Entire sectors have been shaken to their core…hospitality, travel, services.

Now as the economy begins to reopen in some areas, businesses are trying to navigate these unusual times.

And what we’re going to see across every sector is consolidation. Some of these companies will be gobbled up by bigger entities…and some will simply fail.

What’s really happening is that the trash is going to take itself out.

The Coronavirus is the catalyst, but the real problems were there all along.

Let’s take a look at The Hertz Corporation (NYSE: HTZ). The company finally declared bankruptcy on Friday. Yes, I said finally…because it’s been a long time coming.

Hertz has been around since 1918. It’s grown from a fleet of just 12 model T Fords to a Fortune 500 company. And now it’s fate will be decided in bankruptcy court.

The culprit? "An abrupt decline in revenue".

The real story is that Hertz has lost money for four straight years.

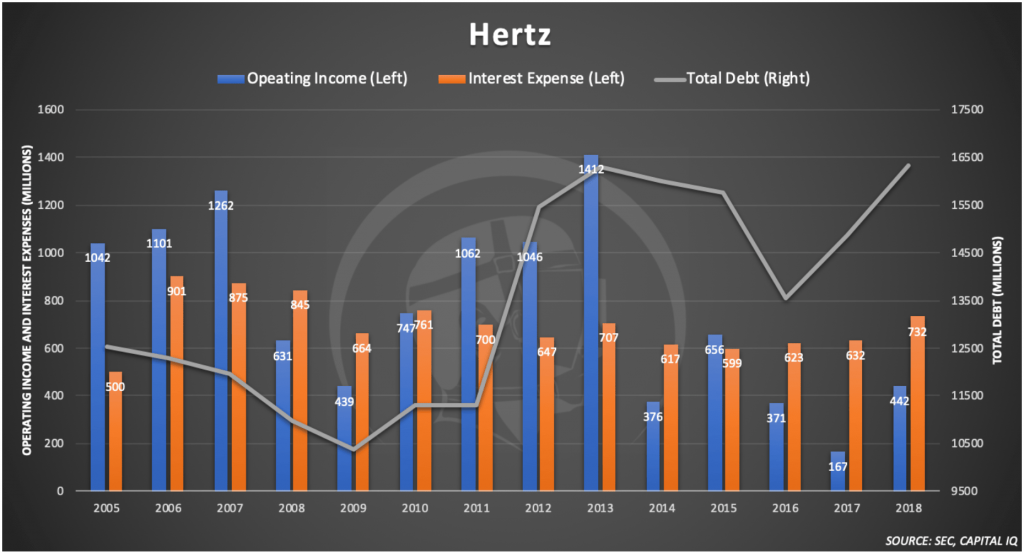

Take a look at this chart from Blinders Off Research.

Since 2014 there was only one year in which operating income covered interest expense. And total debt doesn’t seem to be going anywhere but up.

In 2010, Hertz started looking into the acquisition of Dollar Thrifty. The company expected to pay $1.2 billion. That started a two-year bidding war with Avis.

Reckless Spending

The result was that Hertz would pay $2.6 billion. That’s over double what it wanted to pay!

The integration of the two companies was a nightmare. Then the company spent the money in 2013 to relocate their worldwide headquarters from New Jersey to Florida.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Things didn’t get better as the company cycled through management and pinched pennies.

How do you save money when you’re a car rental company?

You keep the cars in a fleet way longer than they should be. There’s nothing like showing up to your business meeting in your grandma’s ride.

To top it off, the company agrees to pay to settle fraud allegations brought forward by the SEC in early 2019. The accusations ranged from 2012 to 2015.

What COVID-19 actually did was put the final nail in the coffin.

That’s what we’re really seeing happen right now…and it’s not necessarily a bad thing.

Prior to the virus shutdown, shareholders had been riding an 11-year bull market.

This bull market was born out of the 2008 financial crisis. But it kept that momentum going through a combination of historically low-interest rates and an unprecedented rate of companies buying back their own shares.

For the past two years smart economists have been warning of the ever-expanding Fed balance sheet, bond market liquidity and other warnings that the bull party could soon be over.

Anyone looking at the numbers could see those big blue-chip companies were overbought. Yields on dividend favorites had been smacked way down as share prices ballooned.

Everything can appear successful with the market propping it up. Economists sure weren’t predicting a virus. But, they did now the party would end.

Something would be the breaking point. And the losers will be unmasked.

Here's How You Can Profit

Keep your eyes open as the market goes through this consolidation.

Start to notice who’s making bids on smaller companies. Start to notice who’s balance sheets are the strongest. Start to identify the winners.

Then you can add them to your portfolio in the next inevitable market pullback.

But, that's a lot of work for the ordinary investor to track themselves.

That's why I'm here to find those hidden gems for you and be able to maximize your returns.

Not every company is HTZ and will go bankrupt.

A lot of companies were taken to the woodshed and trading at multi-year lows.

One of the sectors has been the 5G.

This pull-back is a gift horse because the pandemic has shown us the need for faster internet speeds.

It's a great time to pick up these 5G stocks at better prices before big money rotates back into them.

Wealthy Tech Investor's had an incredible May with locking in 568% in gains.

But, my newest top pick for Wealthy Tech Investor could be another triple-digit return.

Make sure you join today - the next issue will be released on June 2nd. (Click here to learn more)