Buffett still has a keen eye.

This weekend, Buffett’s Berkshire Hathaway Inc. (NYSE:BRK-A/BRK-B) held its famed annual shareholder meeting. And Oracle of Omaha announced one major revelation.

He sold his entire stakes in four airlines: American Airlines Group Inc. (NASDAQ:AAL), United Airlines Holdings Inc. (NASDAQ:UAL), Delta Air Lines Inc. (NYSE:DAL) and Southwest Airlines Co. (NYSE:LUV).

On the surface, that makes a lot of sense. Airlines are dying right now and targets for government bailout money.

But Buffett has always been a contrarian investor.

So, you might think he’d actually be long airlines, or at least keep his stakes in place.

The reasons he gave make a lot of sense, however. It’s not what’s going on right now at airlines that bothers him.

In fact, he believes their management teams have done a good job before and now during this crisis.

The problem is what comes next. Consumers will not flock back into air travel at pre-crisis levels until mid-2021 at the earliest.

Worse, airlines have too many planes that are costly and useless right now. And worst of all, they will all need to draw billions in new debt to make it through.

Buffett’s take on airlines sent their shares down between 8% and 10% just today.

That’s after they’ve all fallen off a cliff earlier this year:

You could easily take this information and move on. Get out of airlines like Buffett and call it a day. But there’s another important message hidden there.

The New Economy

Buffett didn’t just speak about airlines during his PowerPoint presentation.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

He discussed the nature of the new economy, though not at great length.

He noted that office space is too abundant. Video conferencing and working from home are a new normal. So, maybe stay away from office real estate.

But we can take this a bit further. What else has changed and will likely never return?

Hotels and restaurants, of course, comes to mind. But that is a bit too obvious. Instead, think about who services them.

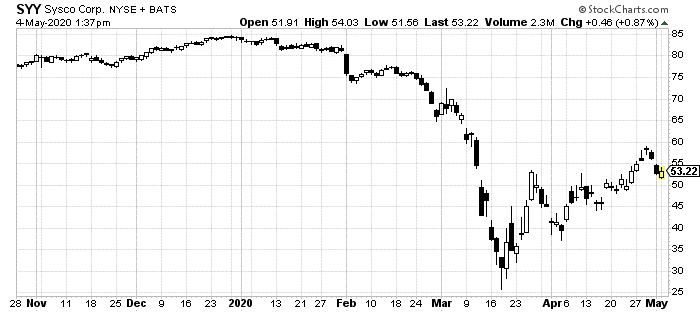

Sysco Corporation (NYSE:SYY) is the major player here. Sysco is one of the world’s largest suppliers of food products to restaurants, hotels, hospitals, and schools. It is also at the eye of the storm.

Shares have fallen, and quite hard:

But they’ve also bounced back by more than 100% from their mid-March bottom. It might not be an entirely reasonable recovery.

Think about what comes next for this food servicer.

The Numbers Don’t Lie

Sysco has about $1.4 billion in annual free cash flow. Or at least it did.

Compare that to its $8.1 billion in debt and minuscule $500 million in cash. It’s clear that any downturn will be tight. And it surely will announce that in tomorrow’s earnings call.

But there’s a worse problem for the company. Like the very companies it services, Sysco could put its dividend on the chopping block.

Many companies, including customers like Darden Restaurants Inc. (NYSE:DRI) and Marriott International Inc. (NASDAQ:MAR) have already cut their own dividends.

Sysco could see that trickle through its own financial results.

So, while Buffett warns of airlines and office space, we should listen. But also pay attention to where else the new economy will strike.

Buffett told shareholders, "The world changed for airlines." Well, that echo's true too for companies like Sysco.