The S&P 500 is finally reversing after nearly six straight months of gains. With today’s drop, it is nearing a full-blown 10% correction from its beginning-of-the-month peak.

But there’s a reason investors call this short-term collapse a “correction.” In super-hot markets like the one we’ve seen since mid-March; prices can get out of control.

Fortunately, there’s one play that hasn’t quite shared the tremendous success of the overall market but has followed suit with the recent correction anyway.

Illumina Inc. (NASDAQ: ILMN) is a frontier technology company. It specializes in next-generation sequencing or NGS.

This technology has garnered a ton of attention over the last dozen years. And for good reason.

Illumina’s corner of the market is the use of genome sequencing in testing and analyzing disease outbreaks like Ebola. And yes, COVID-19 too.

In fact, the company’s Illumina COVIDSeq Test was the first sequencing test to be approved by the FDA’s Emergency Use Authorization at the outbreak of the coronavirus.

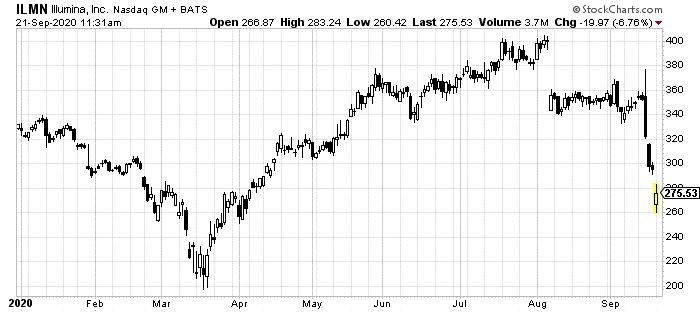

Still, you might not realize how successful Illumina has been of late. Despite its COVID test, the company has had a rough 2020.

Investors steamed in early August when the company announced worse-than-expected quarterly results. Those results still ended up in profit territory. But not by enough for investors.

And the most recent collapse, happening as I write, is due to something else entirely.

Illumina announced today that it is going to buy back GRAIL, a company with an early cancer-detection product set to go into commercialization next year.

Illumina itself created GRAIL back in 2016 but kept just a 14% stake in it. Since then, other huge names have stepped in as investors in the cancer-detection company including Jeff Bezos, Bill Gates, Johnson & Johnson (NYSE: JNJ), and Merck & Co. (NYSE: MRK).

With this deal, worth $3.1 billion in cash and $4 billion in shares, Illumina will gain about a 93% ownership stake in GRAIL.

This is huge. It’s also why investors are fleeing ILMN shares today.

You see, investors don’t like this large price tag. But, as is often the case, they are likely missing the forest for the trees.

GRAIL’s early cancer detection product is set to go into commercialization next year when this deal is likely to be finalized. And with this new product, GRAIL will join just a handful of peers in this next-generation medical breakthrough.

Right now, the market is primarily split between Exact Sciences Corp. (NASDAQ: EXAS) and Guardant Health Inc. (NASDAQ: GH).

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

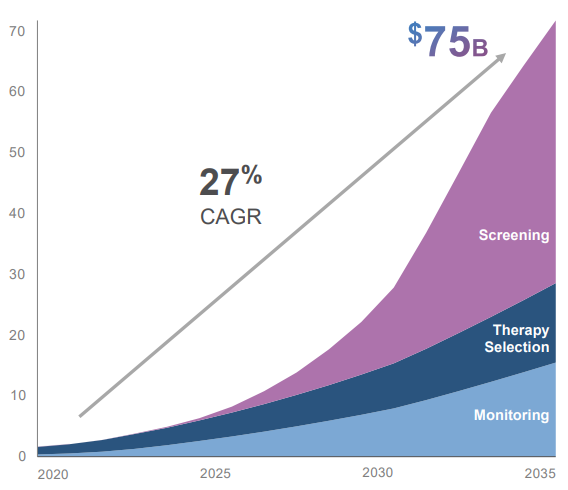

Between these two giants in this new market, they bring in a little over $1 billion in sales each year. But here’s the thing, that’s just a drop in the bucket.

The NGS Oncology Testing Market is expected to reach $75 billion over the next 15 years. GRAIL’s $8 billion price tag is nothing compared to this opportunity.

Some 150 million tests annually will be performed. There’s room for all three here. Exact, Guardant, and GRAIL all stand to grow exponentially with this niche testing and diagnostics market.

Illumina, by doubling down on GRAIL, is making an exceptionally smart move. And because investors think in terms of days or weeks rather than years, there’s a short-term buying opportunity here.

Right now, because of the overall market’s drop and investor miscalculation, shares of ILMN are trailing the S&P by about 16%.

In short order, that will reverse. Farseeing investors have a real chance to get in on the ground floor here.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder