The world of finance is ever-evolving. And there’s no greater example than the Wave Kentucky Whiskey 2020 Digital Fund.

Just looking at the name of this fund may cause your eyebrows to jump to the top of your skull. And that completely valid reaction is certainly shared by many.

But there’s a lot going on here worth really exploring.

For starters, this fund does exactly what its name suggests. It buys whiskey and trades in digital tokens… or at least it will.

This week, this strange-sounding fund purchased its first 1,000 barrel-batch of whiskey from Wilderness Trail Distillery, a Kentucky whiskey maker.

The goal is to eventually own between 10,000 and 20,000 barrels of the 2020 production run.

In turn, its private investors will receive digital tokens, or a cryptocurrency, dedicated to this fund.

I know. This sounds a little crazy. But there’s real genius behind this.

Financial investment companies like Wave Financial are always on the hunt for alternative asset classes. This particular team’s President International & Partner Matteo Dante Perruccio even noted in an interview that he’s looked at far wilder options like Japanese racehorses.

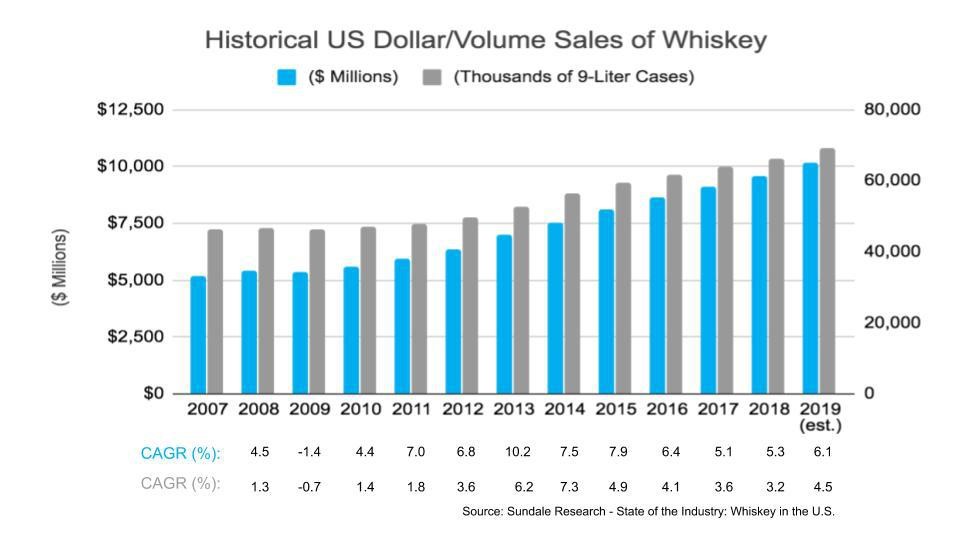

But he liked what he found with whiskey. In many ways, whiskey as an asset moves like many imagine real estate does… steadily upwards and rather predictably.

Even during recessions, there’s no real fall-off in demand. In fact, as I wrote back in May, spirits, including whiskey, and wine saw sales skyrocket as lockdowns were going into effect.

What’s more, whiskey grows exponentially more valuable as it’s is aged. Obviously, that makes sense. But because of the tight financing involved in the production of spirits, few companies keep back large portions of their output for extended aging.

Wave predicts that this alone will increase its per-barrel value of this batch from $1,000 to $4,000 within five years.

This brings me to the second reason why this strange-sounding fund actually makes incredible sense.

It is expensive to run a liquor business. That’s especially true of fine whiskey, which needs specific equipment and types of barrels and storage to add flavor.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Banks, while rates are at extreme lows right now, still might not be willing to lay out money for something that is just going to sit there for years. Loans with roughly 10% interest rates and no current cash flow during the aging process come at a high cost for distilleries.

Instead, selling to a fund like this, paid for by investors up front, offers a clear solution. For investors, this is where the fund changes the game.

Certainly, this fund doesn’t need to be digitized. Meaning, it could just as easily offer shares or tradable units like any other closed-end fund backed by specific assets.

Instead, possibly to add to its appeal, or to potentially even streamline the process Wave has gone down the crypto route.

In about a year or so, Wave will issue digital tokens, just like many other cryptocurrencies out there, to investors. These tokens will quite literally be backed by the whiskey it is buying today.

This allows those investors to trade those tokens on a secondary exchange, even while the whiskey remains sitting in barrels in a basement somewhere.

In five or six years, when the whiskey is ready to be sold, those investors can either exchange their tokens directly for the whiskey or for the cash equivalent.

Thus, theoretically, each $1,000 investment, tradable for five years or so through a digital exchange, becomes $4,000 or $4,000 worth of whiskey.

No one knows 100% the fate of any or all cryptocurrencies and digital tokenization. But watching this fund during the next five years will be worth it.

It is quite likely that we’ll see more deals like this. It provides a test of both a new trade in whiskey and a great example of asset-backed, limited-lifetime digital tokens.

This new evolution of the world of finance could be cutting multiple pathways forward for both funding and investing.

And as new opportunities come out of it, smart investors should pay attention.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder