Congress isn’t known for its foresight when it comes to the adoption of technology.

But it did get one thing right decades ago.

And only now are we seeing just how important one law from 2000 truly is.

Congress passed the Electronic Signatures in Global and National Commerce Act 20 years ago this month. And it took all that time before we can really see the importance of this law.

DocuSign Inc. (NASDAQ:DOCU) is almost as old as the law that created its business.

But only this year, when businesses were forced to transition to work-from-home life, has investors even noticed it.

The company offers legal e-signatures for anything from contracts to leases and mortgages.

Obviously, with next-to-no face-to-face interactions over the last few months, the ability to sign these kinds of documents in your underwear on your couch has been a godsend.

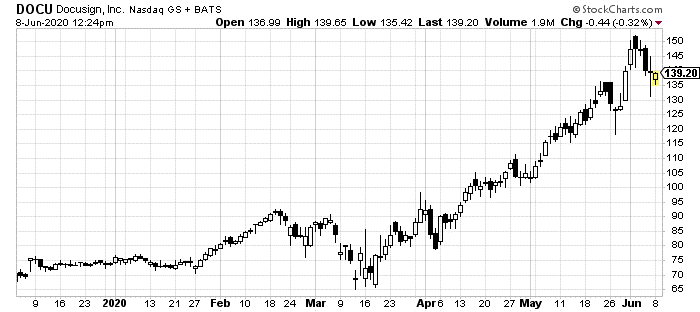

Investors have noticed:

The shares of this e-signature company have nearly doubled this year. And seemingly for good reason.

Post-COVID life will undoubtedly carry some of the lessons we’ve learned during the first half of 2020.

But it will also carry some technology forward.

Zoom’s video conferencing, Slack’s management software and Dropbox’s file-sharing comes to mind. DocuSign’s electronic signature platform certainly fits in there somewhere.

And while this is a great story and has made investors a bunch of money recently, there’s a major problem.

No Moat

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

As noted, DocuSign is an old, established company in this niche industry. It was founded in 2003, just a few years after electronic signatures became a thing.

However, it has never really dominated this space. It has grown in that time into a $25 billion company.

But its business isn’t really built on much.

Don’t get me wrong. Its services are invaluable. But just about any tech-minded company can replicate its offerings.

Electronic signatures aren’t something that can really be protected by patents or intellectual properties. And even if it could, we all know who would have done so by now. In fact, it has. But has already been sued on that point.

Adobe Inc. (NASDAQ:ADBE) is even older, with operations dating back to the early 80s. It is also best known for the very thing DocuSign’s entire business relies on: PDFs.

Adobe’s services include a lot more than just electronic signatures in its PDFs, of course. But it does offer that too. Its price point is pretty similar as well.

DocuSign charges a subscription of $10 per month for a single user. Adobe Acrobat Pro, which is what you need to use its electronic signature ability, costs $14.99 per month.

Sure, that’s more expensive. But if you also use any of its other Creative Cloud products like Photoshop, Illustrator or InDesign, you know that it works seamlessly with the rest.

It is also a better-known brand, which carries a lot of weight for businesses looking to switch to electronic signatures on important contracts and legal agreements.

There’s another problem, however, that DocuSign investors should be aware of. It is itself very expensive.

How to Net 50% on the Downside

The company just reported its first-quarter last week. Sales jumped a tremendous 39%. Yet, despite its size and maturity, it still wasn’t able to turn a profit.

Think about that. The company is likely experiencing the greatest period of adoption for its products in history. Yet, it can’t net a dime in income.

Still, that growth should be of note. So, to properly compare it to its peers and see if it might be worth investing in, let’s look at sales.

Right now, it trades at 19 times its expected 2021 revenue. Adobe, a company more than seven times DocuSign’s size, trades at 12.6 times next year’s sales estimate. And Adobe does have a profit.

While expected to grow faster, 25% sales growth estimate compared to Adobe’s 16%, DocuSign is still clearly overbought.

If you already own shares, take this chance to exit with a sturdy profit.

If you don’t, well, don’t fall for this trap.

And if you’re especially adventurous, a short position right now could net you around 50% in profits as investors realign its share price.