Have you ever wondered why you can’t buy a stock at the IPO price?

When you see companies come to market and pop like Airbnb Inc. (NASDAQ: ABNB) and DoorDash Inc. (NYSE: DASH), it can be frustrating.

It’s even worse when you find one you can’t wait to get into but by the time shares are available on the open market, they are trading at two or even three times the promised price.

The SEC just made a game-changing rule to potentially end this serious problem.

But it’s not without its own question marks.

When a company decides to go with a traditional IPO, they bring in big banks like Credit Suisse and Morgan Stanley to pitch it to big-time investors.

These investors are hedge funds, institutional investors and the like. They certainly aren’t retail investors like you or me.

Successful IPOs find that by the time they get listed, these initial transactions are many-times oversubscribed. Meaning, the underwriting banks found far too many of these big-time investors for the number of shares actually being offered.

This is how huge IPOs like DoorDash and Airbnb jump so fast. Simple supply and demand dictate that when you have too many buyers and not enough sellers, prices go up.

Here’s the problem.

Those underwriters get to pick which investors are able to buy at the set IPO price. Meaning, they literally hand instant profits to whoever they want… all while taking a large cut off the top as commissions and fees.

By the time you or I can get into a new listing, shares could be astronomically higher than either we wanted or is fair valuation.

That’s why so many IPOs are both successful, but end up becoming flops for early retail investors.

This has been an ongoing problem for decades. The process hasn’t changed for traditional IPOs since the 1980s.

That’s why we’re seeing alternatives like initial coin offerings (ICOs), which open trading cryptocurrency tokens rather than cash or shares. The boom in special purpose acquisition companies (SPACs) this and last year has also been revelatory.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

But IPOs still dominate the landscape. The NYSE, which is itself tasked with leveling the playing field as much as possible (though, it hardly does), proposed a change.

After a very long time, the SEC just agreed to this change. It will allow for direct listing on the NYSE, essentially cutting out the middlemen.

Instead of Morgan Stanley pitching a startup to a group of suits at some hedge fund in a Manhattan penthouse, that company can just go straight to market and let investors themselves – even lowly ones with a few thousand in their Robinhood accounts – buy shares in minute one.

Direct listing isn’t the new part. That’s been around for a few years. What’s new with this change is that now these companies can directly list new shares. Meaning, they can be just as effective at raising capital at IPO as any other method (traditional or SPAC).

This could fundamentally shift the IPO landscape, especially for Silicon Valley and tech companies wishing to go public.

NYSE’s chief competitor, Nasdaq, is following suit with its own petition for direct listing with capital raises.

Of course, buyer beware…

The main argument against allowing companies to raise capital by direct listing has been investor protection. At least, on the surface.

I’m sure you’ve heard this argument before: if you let the public investors do whatever they want, they’ll screw everything up.

That’s the powerful groups like banks and Wall Street insiders basically saying, “we want our cut first.”

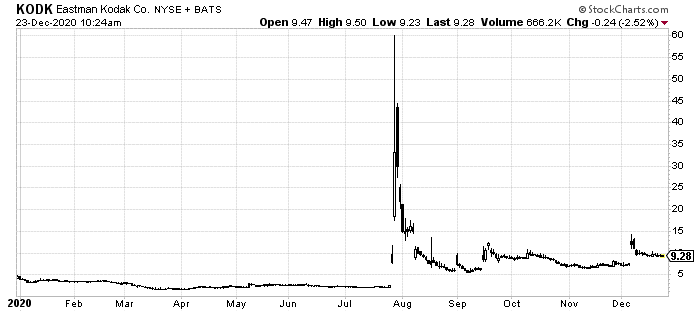

In truth, we have seen some mania in the retail space no one can deny. Remember when Eastman Kodak Co. (NYSE: KODK) soared this summer off uncertain news about a defense contract?

But for once, instead of agreeing with the argument that investors should be sheltered from making mistakes, the SEC decided that investors have the right to make those mistakes… and in this case, those previously hidden profits too.

2021 will see a lot of both, no doubt. As the first rounds of direct-listing IPOs start to come in, we’ll see wider price jumps and falls. That’s to be expected since underwriters can’t pick their favorites anymore.

But we’ll also be able to get in at the price the company actually IPOs at. Meaning, no more sitting around for hours on day one of trading just to see the first shares priced three-times higher than promised.

As we wrap up this wild and less-than-pleasant year, we can take this as an early Christmas present.

It may seem small. But any win against the broken Wall Street establishment should be cheered.

I’ll certainly take it.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder