Volume #1 Issue #10

In This Issue

Too Much Time on Our Hands

The Coronavirus has impacted every aspect of our lives, and in doing so it’s made us yearn for some sense of normalcy. Sports fans are anxiously awaiting the next season of their sport of choice. And when they return there’s plenty of money waiting to be spent.

There’s Still a Vig… But You Won’t Have Your Kneecaps Broken

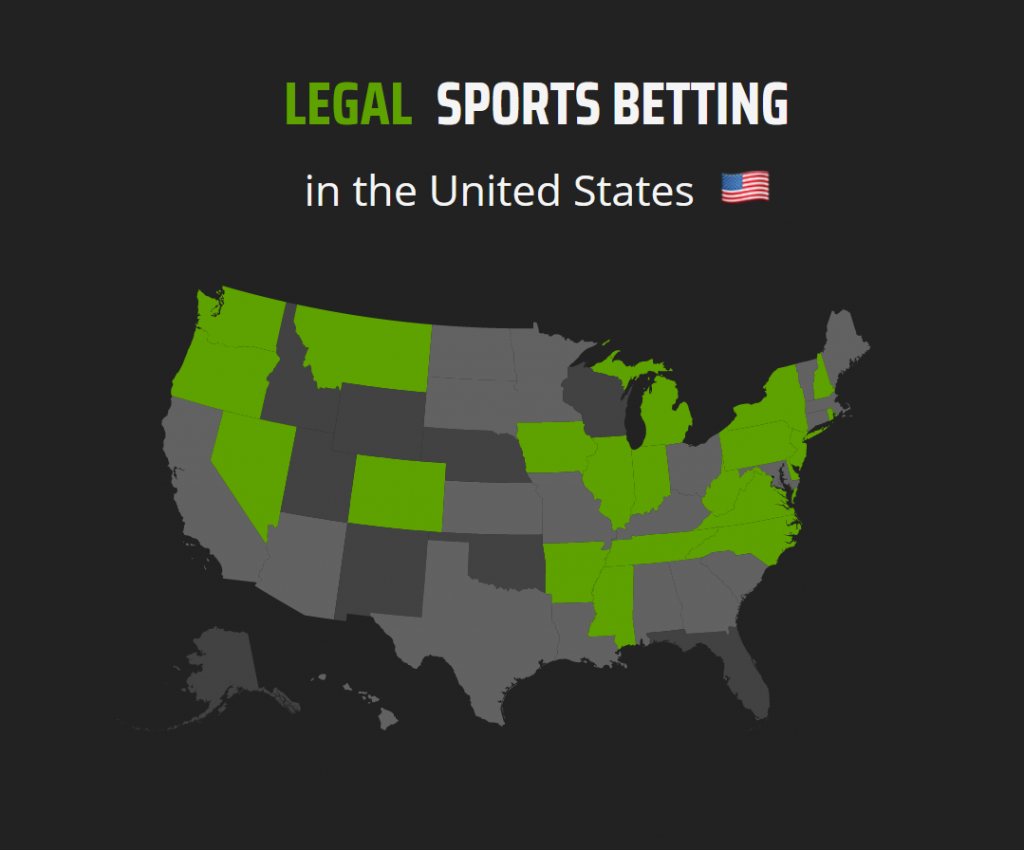

The legalization of sports betting is making its way across the US. In fact, all but three states have made strides forward, and why not, it’s a great way to boost tax revenue. One company was the first to jump in 2018, when New Jersey became the first state to legalize sports betting outside of Nevada. And it’s continued to prove success since then.

Two Quick Earnings Updates

Last month we noted that two of our current positions would have earnings releases after we wrote the issue. We take a moment to run through those numbers and let you know what they mean for you.

What comes to mind when you think about sports betting?

I tend to picture the scene about 13 minutes into the 1995 Scorsese classic Casino where we see the back-room chalkboards of Chicago area oddsmakers.

The film was based on the life of Frank “Lefty” Rosenthal, one of the most infamous bookies/ oddsmakers of all time. He ran the biggest illegal bookmaking office in the U.S. and had the knack for setting the perfect odds based on meticulous research.

Perfect odds meaning that they were appealing to the gambler…but usually ended up in good news for the house. He would eventually be driven out of Chicago and end up in Las Vegas.

During this time (the fifties) sports betting was legal in Las Vegas, but you had to walk into a casino to place your bet…hence the existence of bookies everywhere else. Sports betting dates to the ancient Greeks. The introduction of the Olympics led to the earliest records of betting on athletics.

It would eventually spread to the Romans, who would bet on Gladiator games. And as early as medieval times, religious leaders tried to make a law forbidding it. But as new sporting events were introduced to the world, sports betting continued to grow.

Las Vegas handles billions of dollars of sports betting every year, but that’s only a small percent of the betting that goes on over the entire country. Bookies are not yet a thing of the past.

The invention of cell phones and the internet made it even easier to stay in contact. But there will always be some people who will not participate in illegal activities. And that money is quickly becoming fair game.

The Supreme Court Decision That Snowballed Legal Sports Betting

Signed into law in 1992, the Professional and Amateur Sports Protection Act (PASPA) gave sports leagues the ability to challenge betting laws in courts. It was commonly thought that if sports betting became widespread so would fixing the games. Why do you think it took so long for Las Vegas to get any professional teams?

In May 2018, the U.S. Supreme Court ruled that PASPA violated the 10th amendment of the Constitution. It illegally empowered the federal government to infringe upon states’ rights. So now, each state is free to decide whether they want to legalize sports betting individually.

Some states like New Jersey were standing by for the repeal right away. Voters in the state have passed a constitutional amendment in favor of legalizing sports betting in 2011.

Meaning that as soon as the Supreme Court made its ruling, New Jersey was in. West Virginia and Pennsylvania were among those states that had already taken steps toward legalization.

Since then every state has made major moves towards legalization except for Idaho, Utah, and Wisconsin.

There is a ton of money just sitting here ripe for the picking now that the irrational fears that legalization will lease to increases in-game or match-fixing are falling to the wayside.

At the time of the court case, it was estimated that at least $150 billion in illegal wagers on professional and amateur sports were made by Americans every year. And states are incentivized to legalize so they can then collect a piece of that action in taxes.

New Jersey has an 8.5% tax for sports bets made in person and a 13% tax for online and mobile sports bets. In just the first 15 months, Jersey saw $36 million in state tax revenue.

West Virginia and Pennsylvania saw nice windfalls as well. We’re seeing this new industry appear right before our eyes, and in fact, 2020 created the perfect storm for expansion.

Too Much Time on Our Hands

The Coronavirus changed the way that we live in ways that aren’t going away anytime soon. The creation of 4G may have allowed for the initial wave of being dependent on mobile apps…but this year solidified it.

Suddenly Americans found themselves stuck in their houses. Some people even without work.

Sports fanatics started going through withdrawals. We all have that friend whose life revolves around their favorite team.

It wasn’t pretty when their entire existence seemed to be spun out of control. You might have caught them re-watching games…commentaries and even entire seasons.

ESPN turned to commentaries and talk shows to fill the empty air. That pent-up customer demand will turn into action as soon as leagues start rolling again.

Sports is the 11th largest industry in the U.S., ahead of chemicals, with an estimated worth of $750 billion. Major League Baseball is projected to lose several billion during the shortened season. And the NBA expects to lose an estimated $500 million this season in ticket sales alone. That’s money burning a hole in the pockets of fans all over the country.

And that means these sports junkies can get back to an industry that goes hand in hand with sports… daily fantasy sports (DFS).

Fantasy sports leagues are nothing new and have a long interesting history. In the 1940s, baseball star Ethan Allen released a “table game” called All-Star baseball which allowed fans to choose a team from a collection of player cards.

Each player’s performance was determined by probabilities that were derived from the player’s actual past performances.

In 1961, a mathematics student devised a more complex simulation game called Strat-O-Matic Baseball. The game eventually evolved into “The Baseball Seminar” which included a series of participants who pad an entry fee to “draft” a team of baseball players. The winner was then determined at the end of an actual Major Baseball season based on each player's real-life performance.

As it evolved, there was an immense amount of paperwork involved in calculating player and team statistics, making it the perfect candidate to be done by a computer. And by 2011, fantasy sports had turned into a $5 billion per year industry. Nearly 60 million people now play fantasy sports.

The bonus is that a study conducted by the Fantasy Sports & Gaming Association found that 79% of fantasy sports players who are no current sports wagerers say they will likely participate in sports betting once legalized in their states.

The company I’m recommending to you today is primed to process all that sports money, whether DFS or betting.

There’s Still a Vig… But You Won’t Have Your Kneecaps Broken

The company that’s taking a quick lead in this industry is DraftKings Inc (NASDAQ: DKNG).

DraftKings is a digital sports entertainment and gaming company created to fuel the competitive spirits of sports fans. It is committed to responsibly creating the world’s favorite games and betting experiences by developing the most innovative and entertaining real money products.

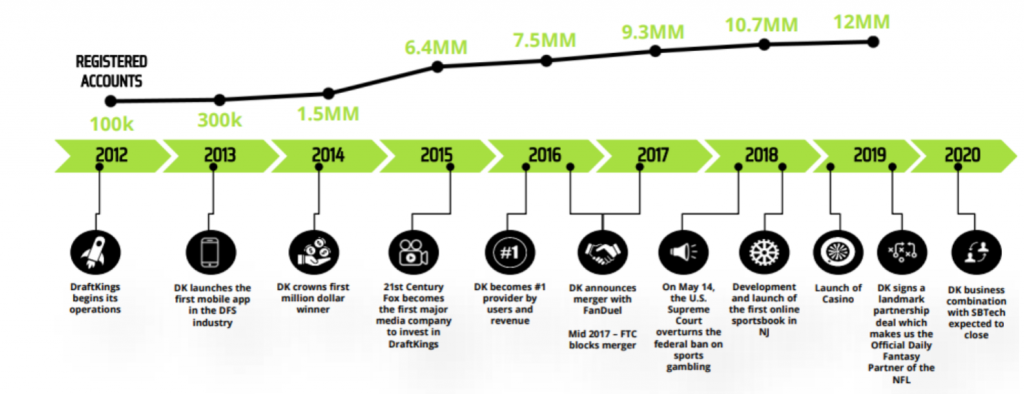

The company was formed in 2012 when former Vistaprint employees Jason Robins, Matthew Kalish, and Paul Liberman launched a one-on-one baseball competition to coincide with Major League Baseball’s 2012 opening day.

The platform now allows for daily and weekly fantasy sports based on the 15 categories in 8 countries.

By 2017, DraftKings had eight million users. Last year it reported $213 million in revenue from fantasy sports. That’s approximately 60% of the market share.

DraftKings has the highest ranking for the preferred platform among fantasy participants.

The company’s products range across daily fantasy, regulated gaming, and digital media. It’s an official partner of the NFL, MLB, and the PGA Tour. As well as the authorized gaming operator of the NBA and MLB and an official betting operator of the PGA Tour.

The overall goal is to forever transform the way people experience sports.

This is a big solid chunk of DraftKings revenue, but the real excitement is the addition of sports betting. The company launched its first legal online sportsbook in August of 2018 in New Jersey.

Since then it’s expanded these operations to Colorado, Indiana, Iowa, Mississippi, New Hampshire, New Jersey, New York, Oregon, Pennsylvania, and West Virginia. And DraftKings was even one of the handful of licenses given for Tennessee’s November launch of sports betting.

Sports betting is more than just through the mobile app. DraftKings also offers retail sports betting in partnership with casinos throughout the country. We’re talking about over 40 TVs and multiple odds boards.

As Legalization Ramps Up, Share Prices Will Soar

DraftKings just went public April 2020 when it completed its reverse merger with Diamond Eagle Acquisition Company SPAC on April 24. And it’s currently the only US-based vertically integrated sports betting operator. That puts the company in a prime position as more and more states turn to the legalization of sports betting.

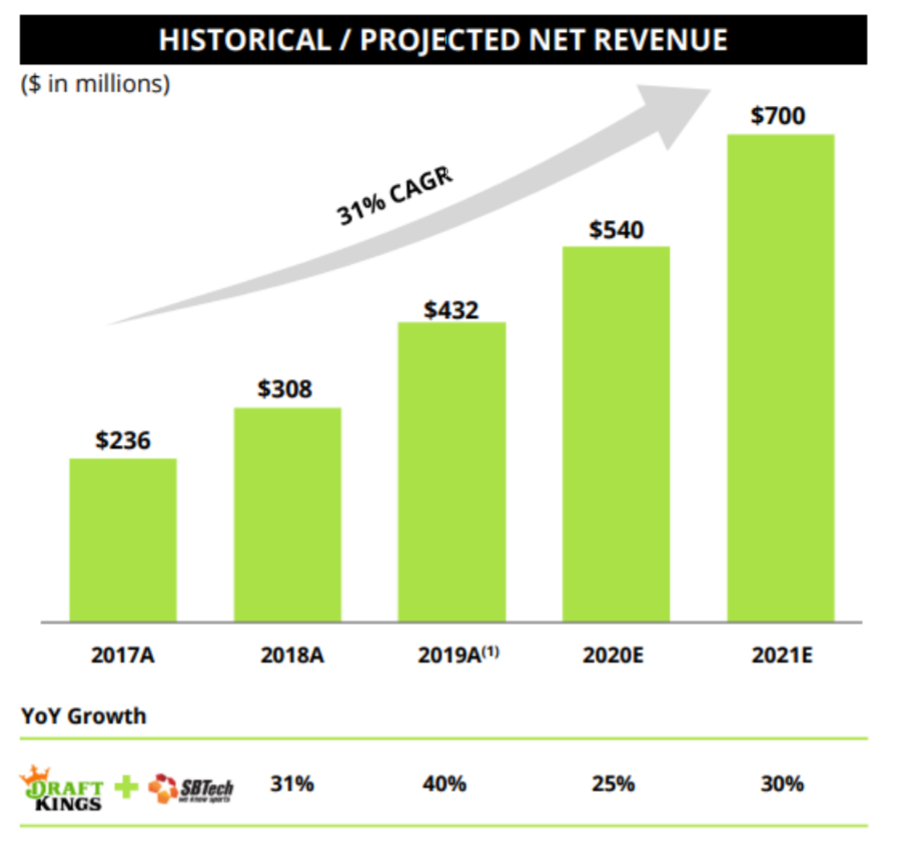

For the second quarter of 2020, the company reported revenue of $71 million.

That was up 24% when compared to the same period of the previous year. Except there was one difference…this year was missing quite a few sporting events when compared to last year.

The company made sure that even though there was a pandemic going on, it kept coming up with creative ways to engage fans. This meant new fantasy sports and betting products for NASCAR, golf, UFC, and European soccer.

Plus, the company also has a standalone casino app in a select state under the name DraftKings Casino. It offers all the fun of the casino floor in the palm of your hand.

Users in New Jersey, Pennsylvania, and West Virginia can play over 310 slot games, 15 live dealer games, and 35 table games including blackjack and roulette. In the end, it’s a way to attract the casino customer and potentially bring them into the realm of sports betting.

There’s no doubt that DraftKings is one of the leaders to watch as this industry continues to unfold. And investors are noticing.

Shares have more than tripled since going public. We don’t think that growth is going to slow down any time soon.

Co-Founder and CEO Jason Robins reminds investors “As a technology-first organization, we will continue to focus on bringing new and innovative products to market that strengthen our engagement with customers and maintain our competitive differentiation.”

Action to take: Buy DraftKings (NASDAQ: DKNG) up to $65 per share.

We noted at the end of last issues that PagerDuty Inc (NYSE: PD) and MongoDB Inc (NASDAQ: MDB) both had earningson September 2nd … so let’s jump right in.

PagerDuty is a global leader in digital operation management. CEO Jennifer Tejada reaffirmed that “PagerDuty is well-positioned to benefit from the long-term tailwinds of digital acceleration, cloud migration, and DevOps.”

For the second quarter, the company saw total revenue of $50.7 million, up 25.7% when compared to the same period last year. PagerDuty is still working hard to expand both with current customers and within the market.

During the quarter, the company saw approximately a third of its current customers increase the adoption of PagerDuty products.

This is all on track for the management’s full-year expectation of 24-27% year over year total revenue growth.

Since the call, Pager Duty has announced new integrations with Microsoft Teams and Zoom. Plus, it announced that it will acquire the leading provider of DevOps automation Rundeck.

This is proof of the company continuing its growth, which in the end means more money for shareholders. Shares are down slightly since we recommended this position, which creates an even better buying position if you haven’t gotten in yet.

MongoDB is a leading general-purpose database platform and announced strong second quarter performance. President and CEO, Dev Ittycheria pointed out “The record number of direct sales and total customer adds in the quarter are clear proof points that our focus on getting more customers onto our platform is working.”

Total revenue for the quarter was $138.3 million, which was an increase of 39% over the previous year. Subscription revenue increased by 41% while services revenue increased by 11%.

Over the quarter, MongoDB announced new updates for its platform and hosted a two-day event with over 14,000 attendees. The company also was awarded Gold Data Platform partner status by Microsoft which will allow for more comprehensive solutions from joint MongoDB and Azure customers.

This is all good news for the company, and we recommend you hold your current position in MongoDB. Shares are up over 190% since we got into this position.