Well, they finally did it. The suits have taken over the weed business.

I say that a bit tongue in cheek. But it is true.

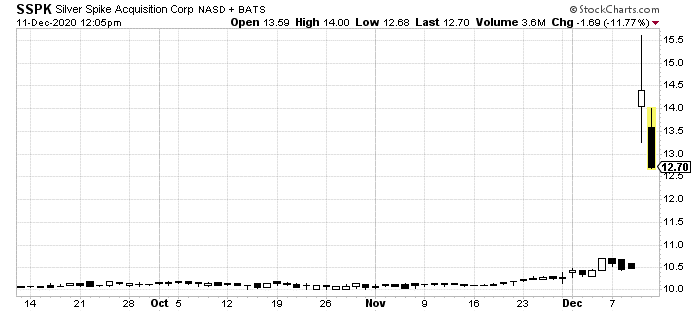

In a deal announced this week, WM Holding Company is going public through a merger with Silver Spike Acquisition Corp. (NASDAQ: SSPK), another of those infamous special purpose acquisition companies (SPACs).

WM Holding is the company that runs Weedmaps, an all-purpose, do-it-all marijuana resource for consumers, businesses and brands.

Going through everything Weedmaps does could fill hundreds of pages. So, I’ll cut to the chase.

Weedmaps is the Yelp, Google Analytics, Google Ads, Instagram and DoorDash of marijuana.

It truly is a remarkable enterprise in the sheer scope of its reach and product initiatives.

Weedmaps, if you haven’t used it, provides marijuana customers a Yelp-like platform to find dispensaries, brands, specific products and even delivery and pickup options.

It does this for a large fee… not to the user, but to the dispensaries and brands.

On average, these business clients pay around $3,000 just to be part of the platform. And because competition is tight and advertising options are low, they do pay it.

The company has around 50 to 55% of the entire cannabis market in the U.S. as clients. And with stations continuing to open up their marijuana laws and new licenses, that’s an enormous opportunity.

But before you start piling into SSPK shares, which have absolutely taken off since this deal was announced, it’s important to dig into what the future looks like in this half-business, half-tech side of cannabis.

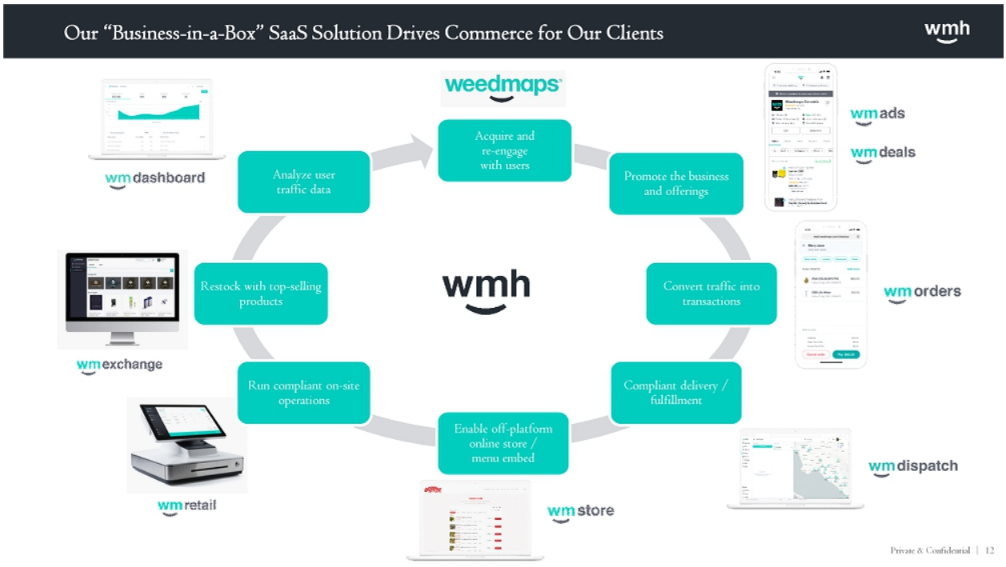

Perhaps the largest trends that have really hit home with investors over the last few years are “Business-in-a-Box” and “Software-as-a-Service.”

I’ve talked about these terms in the past. BiaB (the concept, not the company with that name) is the general idea of integrating different aspects as one package. In Weedmaps’ case, here’s how it works.

It sells subscriptions to dispensaries and brands. That includes official pages, where customers can find and interact with them. It also allows connecting those brands to those dispensaries. Want to find which dispensaries in your area offer a specific strain of weed? Weedmaps can help.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

From there, there are several addons. These include things like regulatory and compliant help, analytics on what’s selling and what you should focus on restocking. Weedmaps is also building out sales points through its WM Retail and WM Store products. And, of course, advertising on deals and brands for set prices.

That’s its BiaB idea. But it is also a SaaS company, not entirely different from the likes of Adobe and Dropbox.

The subscription money it collects from dispensaries and brands is almost a given, constant expense these companies need to pay each year. In some ways, it’s almost like a ransom due annually just to keep some online exposure and happy, growing numbers of customers.

You can see why these concepts are so appealing to investors. Integrated services and business management in exchange for recurring revenue is a high margin product offering, after all.

Weedmaps is turning this business model to one of the fastest-growing industries in the world: marijuana.

So, how to play it?

The deal Weedmaps struck with SSPK will hand over about $585 million, giving the company a $1.5 billion valuation.

Considering the possible “irrational exuberance” we’re seeing in IPOs and these SPAC deals, that’s actually on the low side.

Consider this. Weedmaps has been around for more than a decade in private form. Yet, it claims to have never had a year end in the red.

Moreover, as you can imagine, sales and earnings have grown rapidly each time a state comes online and licenses are issued. Each of those licenses for companies to produce and sell marijuana products means a new customer for Weedmaps’ CiaBaaS model.

So, considering that huge growth and business prowess, it’s crazy to think that investors would only value Weedmaps at about 28 times its 2021 estimated earnings before taxes and 17.5 times its 2022 estimates.

The topping on the cake is its management. During his investor presentation this week that came alongside the SSPK deal, CFO Arden Lee told investors that no one – not he, nor CEO Chris Beals and COO Steven Jung – are cashing out during this transaction.

Meaning, everyone on the inside is staying 100% in. That’s not a perfect measurement of future success, of course. But when insider experts are staying doubled down on Weedmaps’ potential, it does speak volumes.

None of this is to say that Weedmaps will ultimately stay the Yelp, Google Analytics, et al of the cannabis world. But for right now, with this deal, there’s a real upside opportunity for early investors.

Ultimately, WM Holdings won’t begin trading until next year. But you can get into its SPAC right now. And if you are long cannabis, this is one chance to get into it early.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder