The U.S. Department of Justice announced an antitrust lawsuit against Alphabet Inc. (NASDAQ: GOOG) yesterday.

That’s good for Google.

In the early days of trust-busting, there was no discernable benefit to a company getting dismantled.

Standard Oil, the highest-profile loser to Theodor Roosevelt’s use of the Sherman Antitrust Act, fought tooth and nail to keep all of its parts together.

But since we have more than a century of post-break-up results to look at, we can see how that played out.

Sure, in the days before Standard Oil’s downfall, it controlled more than 90% of oil production in the U.S. and 85% of sales.

But what historians like to gloss over was the sheer profit unlocking that came out of breaking apart those numbers.

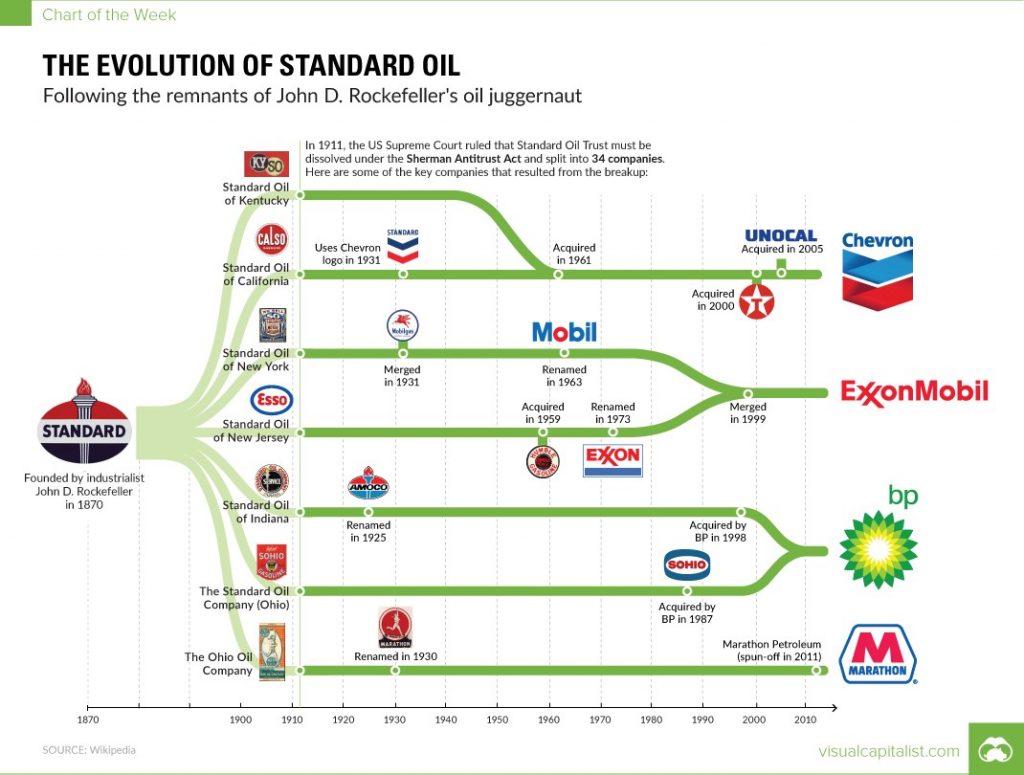

In 1911, the U.S. government forced Standard Oil to break up into 34 different entities in forced spinoffs.

Shareholders at that time got a little piece of each. Today, those spinoffs have evolved into major names like BP, Chevron, and ExxonMobil.

While no single entity reforged into the same kind of market dominator as Standard, those early shareholders were not left penniless.

Why? Sometimes separating out the parts can create tremendous value.

That’s why Google shareholders need not worry.

Standard Oil kicked off the antitrust train at the beginning of the 20th century like a lion. But Microsoft Corp. (NASDAQ: MSFT)’s own troubles ended it like a lamb.

Throughout the 1990s, Microsoft was in court battling the government over its integration of various software with its Windows operating system, specifically Internet Explorer.

Rather than breaking up the company, it ended up getting a slap on the wrist for the most part.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Microsoft could no longer force the use of its other products just because customers bought Windows. But it didn’t have to really give up anything in the end.

Today, we see Microsoft with a huge host of products and a $1.6 trillion market cap.

The argument that seemed to create this new landscape for tech monopolies was that if Microsoft doesn’t force the use of any two products together, it can continue to build up its own side businesses without hassle.

That’s oversimplifying a decade-long technology and legal battle. But it gives you a good look at what Google might face.

The point of showing how these two very different results from antitrust battles both benefited the original shareholders is what I’m getting at.

Trust busting is typically good for everyone.

In the early 20th century, both Standard Oil shareholders and small-time independent oil companies benefited.

In the 2000s, Microsoft flourished, yet opened the door to the likes of Google’s own Chrome, the center of this current lawsuit.

Forced spinoffs of this size tend to unlock enormous value. Likewise, they do offer competitors a little space to create and differentiate themselves.

It is far, far too early to see how Google’s ordeal will go. But the final issue of note when it comes to antitrust battles is that they last a very long time.

Standard Oil’s 1911 split up started with the 1906 antitrust case.

Microsoft’s final verdict came in 2001. But it began with a Federal Trade Commission inquiry in 1992.

AT&T’s 1982 breakup, the other major 20th20th-century monopoly case falling only to make its shareholders very rich, came after eight years of court battles.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder