Combining stability and growth is virtually impossible.

When a company’s products offer stable, near-guaranteed income, that’s great. In times like these, recession-resistance is crucial.

Likewise, when a company can prove to investors that its path to high growth is solid, its stock almost always goes up.

But the two are often seen as incompatible. Stability usually comes from boring products we all unthinkingly buy continuously like toothpaste and coffee.

High growth products are often things that come in waves, like a new-model iPhone or Zoom calls.

But there’s one area of the tech world that can in fact combine the two: cloud software.

Change in Business Model

The clearest example of just how advantageous this subsector is comes from Adobe Inc. (NASDAQ:ADBE).

If you work with computers at all, no matter which industry you find yourself, chances are you use Adobe products.

If you work in a creative or design field, you definitely do.

Adobe is known for its suite of design staples: Photoshop, Illustrator and Lightroom.

Now, you might be thinking: “Sure, it sells software staples. But how is that different from countless others?”

The answer is in how it sells those products.

A few years ago, the company flipped its business model on its head.

No longer do people go out and buy their software and have full access forever. Instead, it moved to a subscription model.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Nowadays, Adobe customers pay for its Creative Cloud.

This subscription-based model ensures that customers always have the latest version of its products, with constant updates and customer service. But they also must pay each year for service.

This took a while before it caught on. But now, we can see just how well the new model is working.

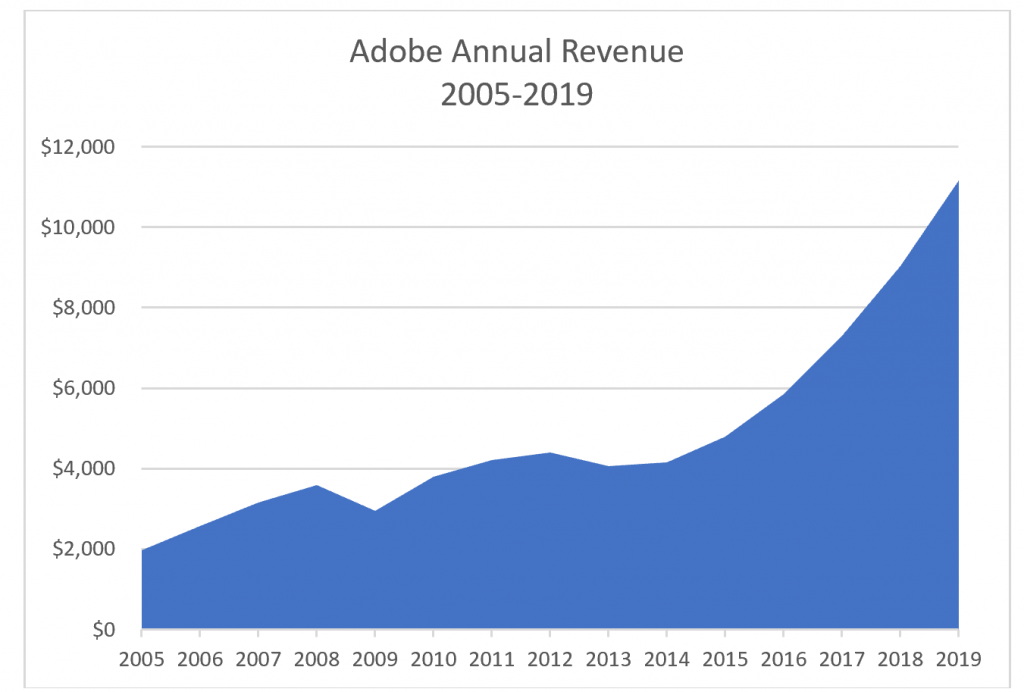

Adobe’s revenue has grown from $3 billion a decade ago to $11.7 billion over the last 12 months.

As you can see, once it switched to a cloud subscription model in 2013, its top-line starting hockey-sticking.

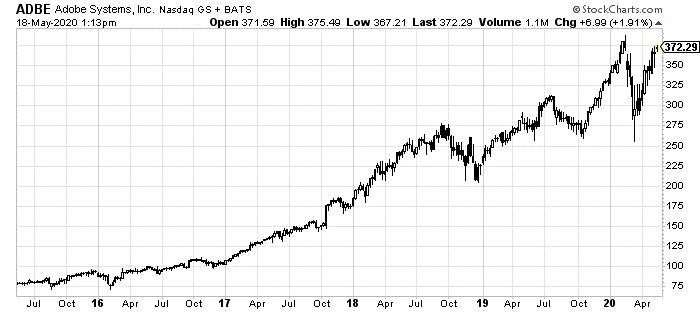

It’s stock has followed suit:

The Path Forward to Growth and Stability

This is an incredibly powerful model. Clearly, it offers growth.

Spending-per customer has risen. And as its products become ever-more essential in the creative and design worlds, the number of customers have gone up too.

But the real interesting part of this is how it is expected to perform this year… when the rest of the world is suffering a recession.

While other companies from consumer staples that ordinarily do well during recessions to other tech plays are cutting guidance, Adobe forecasts between 16% and 19% top-line growth.

And since its business is a relatively high margin, that filters straight down into its net earnings.

That’s expected to come in at around $9.75 per share for 2020, up from $7.87 last year.

That’s not just speculation either. During the first quarter, the company saw 19% sales growth and 44.1% earnings per share growth.

This proves both its stability in an irrefutable economic downturn and its high-growth capabilities in all markets.

There’s a final angle worth considering too.

Post-COVID World

As we’ve seen from every part of the economy, working from home is working.

Companies like Google and Facebook have extended employees working from home until the end of the year. Even Amazon has pushed their WFH-eligible workers return date to October.

Going forward, that means each of those employees that need Adobe’s products will have to have their own subscriptions.

They’ll have to pay for those services on an ongoing basis. Or their companies will. And that means even more revenue growth down the road.

When trying to find a stable, yet-growing place to park your investment money, it can be tough.

But as we’re clearly seeing Adobe’s subscription model fits the bill.