As if 2020 wasn’t bad enough. Now, yet another crippling record is being broken.

I read a lot of financial news. And over the handful of years, I’ve seen a startling amount of one specific type of story pop up on just about every company I dig into: class-action lawsuits.

They are everywhere. From the tiniest companies freshly on the market to the largest bellwethers in the Dow, you can almost guarantee there’s an ongoing lawsuit somewhere.

If you haven’t followed the news of late, or been overwhelmed by the sheer weight of how much we’re getting every day, you might have missed this story.

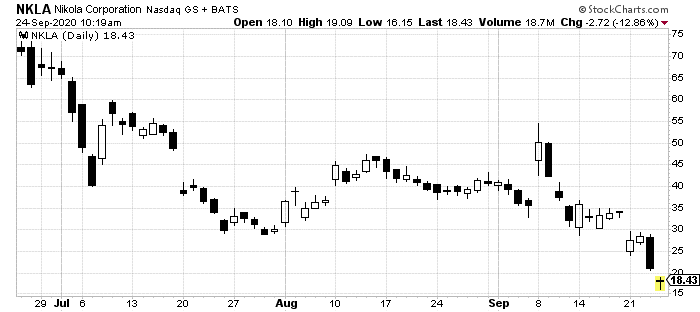

Nikola Corp. (NASDAQ: NKLA), the battery/fuel cell truck dynamo, struck a deal with GM the same time a scathing report of fraud was published. We covered this story earlier in the month.

The point is that Nikola and its founder Trevor Milton got caught lying, allegedly. Regardless of the truth, Milton’s out and as of today deleted his wild Twitter account.

In the background of this huge story, which has caused NKLA’s stock to drop like a block of cement, is the lawsuits. As you can imagine, if investigators do discover Milton and his team were lying to investors, Nikola is screwed.

This is a case where a class action lawsuit put forward on behalf of shareholders absolutely makes sense.

But it is also true that this is a rare, freak occurrence. As much as we all hear about corruption on Wall Street and elsewhere, stories like Nikola’s just don’t happen every day.

After all, we have rules regarding regularly-filed statements of operations, SEC oversight, and more countermeasures against false statements.

Yet, with all of that said, why are there more than 600 of these open cases pending right now? Surely, there aren’t 600 Nikolas out there.

Well, there are some important developments and trends that got us here. And more importantly, several takeaways every investor should be aware of regarding this litigation nation.

It might seem like a modern development in the world. But class-action lawsuits have been around for a very long time. In fact, modern law on the subject in the United States got its roots from the Federal Equity Rules of 1842.

But you wouldn’t be wrong to think that these have been ever more common. Each of the last three years saw record numbers of shareholder class action suits.

2017 saw about three times as many of these lawsuits than the previous ten-year average. 2018, 2019 saw even higher numbers. No doubt 2020 will shatter these records with ease.

A number of factors can be attributed to this rise, including a court case in 2017 called Cyan Inc. v. Beaver County Employees Retirement Fund that allowed the same cases to be tried in both state and federal courts simultaneously.

Basically, that lets law firms collect double the fees and amounts to twice the number of cases each year.

The way law firms themselves seek out opportunities to sue publicly-traded companies is also a huge factor. It has become almost a separate business for them to extract fees for lengthy suits like these.

It’s also how the market has moved recently that indicates the number of cases. This is especially true this year.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Just think about how many companies might have misquoted or misled, even by accident, investors about the impact of COVID-19 on their operations.

Combine that with the record number of mergers and acquisitions, each of which comes with tons of opportunities for hiding information or misleading investors. Add in extreme market volatility, and you get a nasty concoction of trouble for corporations.

Finally, take a look back at Nikola’s situation. No doubt the company is in trouble right now. But exacerbating the whole thing beyond belief was Milton’s crazy Twitter account.

Social media has stirred the pot even further when it comes to securities lawsuits. How many times now has Elon Musk crossed the line with his own Twitter account? How many times does a flood of social media posts force the hand of some company?

It’s only going to get worse… or better depending on your disposition. Bringing light into the inner workings of corporate governance and the backrooms during mergers and acquisitions does have its benefits.

But what do you do in this highly-litigious world?

There are a few steps you can take that might seem extreme or even paranoid just a few years ago. But they could protect your portfolio from the flames of another Nikola.

2020 is a new age. Whether you like it or not, we live in a different world and a different stock market. And this rise in securities class-action lawsuits is only going to get worse.

So, take the steps above to protect yourself. It could both protect your portfolio and reap its own rewards if you, yourself have a case.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder