How many times over the last few weeks have you uttered, “I can’t wait for this election to be over?”

How many times in just the last 24 hours have you said that?

Here at Emerging Profits Daily, we really don’t often get political. But politics affect the market and where the money goes.

So, on Election Day 2020, let’s take a look at politics through that lens. And I’ll dive into exactly what effect this day will have on those markets in the short term.

You Think This is the End?

Before I get to how U.S. politics and this election plays into emerging profits, I have some bad news: this isn’t the end.

Even if, by some miracle, one candidate wins in a landslide tonight, with the other conceding leading to either a second term or a peaceful transfer of power, this isn’t over.

First, there are going to be court battles. Then, there will be recounts. And finally, there will be a new makeup of Congress.

Theoretically, there are an endless possibility of potential outcomes and Congressional makeups. But in today’s politics and this environment, there are really only two: either one party gains control over both houses or the two chambers of Congress remain party divided.

Can you imagine, in either of these scenarios, a 2021 and beyond that isn’t as chaotic in Washington as this year has been?

And that’s where the emerging profits comes in. This chaos has a different word on Wall Street: volatility.

Investors Underestimating the Volatility to Come

Again, this isn’t about who you or I feel is right or wrong to lead the U.S. Longer term, it certainly does matter who is in the White House and atop the Congressional makeup. But shorter term, the chaos and volatility are the whole point.

Let’s say every incumbent running this election is reelected in sweeping landslides. That includes President Trump, the Republican Senate and the Democratic House. There should be no change, right?

Well, consider just how much was done to ease markets just this past year. Besides the CARES Act very early on, Congress hasn’t really done much. Investors have noticed and complained. Hell, I’ve complained.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

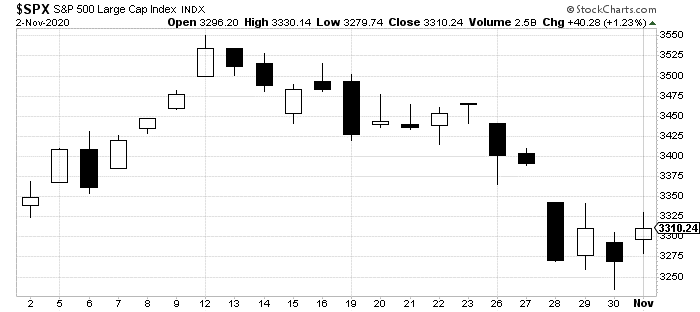

And it shows in the market. Just look at October’s disappointing performance as talks for a second stimulus collapsed:

The Fed has already pulled about every string it could as early and as often as it could to keep credit flowing and corporation’s liquid. Its hands are tied until Congress acts. So, even no change from this election doesn’t spell the end of investor panic.

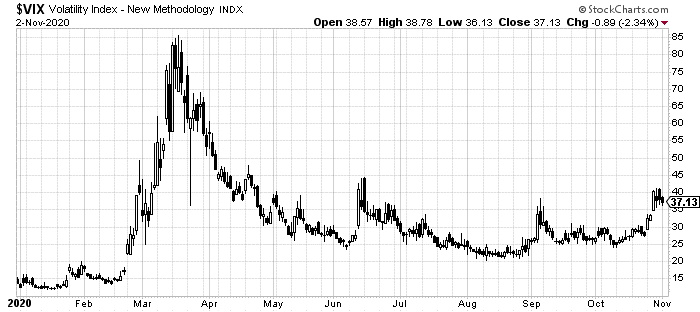

All of this leads to what Wall Street is missing: a real sense for how volatile this period really is. Take a look at the CBOE Volatility Index (VIX), also called the fear gauge:

Clearly, investors were very panicked back in March at the outbreak of COVID. But despite the most heated election in living memory, Wall Street isn’t really even as hesitant as they were in June let alone March.

The likeliest outcome is some kind of change, either to the makeup of Congress or even at the White House. But before even that change could happen, there will be almost assuredly a long drawn out post-election court battle in several states and recounts. I’m not even going to speculate over protests or the possibility of violence the media is forecasting no matter who wins.

All of this will only push the fear gauge up, no matter who might prevail in the end. For smart investors, that’s when protective investments find their traction.

Things like gold and silver become hot commodities again. Protective puts, which is actually what the VIX measures to a degree, will see premiums go up. Consumer staples like Procter & Gamble Co. (NYSE: PG) typically outperform more volatile or politically-sensitive tech stocks.

I’m not saying there won’t be money to be made elsewhere. But putting political opinions aside, this is a true emerging profit moment. And in the short term, fear will be a more powerful force than greed on Wall Street.

And protective investments are going to — at least temporarily — boom.

So, on this election day, besides voting, that’s one more thing to consider getting done before the market closes.