The NBA looks set to approve a return to action with a 22-team play-in tournament.

The MLB is seeing negotiations between the players’ union and owners on a return.

And the NFL is signaling an on-time regular season kickoff.

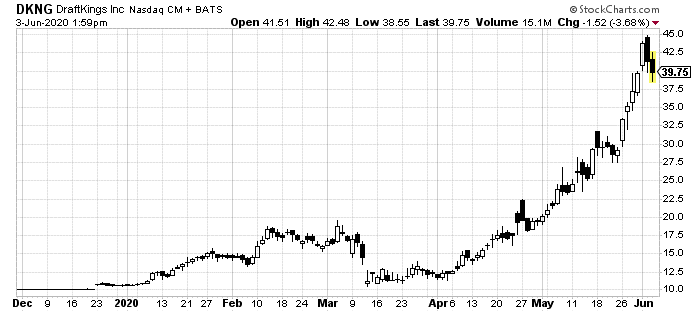

So, it might not come as a complete surprise that investors are over-enthused about the return of sports betting:

DraftKings Inc. (NASDAQ:DKNG) has quadrupled in price this year despite sports being cancelled around the world.

The McRib Effect

One could argue this is the "McRib Effect." McDonald’s could keep the popular menu item at all times. But it has found a way to turn intentional scarcity into even higher profits.

The same can be said for sports and sports betting. This hiatus from sports has only made the already-lucrative sports betting world salivate at a return.

Sports watchers have already shown their appetite for anything returning.

NASCAR returned last month to a 38% increase in viewers compared to its final pre-hiatus race.

Investors are rightfully asking, what will the return of even more popular sports like basketball and baseball look like?

Of course, that speculation is feeding the fast-growing sports-betting world.

The Good

There are several reasons speculators are piling into DraftKings. The McRib Effect is only the tip of that iceberg.

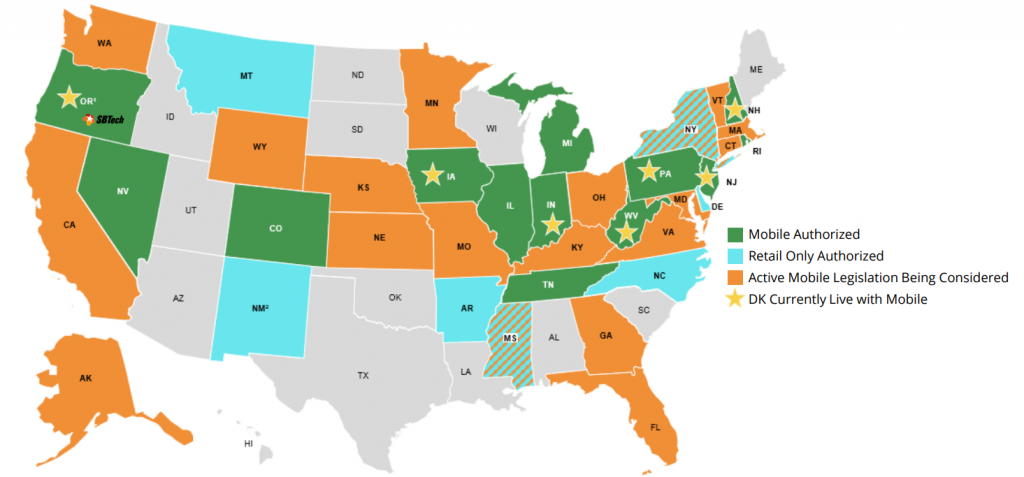

Nineteen states have already approved online and mobile sports betting. This is even before the coronavirus struck the industry.

Seventeen more are considering legalizing it right now. With state budgets under assault, legislation to open up sports betting is looking even better right now.

Another reason why DraftKings, in particular, looks so hot to investors because of their market position.

It controls one-half of a duopoly with FanDuel. A roughly 50% market share in any industry is attractive. But in a hot one, that’s easy money.

Finally, excited investors point to DraftKings’ "iGaming" business as the icing on the cake.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Casinos are only now starting to open up. Still, expected attendance is set to remain low.

Online casino games could offer a solution. DraftKings owns a piece of that puzzle too.

The Bad

The company proudly touted its massive cash position just two weeks ago. At the end of 2019, the company had $491 million sitting on the books. By the end of the first quarter, it had just $97 million.

Yet, without sports, it saw its loss from operations grow to $66 million in the first quarter.

While the return of sports is no doubt going to reverse some of this cash burn, it won’t fix it overnight. DraftKings has long operated at a loss.

Even with the McRib Effect, the company isn’t even pretending it will hit profitability for another 18 months or more.

The numbers don’t justify a four-fold jump in share price during a period with no sports at all to bet on.

And that leads to the worst part…

The Ugly

The company, in its current form, is actually something brand new.

Rather than IPOing its shares on the public market, the company agreed to be sold to a "blank check" or special purpose acquisition company (SPAC).

SPACs are basically middlemen in the M&A world. They themselves go public without businesses. With that injection of money, they go out and acquire other companies. That’s what Eagle Acquisition Corp did with DraftKings.

There’s nothing wrong with that. It’s simply another way to raise money and go public. But since all of that just happened during the last few months, we have access to specific SEC filings. And one looks terrible.

As CPA Danny Vena points out, DraftKings’ recent S-1 filing included this line:

"Based on its recurring losses from operations incurred, expectation of continuing operating losses for the foreseeable future, and need to raise additional capital to finance its future operations, as of the issuance date of the annual consolidated financial statements for the year ended December 31, 2019, the Company has concluded that there is substantial doubt about its ability to continue as a going concern within one year after the date that the consolidated financial statements are issued."

In accounting terms, that’s essentially resignation that the company’s books are going to face some serious financial crisis event over the next few months.

The slow return of sports, fast-draining cash coffers, and overhyped market enthusiasm all point to a short-term correction.

Very rarely do we see a company that quadrupled in price in a short amount of time without a decent pullback.

However, this is a hot stock and we've seen Hot Money jump into this for quick gains.

The Fast Cash Returns

Last Thursday, I posted this on Twitter:

Yesterday, those calls traded up to $5.02 per contract, which is a 100% gain!

That's like getting $5 back for every $2.50 per contract.

That's the type of fast returns we look for in Hot Money Trader.

In fact, we closed out two double-digit winners this week.

But, look for a short-term drop in DKNG soon, but I suspect buyers will jump in and try to push it back to $50 per share.