Elon Musk is at it again.

During this week’s earnings call for Tesla Inc. (NASDAQ:TSLA), he ranted… and ranted hard.

First, he described the US government as fascist for forced lockdowns. Then he felt the need to conjure up William Wallace with a scream of "FREEDOM!"

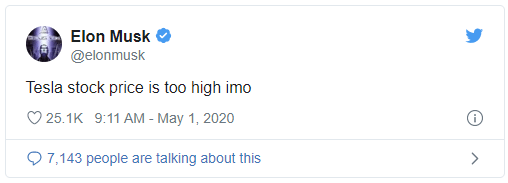

Then, just this morning, he told his 33 million followers on Twitter that his company is overpriced:

While the theatrics are either humorous or painful depending on whether you’re a shareholder, they do lead to the real story… sort of.

Elon’s business isn’t the only one affected by stay-at-home orders.

And everyone has their own opinions about the next steps.

But questioning the fairness of your company’s stock price is a far different topic.

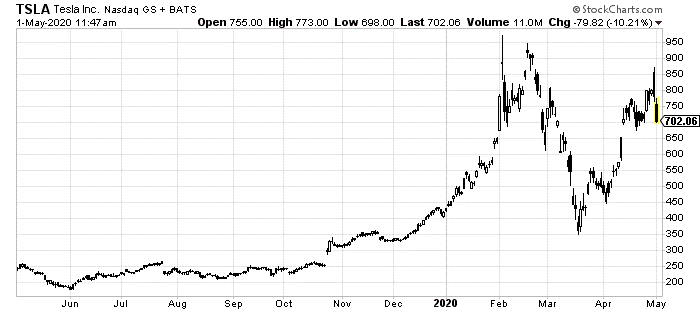

Rollercoaster Ride for TSLA Shares

If you haven’t paid attention, TSLA was a news story well before this pandemic.

In fact, it was the most headline-inducing stock in the lead up to COVID-19:

That chart might look more appropriate for a dot com in 2001 than a car manufacturer.

But there’s a good reason for it. No one can figure out Tesla.

The company is an enigma. Its products are clearly in demand, as it has struggled with making enough of them for years.

Its profitability is confusing and the cars catch on fire.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

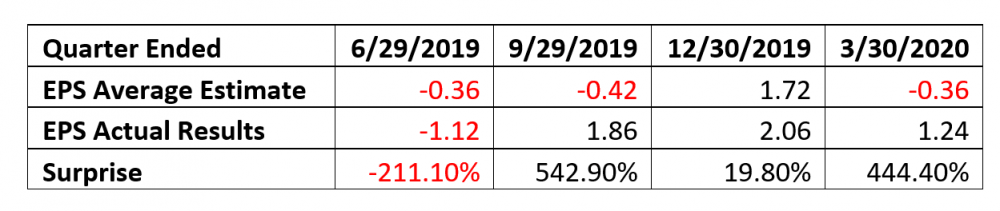

Analysts cannot get a bead on whether the company is going to turn black or red from quarter to quarter.

Here are just the last four quarters of earnings history:

As an investor, what are you supposed to make of this?

If Wall Street experts can’t consistently guess if the company is profitable, how can anyone else?

Deciphering These Chaotic Results

There are specifics, we can look at, however. And any smart investor should.

Trading on Musk’s Twitter rants is akin to the spin of a roulette wheel.

The last column in the above chart shows results from this most recent quarter.

Despite analysts expecting the lockdown to nosedive earnings, Tesla’s Shanghai factory came through.

On top of its Chinese operations coming back online sooner than expected, Tesla’s Model Y launched with a profit. That’s a first for the next-era car maker.

While it didn’t offer any new guidance for 2020, it expects to still hit its 500,000-vehicle sales mark for the year.

Analysts expect somewhere in the 435,000 range. But we’ve already seen how wrong they can be.

The real question is: has the two-part rally in TLSA shares been justified? Should you get in now?

What Action, if any, to Take Now?

We can somewhat take Elon’s own words at face value.

But shares are extremely overpriced right now.

This stock continues to increase because of perception.

Tesla’s products and innovation are wonders. And the company has a great future, clearly. Demand has only gone up, even after the sparkle of such a machine has worn off.

Profits are achievable… at least in some quarters.

But when share prices rocket higher from $200 to nearly $1,000 in six months, there needs to be more than hope.

Think what you will of Elon Musk.

But today’s Tweet could be on the mark.

It's likely Musk tweeted that because he wants the stock price lower because he wants to do a round of raising at a lower price.

Whether the SEC allows it is a question for another day.

I've been wrong on TSLA shares for some time.

If you have been lucky enough to catch this ride higher, you have to strongly consider taking your chips to the window and cashing out!