Mullets? Neon’s? Windbreakers? Popped Collars? All accessories that probably aren’t in your regular wardrobe rotation. However, you might have them stuffed into the back of your closet for your next eighties themed party.

We’re not going to argue that most of these things should be left back in the 80s. But there’s one accessory that three college kids turned into the next IT industry trend.

We’re talking about the pager.

The first pager like system was used by the Detroit Police Department in 1929. And 20 years later pagers would find their niche when used in New York City’s Jewish Hospital.

Motorola took this idea and ran with it to consumers. They coined the term pager 1959 even though the first consumer pager wouldn’t be widely available until 1974.

At the beginning of the 80s there were 3.2 million pager users worldwide. And by 1994, 61 million pagers were in use. But that’s about as popular as pagers would get.

By 1998, the first downloadable ringtones were available for cell phones…and pagers became a way of the past.

Today nearly 8% of hospitals still rely on pagers. Meaning that the only place you’ll find pagers are on hospital staff and waiting for a table at the Olive Garden.

Just because physical pagers are a thing of the past, doesn’t mean that the need for pager-like systems is completely gone.

In 2009, three University of Waterloo software engineering graduates realized that this 80s trend was the key to making life easier for IT professionals.

A Missing Piece of a $3.9 Trillion Industry

The Information Technology department hasn’t always gotten the respect that it deserves. What used to be a few guys troubleshooting your PC is now driving companies into the future.

Leading research company, Gartner predicts that worldwide IT spending could cross into $4 trillion territory next year. Yes, that’s trillion with a t.

This is largely driven by cloud-based offerings which are the key for companies to cut costs and invest for growth simultaneously.

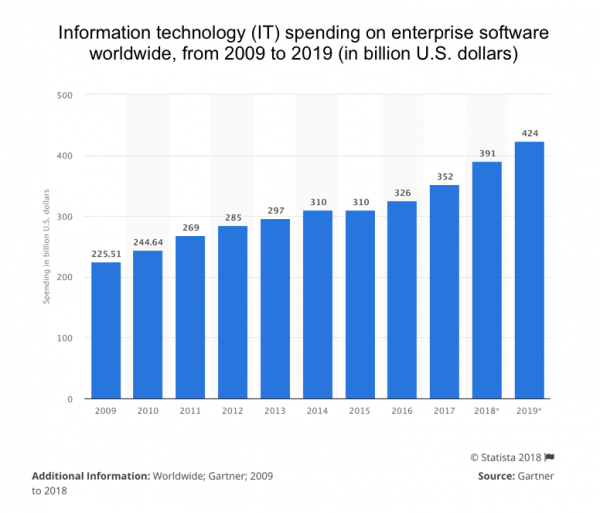

The fastest growing category? Enterprise software.

In 2019 alone, over $400 billion was spent just on enterprise software. And it’s expected to keep growing at 10% for at least the next two years.

Enterprise software is aimed at the needs of an organization rather than an individual. The three main types are customer relationship management, supply chain management and enterprise resource planning.

Each requires collecting thousands of pieces of data and using them to improve logistics and productivity. An added side effect of improved productivity is usually improved employee happiness and work life balance.

This software becomes even more integral to a company when its workforce is spread out…potentially all over the world.

It’s estimated that 56% of the US workforce hold a job that is compatible with remote work.

Before the Coronavirus pandemic, less than 5% of the employees worked at home more than half-time. And although the demand for flexibility has been building for decades, the Coronavirus pandemic pulled the trigger for many companies.

Instead of shutting down completely, they sent employees home with Microsoft Teams and Zoom to continue collaboration. A genie has been pulled out of the bottle and may not be able to be put back.

Global Workplace Analytics estimates that 25-30% of the workforce will be working from home multiple days per week by the end of 2021.

Even if companies don’t continue to use work from home procedures, they will make sure systems are in place if need be.

This situation makes communication with employees even more important. And it means that companies are looking for software that is fully integrated to provide the right information at the right time.

Companies that don’t adapt will be left in the dust.

There’s never been more incentive for companies to accelerate their digital transformation.

That’s where our young graduates Alex Solomon, Andrew Miklas and Baskar Puvanathansan come back into the picture.

“Paging” Employees Before A Problem Occurs

In 2009, these three had the idea to gather data, combine it with artificial intelligence and connect it with the ability to send alerts to necessary staff members.

PagerDuty (NYSE: PD) has the mission of connecting teams in real time by being the central nervous system of an organizations enterprise software.

What makes PagerDuty different is its unique combination of human and machine data that makes it reactive, responsive, proactive and preventative.

The company mines machine data and human response data so that the software learns from every incident. This not only allows for the identification and prioritization of alerts, but the company can also begin to anticipate issues before they even happen.

That’s how it helps its clients accelerate their digital transformation at scale.

It harnesses digital signals from virtually any software-enabled system or device. This could be point-of-sale systems, manufacturing equipment, financial software.

PagerDuty then analyzes all that data using artificial intelligence combined with human response data. From there it can be prioritized and turned into actionable advice. The right people can then be “paged” to take action.

All of this happens in a matter of second.

It’s not reinventing the wheel, but instead bringing it all together.

PagerDuty has over 350 existing integrations. That includes Salesforce, Shopify, Cisco, and DocuSign. It even recently announced that it’s compatible with Microsoft Teams.

So, what does that mean for clients?

It means there is finally a way to collect data from all the miscellaneous systems throughout a company and turn it into something useful.

Because of these integrations, PagerDuty has broken out of strictly IT functions. It’s moved into crisis management, frontline healthcare, worker notification, supply chain operations management.

The company has over 13,000 customers with over 500k users. This includes customers such as LabCorp, NBC Universal, PGA Tour, TD Bank and Domino’s Pizza.

Another extremely satisfied customer is American Eagle Outfitter (AEO).

AEO is a multi-brand specialty retailer of apparel and accessories for both men and women. The company operates more than 1,000 stores all over the world and ships online order to 81 countries. Plus, its AEO and Aerie merchandise is also available at more than 200 international locations in 25 countries.

That means there are 1,000 point of sale systems that could go down at any point in time, online shoppers in every time zone, and a massive supply chain that needs to stay organized.

That’s just a quick look at the operations to oversee. There’s so much more to it.

The management is extremely satisfied with the integration of PagerDuty.

Matt Kandra, Sr. Manager of Production Support at American Eagle touts “From our perspective and for our needs, Pager Duty has the most advanced and streamlined tools on the market.”

He also explains about how PD allows alerts to get into the hand for the right staff. Prior to the implementation all these alerts were going to a single email box. Then hopefully the right email was seen by the right person so that it would get handled in a timely fashion.

By using PagerDuty, machine learning can pick up on potential failures before they get out of hand.

Plus, it makes implementation of an on-call system incredibly easy. The right staff is alerted in a timely fashion. Plus, employees are only alerted in the middle of the night if an incident requires immediate attention.

It’s a $1.8 billion company that’s more than happy with PagerDuty’s software.

And happy customers are more likely to renew.

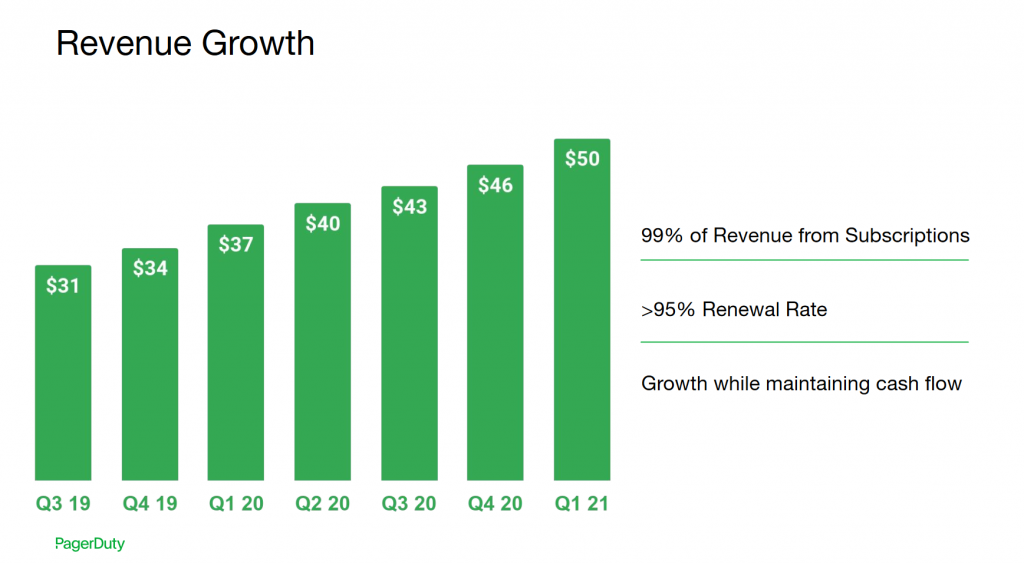

As seen in the above slide from PagerDuty’s most recent investor presentation, 99% of revenue is from subscription. That’s not an issue since the renewal rate is over 95%.

In fact, companies that use a subscription model tend to have more solid revenues since many times these revenues are locked in for a certain amount of time.

So, why haven’t share prices skyrocketed leaving us in the dust?

A Bumpy Ride Creates Opportunity

Many investors have learned that a solid idea doesn’t necessarily make it a good investment.

That’s especially true when a company doesn’t have a longstanding record of historical share prices.

The company went only went public in April of last year…and shareholders who got in at the beginning haven’t had the greatest luck.

Shares have gone nowhere. But that’s not uncommon for a technology company 15 months after IPO.

In order to get a better understanding of the opportunity, we have to look at the financials. Revenue for 2017 was $79.6 million…then $117.8 million for 2018 and $166.4 for 2019.

That’s an increase of 48% and 41%. Not too shabby.

Analysts estimate that 2020, 2021 and 2022 are all set up to see revenue increases of at least 28% as well.

For the first quarter of fiscal year 2021, revenue increased to a record $49.8 million. Meaning the company could well be on track to see $200 million for the year.

This doesn’t mean that the rest of the year will be smooth sailing.

The recent pandemic may cause some slowdowns. Some enterprise customers will have no choice but to pause expansion deals. And some of PagerDuty’s smaller clients may be feeling financial strain.

But a slowdown doesn’t mean shutdown.

Demand for enterprise software is going nowhere but up. And as PagerDuty continues to expand it capabilities, it’s sure to solidify its spot as a leader in the industry.

Action to Take: Buy shares of PagerDuty (NYSE: PD) at market up to $45 per share before the market catches on.

RF Industries (NASDAQ: RFIL) is a national manufacturer and marketer of interconnect products. The management announced its second quarter results on June 11th. Net sales were $10.4 million which was a decrease of 23% when compared to the second quarter of the previous year. This isn’t really a surprise as carrier spending decreased due to the stay-at-home orders.

If we look at sales for the entire first half of the year, the results aren’t as bad as they seem. But investors just aren’t optimistic yet. We’re down slightly on our position since we added it to our portfolio last April. Continue to hold your shares of RF Industries (NASDAQ: RFIL) while shares are tracking sideways and waiting to see how the third quarter turns out.

Invitae Corp. (NYSE: NVTA) is a leader in advanced medical genetics. Its mission is to make genetic information affordable and accessible to everyone and anyone who can benefit.

Last month, the company announced plans to combine with ArcherDX to create a genetics leader with unrivaled breadth and scale. The combined company will offer patients and clinicians a full suite of cancer testing for risk, therapy optimization and personalized cancer monitoring.

This $1.4 billion transaction will allow projects at both companies to continue at a quicker pace.

Share prices jumped around this announcement and shares are now trading over $30. Continue to hold your shares of Invitae Corp (NYSE: NVTA).

Twilio Inc. (NYSE: TWLO) has the mission to fuel the future of communications whether voice, text, video or email. Its APIs are simple enough for any developer and robust enough for any demanding application.

This is a no news is good new type of situation. We’re up 161% since we added Twilio to our portfolio. Continue to hold shares of Twilio Inc. (NYSE: TWLO)

Pinterest, Inc. (NYSE: PINS) is another no news is good news situation.

Shares dropped as low as $10.92 in March, but have since recovered back to $23.

That’s just a few dollar above our entry price, but at least we’re in the black now. This is good news, but there’s no guarantee the rest of the year won’t be just as bumpy. Continue to hold your shares of Pinterest, Inc. (NYSE: PINS).

Alteryx, Inc. (NYSE: AYX) is revolutionizing business through data science and analytics. Hundreds of thousands of people rely on Alteryx to enable data scientists to manage all their analytic models.

This is one situation where the Coronavirus sends more customers to a specific software. When data scientists work from home, it’s necessary the software is as user friendly as can be. The winners of this situation will be the companies that are accelerating digital transformation in the work-from-home age.

Alteryx even announced new product innovations in June. Alteryx Analytics Hub is a new product to extend the power and value of the Alteryx Platform and Alteryx Intelligence Suite is a new predictive modeling add-on.

Two more additional options for transforming how businesses leverage their data asset.

Share prices have almost doubled since March lows and we’re sitting at almost 200% gains right now. Continue to hold shares of Alteryx, Inc. (NYSE: AYX).

Fastly, Inc. (NYSE: FSLY) is in the business of helping organizations surpass their end-user’s expectations by powering fast, secure and scalable digital experiences. The Fastly platform handles hundreds of billions of internet requests a day through its cloud platform.

Since December, Fastly has seen network capacity increase of 35%. Last month, it announced that its network had reached the important milestone of 100 terabits per second of connected edge capacity.

It’s evidence of Fastly’s ongoing commitment to building a more efficient network and enables faster growth, scale and enhanced safety.

Since our entry in last November, shares are up over 360%. Continue to hold shares of Fastly, Inc. (NYSE: FSLY).

Veeva Systems Inc. (NYSE: VEEV) is a leader in cloud-based software for the global life sciences industry. Its solutions are aimed at pharmaceutical and other life sciences companies. Because of regulatory compliance these companies look for software providers that cater specifically to their industry.

Veeva is in the perfect position to serve these customers especially in the post-Coronavirus world. The number of remote meetings with healthcare providers has increased by more than 50 times from February to May. These sensitive interactions need to be efficient and protected.

Veeva also announced a new capability that speeds up the digital submission of promotional products to the FDA. That’s a very niche need. But this feature that can shave hours of time preparing content.

Any company that can stay ahead of evolving regulations and compliance will have a prime spot in the industry and Veeva wants to secure it.

Shares are still on fire and we’re up nearly 200% from our entry. Continue to hold shares of Veeva Systems Inc. (NYSE: VEEV).

MongoDB Inc (NASDAQ: MDB) is a leader in general purpose database platforms. It was designed to unleash the power of software and data for developers. And it’s used by more than 18,400 customers in more than 100 countries.

Last month, the company announced its first quarter numbers and they were strong.

First quarter revenue was up 46% when compared to the first quarter of the previous year. It’s one of those companies that going to keep seeing money pour in because of the Coronavirus. Workplaces are changing and database control is key.

Shares are up almost 190% since our entry. And we think there’s still more room to collect profits. Continue to hold shares of MongoDB Inc (NASDAQ: MDB).

Okta Inc. (NASDAQ: OKTA) is used by more than 8,400 global organizations to manage access and authentication to protect customers and employees. And it’s proving even more useful during the changing workplace norms from the Coronavirus.

In the face of the changing industry, Okta is joining with CrowdStrike, Netslope and Proofpoint to secure remote work. Whether companies allow employees to stay remote, or simply want to make sure they can work from home in emergencies, remote work is here to stay.

Since our entry in January, shares are up over 230%. Continue to hold shares of Okta Inc. (NASDAQ: OKTA).

GOGO Inc. (NASDAQ: GOGO) is the leading provider of broadband connectivity products and services for business aviation.

At the end of June, the company hit 3,000 daily flights. That’s a vast improvement from 378 daily flights in mid-April. So, it’s a good sign of strong recovery from the Coronavirus impacts.

Since those mid-April lows, nearly 60% of Gogo’s suspended customers have reactivated their service. Although that seems like good news, investors aren’t onboard quite yet. Shares are down 40% from our entry. Continue to hold shares of GOGO Inc. (NASDAQ: GOGO).

Loral Space & Communications (NASDAQ: LORL) is a satellite communications company headquartered in Ottawa, Canada. Last month, the company announced it had completed live in-orbit testing on Telesat’s Low Earth Orbit Phase 1 satellite. This rigorous testing ensures the ability to provide the best connectivity for customers.

If you got in when we first recommended shares, you’re looking at an entry price of around $25.58. Plus, anyone who got in before May 13th collected a cash dividend of $5.50.

Shares slid at the end of March and have since been trading sideways, so you’re sitting at a small loss right now. Shares of Loral Space & Communications (NASDAQ: LORL) remain a buy at these prices.

Advanced Micro Devices (NASDAQ: AMD) is one of the household names of semiconductors.

Semiconductors are rapidly evolving to become more compact and more powerful. One example is the new AMD Radeon Pro for the 16-inch MacBook Pro. It’s designed to deliver desktop quality graphics in mobile form.

AMD also announced that has exceed its 2014 goal to improve the energy efficiency of its mobile processors 25 times by 2020. The new AMD Ryzen 7 4800 H shattered that 2014 baseline measurement by 31.7 times.

We’re not worried about AMD performing.

Right now, we’re sitting at a modest gain of 7%. This is mostly due to fact that we just added AMD to our portfolio in April. We have no doubt, shares will keep going up. Shares of Advanced Micro Devices (NASDAQ: AMD) remain a buy at these prices.

Telefonaktiebolaget LM Ericsson (NASDAQ: ERIC) is one of the leading providers of Information and Communication Technology (ICT) to service providers. It’s a quest for easy adaptability and full connectivity.

Ericsson is working to have its 5G everywhere. This includes in the European rail industry, in commercial services in Madagascar, in Croatian telecom…really anywhere and everywhere.

The expansion isn’t going to slow down anytime soon. We’re sitting at a small gain of 12% from our entry in May. Management will announce its second quarter earnings on the 17th. So, we’ll know more about the impact of these new 5G deals on the numbers then.

Shares of Telefonaktiebolaget LM Ericsson (NASDAQ: ERIC) are still a buy at these prices.

Last, but not least we have our two recommendations from last month.

You should have been able to grab shares of Cloudflare Inc (NYSE:NET) for $29.40. Shares have been increasing since, so you’re already sitting on a nice gain of 24%. Shares of Cloudflare Inc. (NYSE: NET) remain a buy.

We also recommended shares of Mimecast Limited (NASDAQ: MIME). We expect that you should have been able to get in around $44.11.

The company just joined the ranks of the Russell 3000 Index at the end of June. Inclusion in an index expands the company’s visibility since they are widely used by investment managers and institutional investors. Shares of Mimecast Limited (NASDAQ: MIME) remain a buy.