marvell as well, particularly as it grows in the 5G market with an expanded partnership with Samsung Electronics Co., Ltd., to develop and launch of multiple generations of radio and control plane processors.

Marvell offers a wide range of storage products, including hard disk drives and solid-state drive controllers, as well as many components for hard disk drives. In fact, the firm recently announced one of its largest customers, Toshiba Corp., included its hard disk drive controller and preamplifier into the Toshiba portfolio.

Crucial to its work on 5G, Marvell also offers networking products, such as single-chip network interfaces, and connectivity solution, like Wi-Fi system-on-a-chip products.

Marvell’s recently introduced a suit of new Ethernet switches that are designed to help data centers adapt to the massive amounts of data required to run technologies on 5G, like machine learning, artificial intelligence, edge computing and the Internet of Things (IoT).

Marvell’s flexible software products do away with the need to physically configure hardware, while it helps these data centers reduce their power consumption and enable low latency.

By the Numbers: In its last quarter of fiscal 2019,Marvell’s enterprise Ethernet switch products helped its networking business climb 69%, year-over-year, to $387.5 million. Zion Market Research sees the global industrial Ethernet market will expand by double digits to reach $59 billion by 2022.

Marvell has a market cap of about $13 billion, and in its latest reported quarter, saw a 21% jump in sales to $745 million. And there’s no end in sight.

Now, because of the massive demand for 5G around the world – I expect the Phase Three gains to come extremely soon after Phase Two.

Phase Three will introduce the Internet of Things (IOT), and this is where it gets really exciting.

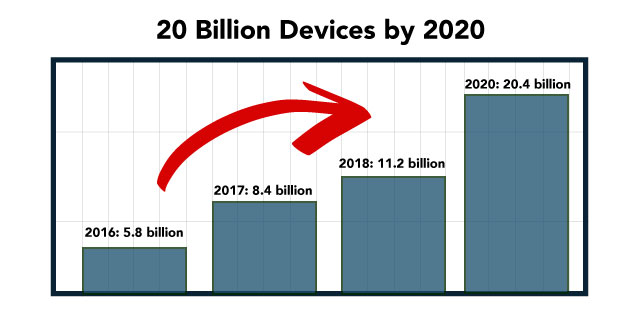

I’m talking about over 20 billion devices connected to the internet by 2020.

And these devices will be made by companies who will use the 5G network to provide new services like drone delivery, self-driving cars, robotic surgeries and so much more.

The Phase 3 company I’m going to reveal is the best pure play for the IOT.

What to Know: Adesto Technologies Corp (, is the leading global provider of advanced semiconductors and embedded systems for the Internet of Things (IOT).

The firm already has more than 5,000 customers worldwide who are building out the latest connected solutions across industrial, transportation, consumer, medical, and communications markets.

Founded in 2006 in Silicon Valley, Adesto focuses on helping its clients scale their IoT solutions, from the chips for the edge devices themselves to the servers, gateways, and connectivity.

In short, Adesto’s IoT technology allows customers to connect their legacy industrial networks to wireless networks of the future.

Its products show up in everything from smart meters for gas, water, and electric to consumer-focused wearables, Bluetooth-enabled wireless ear phones, and the connected medical devices that monitor patient outcomes.

Adesto also develops custom chips used for genetic sequencing, industrial power drives and controllers, augmented reality devices, broadband communications, video conferencing, and satellite modems.

And it’s already assembled an impressive list of customers, including Amazon.com Inc., Honeywell International Inc., Roku Inc., Garmin Ltd., Samsung Electronics Co. Ltd., Broadcom Inc., and Johnson & Johnson.

By the Numbers:As the IoT industry ramps up with the buildout of 5G,Adesto’s revenues have soared 89% over the past three years, climbing from $44 million in 2016 to $83 million.

The firm’s 2018 purchase of industrial and commercial networking pioneer Echelon Corp. has already translated into ramped-up sales for Adesto, which saw $28.1 million in fourth-quarter 2018 revenue, up nearly 74% from the year prior.

Full-year revenue in 2018 reached $83.5 million in 2018, up 48.8% from the year prior, while gross margins topped 46%.

Looking ahead, the synergies realized by acquiring Echelon are helping Adesto mitigate its expected first-quarter seasonal slump, and it expects to see 76% higher revenues than a year ago.

By the end of 2019, the firm believes it will earn about 30% more than it did during the same time frame in 2018, which could be an underestimate for this IoT grower.