There might not be a less innovative industry than mining.

The last great breakthrough for the companies pulling out thousands of tons of gold, silver, copper, etc. came from steam powered machines.

But that could be changing. Innovation doesn’t always start from the industry it ultimately changes. For mining companies, that’s certainly true right now.

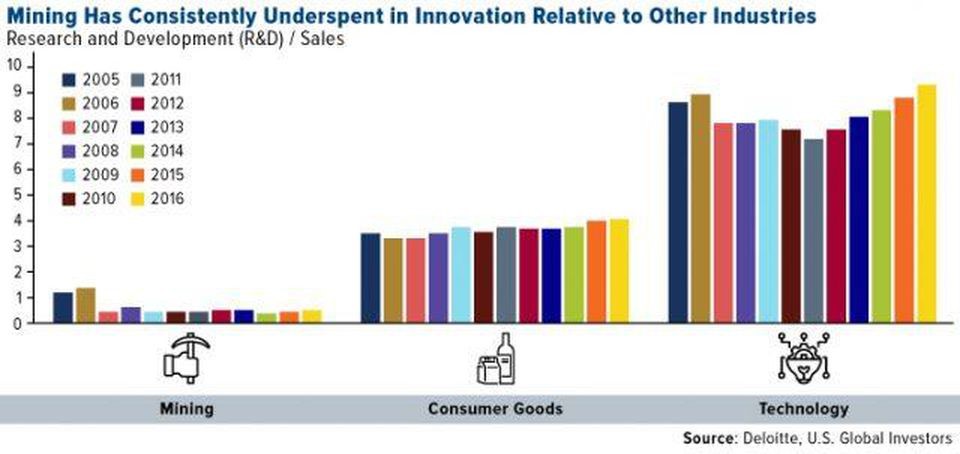

Over the last several decades, R&D spending from miners has barely been high enough to even report.

Though, while the likes of Newmont and Barrick might not be developing next-gen mining equipment, others are.

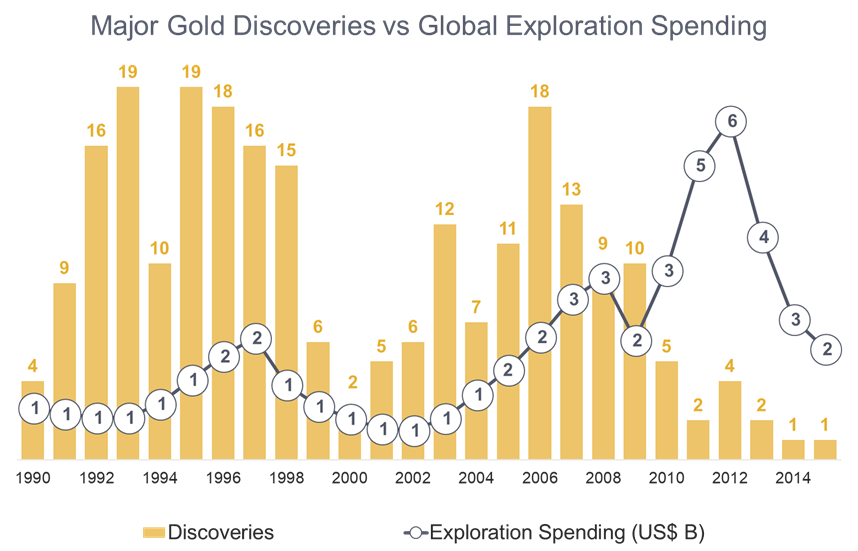

One part of the mining industry, specifically in the gold mine area, that’s been completely underfunded is exploration.

While geologists and data trackers have definitely gotten better over the last two decades or more, both new gold finds and funding towards exploring for gold have dropped.

For the former, there’s just been no luck. For the latter, however, the big miners have tried to find new gold. But when it wasn’t coming, they gave up.

The idea of "peak gold" has flooded the gold mining industry.

Gold, of course, is a natural resource that remains finite. There is only so much gold in the ground.

So, the idea that we could hit a peak and see ever-decreasing reserves scare a lot of people.

But as Ricard Torné pointed out in this article, we’ve already had four "peak golds" over the last 120 years in 1912, 1940, 1971, and 2001. Each time, new discoveries and slight increases in exploration technology quieted the naysayers.

Well, despite limited funding, new technology is coming to light to potentially challenge the current "peak gold" speculation.

Artificial Intelligence in Mining

You might have heard about drones flying over vast swaths of land in places like Nevada and Australia looking for signs of potential gold deposits. That’s certainly a technology that could help with discoveries. But the real breakthrough is more likely to come from how that data is processed.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

You see, the very word exploration is misleading.

The oil and gas industry overuses it. Oil & gas exploration is its own subsector, in fact.

The same goes for gold. There are companies out there that just do that. They search for new gold veins to sell to majors like Barrick.

And while these kinds of companies do drill and analyze soil samples to check, that’s expensive and one reason why companies have been cutting back on spending.

This isn’t really what the industry needs to find its next round of large gold discoveries. In fact, the industry has already done most of the work.

There are mountains of data buried inside every gold, silver, and copper company’s vaults. But no amount of human labor could possibly analyze, process, compare, and project each square foot of geological information found within. That takes next-gen tech.

Specifically, artificial intelligence is coming to save the gold industry.

Companies like GoldSpot Discoveries Corp. (OTC: GDDCF) have developed AI software that is specifically designed to compare this geological data with large real-world discoveries.

This particular company is tiny and virtually untradeable. But the idea behind it is not totally unseen by the multi-billion mining industry.

It, along with absolute giants like Barrick Gold and Teck Resources have been participating in a research project partially funded by the Canadian government called Metal Earth.

This group’s goal is to use all of its combined geographic data and AI such as GoldSpot’s to get a better understanding of how gold deposits were actually formed and where they might be.

Today, there’s no specific way to play this emerging profit trend. But you can’t deny that whoever solves this period’s "peak gold" question will be far richer for it.

This is one emerging technology that is only going to become more and more lucrative as major miners become more and more desperate. And those small companies working on the AI itself instantly become takeover opportunities by the likes of Newmont and Barrick.

Gold is back to 2012 highs at $1,800 per ounce and will continue to climb higher as the Federal Reserve prints money at a pace never seen in history.

Spending on where to find the next big discovery will only increase and get more exciting.

For the time being, I'm a buyer of gold - giddy up!

To your prosperity,

Joshua M. Belanger

Executive Publisher & Founder