Do you remember the first time that you bought something online?

I’ll give you a second to think back.

Was it a textbook on Amazon? Or something rare and kitschy on eBay?

Even before those two now-behemoths would hit the stage in 1995, there was Boston Computer Exchange. The BCE was the world’s first e-commerce company and pioneered efforts to create a fully automated, on-line auction system.

Two important factors limited the explosion of the BCE. Initially it was only for selling and trading computers. And it was the 1980s before many people even believed that computers would be household products.

Fast-forward to 1995, and approximately 16 million people are on the internet worldwide. Amazon is launched as an online marketplace for books. So is “The Auction Web” which would later become eBay.

Continue fast-forwarding to 2000. Amazon is now selling toys, home-improvement items, and toys. eBay now has 12 million registered users and is eying up PayPal to integrate the auction site and payment platform.

Both companies are still around today, and look very different than they did back in 1995. But there’s no arguing that these two companies paved the way for the digital connection of buyers and sellers over the past 25 years. And now it’s even easier to buy and sell pretty much anything with just a few taps.

E-Commerce Apps Are the Future

Maybe you can remember shopping on eBay using your Windows 98 computer and dial-up internet. Now we all carry around a minicomputer in our pockets. And for many of us, we have our phones on us constantly.

How many too many e-commerce apps do you have on your phone? Amazon? eBay? Door Dash? And that’s just to name a few. Within each of them, you can make purchases with 5 clicks or less.

I have a whole page of them. It’s likely that by next year I’ll have an additional page of them. Or maybe different companies will improve and pull ahead.

I know I’ve said it before, but it bears repeating. The pandemic proved our societal dependency on e-commerce. It accelerated many businesses into this realm, and it created a convenience for consumers that they will not want to give up even if we see some normalcy come back soon.

I’m not here to recommend any of these apps that you’ve heard of. Even though many of them have had great years. Shares of PayPal and Amazon are up 113% and 79% respectively since the beginning of the year. They will keep succeeding…but the opportunity that I have for you today is poised to see triple digit gains.

That’s because it’s not looking at the US markets. It’s not even targeting one of the developed markets. Instead, it’s looking to expand e-commerce in Africa. This is a place that doesn’t have much competition.

Africa is an enormously underserved and underappreciated opportunity for digital transformation. Even, Amazon has continued to overlook the continent because of the expense to solve logistical problems of the countries there.

The economy has 1.2 billion people with a median age of 19.4. These young people are connected to the internet in numbers higher than ever. The continent now has over 450 million internet users and that number is still increasing. In 2015 approximately 10.9% of the population was on the internet. Now many countries are seeing that number over 50%.

Nigeria and Mali have almost 62%, Morocco nearly 65% and Kenya has over 87% of the population now using the internet. And most of them are mobile users.

Check out this graphic from Afridigest.

Developed markets such as the US saw a more even time frame when talking about the transition from no internet to being comfortable ordering things quickly on mobile devices. Emerging markets such as those in Africa quickly jumped from no internet to being mobile. Many users skipped over the PC step entirely.

Those over 450 million internet users are mostly via smartphone. Just look at Nigeria. Web traffic generated by smartphones account for 74% of internet activity compared to only 25% from PC. This means that if the right company with the right mobile app comes along, there is an enormous opportunity to make a lot of money. And that’s just the play I have for you today.

The Super App of African Commerce

There are many companies that are setting themselves up for super app status. That is an app that holds more apps. It bundles and replaces the tyranny of apps that you might have needed previously. One app that has many different use cases with many different functions and features.

Super apps are incredibly popular in Southeast Asia. One popular example is WeChat which is incredibly successful by integrating seamlessly into everyday life in China. In addition to being a popular chat app, it allows for a number of third-party services like hailing a cab, buying movie tickets, and even paying utility bills.

One company has the goal of connecting buyers and sellers to become the Amazon and Shopify of Africa. It wants to continue expanding its network of warehouses and shippers to become the FedEx an UPS of Africa. It wants to allow users to complete money transfers and order food with ease and become the Visa and Door Dash of Africa.

Jumia Technologies AG (NYSE: JMIA) wants it’s Jumia One app to essentially be the everything in Africa. We’re talking about expanding e-commerce, payment, fintech, logistics and much more throughout the continent.

So far, the app allows for shopping, ordering food and buying airline tickets. Users can even pay cable and electricity bills. Jumia has 1.2 billion consumers and over 110 thousand active sellers on the platform. Over 40 million products, restaurants and services are listed on Jumia.

The company partners with dozens of the most powerful multi-nationals that want to reach the most underserved and highest growth economy in the world. This includes Nike, Intel, PepsiCo, Nestle, JNJ, and Unilever, just to name a few.

Just like eBay or Amazon, Jumia wants consumers to be able to shop for anything that they need without searching elsewhere.

Total Domination is the Strategy

Although the company’s goal is total dominance, its business is broken down into three clear categories.

First, is Jumia Marketplace. This e-commerce platform showcases not only goods, but also restaurant delivery like Door Dash and Uber Eats. The goods available span over a wide range. Everything from smartphones to apparel to consumer-packaged goods. The platform even offers access to video games in 5 countries.

Shopping in Africa is notoriously difficult given the underdevelopment of the retail industry. Jumia has instead harnessed the power of technology to deliver convenient and affordable goods to consumers. And at the same time supported more than 110,000 local African companies by enabling third-party sellers. In 2019, approximately 90% of the items sold on the marketplace where third-party sellers.

The second category of business is Jumia Logistics.

This is Jumia’s answer to Africa’s logistics challenges. This logistics network has been important to ensuring the delivery of the goods changing hands from the e-commerce side of the business. It offers both home delivery and pick-up station options. But as of November 2nd, the company opened these logistic services to third party businesses who wish to leverage its framework for last mile deliveries across 11 countries.

The logistics part of the business is based on two pillars. One is the proprietary technology and data-driven platform that efficiently aggregates demand and matches it with supply capacity. And the other is the actual physical framework. We’re talking about 23 warehousing facilities for storing, picking, and packaging. Plus, 1,300 sell drop-off/customer pick up locations located across 11 countries. It also includes over 300 local partners or essentially small business owners that execute the actual deliveries.

We’re in a time when many businesses across the world are re-examining their costs. That makes this the perfect time to open up access to Jumia logistics to any company that it can benefit. It will allow those companies better access to rural areas. And of course, will also help the local logistics partners so that they will have more deliveries in similar areas.

Finally, Jumia has its own payment method called JumiaPay. This one is quite similar to PayPal or Apple Pay. JumiaPay handles household bills, pre-paid phone minutes, ticketing to sporting events. It offers credit scores, financing, savings account and even insurance. Plus, there’s been a pilot of a pre-paid debit card in Egypt.

These three segments together create a well-integrated system that will continue to propel Africa’s economy forward. Plus, it should make investors a lot of money. Heck, if even one the company’s three business segments takes hold it will be a worthy investment.

So why is now the time to get in?

A Rocky Year Creates Huge Potential for Big Gains

As I’ve mentioned before and even above. The pandemic catapulted many businesses and trends into the future. It shaved years off of the adaptation of mobile e-commerce. That includes in Africa which is seen as about 10 years behind in technology and trends.

A survey conducted by Visa found that 64% of consumers in South Africa bought groceries online for the first time during the pandemic and that 53% made their first online purchase from a pharmacy. This is a big deal since Africa’s cash dominant society Is one of the key deterrents of growth.

There is $4 trillion in household and B2B spending in Africa, but most of which it happens offline. Consumers are skeptical about paying upfront either due to lack of wanting to spend digital money, or that they will even get their item due to crime and other factors. Shop owners aren’t used to shipping our a good for the consumer and then having to wait to collect their payment.

When the pandemic started closing things down, both consumers and shop owners had no choice but to go with the flow and see what all the fuss has been about. The good news is that a lot of them liked it and will continue to use Jumia going forward.

Just look at the company’s Black Friday event. This consisted of every Friday in November plus Cyber Monday. Jumia saw over 113 million visits and over 1.5 billion page views.

The top categories of purchases were fashion, beauty, and home. During the Black Friday event, 141% more items were sold from top 20 sellers than the previous year. Over 4.8 million packages were handled and over 55% of packages reached consumers in less than 24 hours.

Consumers tried the app due to the pandemic, but in the end, they came back for Black Friday and hopefully had yet another positive experience. This increase in consumers in turn creates an excitement for more sellers to join the marketplace as well.

The company has been working hard to pivot its strategy and prove to investors that their money will be safe. There is some doubt as to whether online ordering can work in the cash-dominant African economy. This means that the company needs to focus first on profitability.

To do this, the company pivoted its selling strategy to less electronics and more daily household goods. The results were a lower average over value of about 25%. Daily household goods are generally cheaper than electronics. But they have better margins.

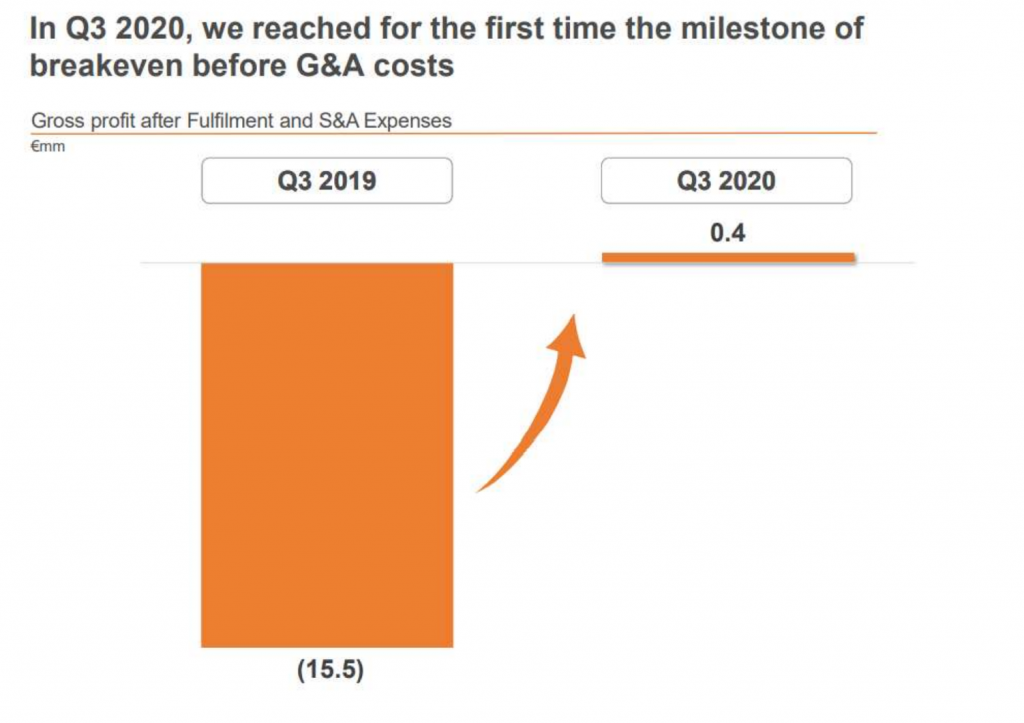

Gross profit per order rose by nearly 20%. Selling and administrative (S&A) expense per order has dropped 52%. And combined technology and G&A. All while active consumers have increased by 23%.

It will be very important to see if these numbers stick. Reining in the costs is a great step. Now it’s time to start seeing the impact on the financials.

Upon checking the company’s most recent results, we find that they are in fact in line with the path to profitability. Gross profit increased by 22%. Sales & advertising expense was the lowest quarterly amount since 2017 as the company continues to increase marketing efficiency.

JumiaPay total payment volume increased by 50% when compared to the same quarter last year. And the company even launched the pilot of Jumia Games across five countries.

Most importantly, for the first time ever, gross profit after fulfillment and S&A turned positive. This includes many individual companies breaking even.

It seems like all the pieces are falling into place and real profits could be right around the corner. And investors are starting to notice.

The company started trading on the NYSE last April for around $25. After almost doubling, the share prices started a steep decline to around $2.

Since October, shares prices have really started to find momentum and recover to that $40 level. This investor optimism was solidified by the pleasant third quarter earnings results.

Now is the time to jump onto this roller coaster. I’m not saying there won’t be any dips, but Jumia is poised to succeed right now. I would expect shares to hit $100 in the next 6 months, probably even sooner.

Action to take: Buy shares of Jumia Technologies AG (NYSE: JMIA).