Most readers of Wealthy Tech Investor know that I’m a big proponent of new trends in technology.

And as we step into 2020, it’s important to reflect back at our results through the last year.

Think back to the end of 2018… The market was in a virtual free-fall from October through December.

And while I noticed many investors were scared and running for the hills…

I predicted it was just a pullback, and the technology sector would see a huge rebound in 2019.

The result? By the end of 2019, the stock market saw its second-best performance in the past 2 decades. The Nasdaq was up nearly 38%, while the S&P 500 rose over 30%.

Meanwhile, our beta-testers had the chance to pocket total gains of 1,161%.

If you had the conviction to be bullish from January on - and through the lulls of late summer – you could’ve crushed the indexes for the year.

In 2019, we had massive success with the Wealth Tech Investor portfolio, with names like ROKU up 322%, Shopify was up 193%, and Trade Desk was up 134% for the year.

We’ve been right on almost every prediction for last year.

But what’s in store for 2020?

Right now, the market sits just 1% below all-time highs and the bulls rule on Wall Street, we have some near-term concerns about this leg of this rally.

The macro (big) picture remains positive in most global regions, but valuations have risen to the highest levels we’ve seen in over a decade.

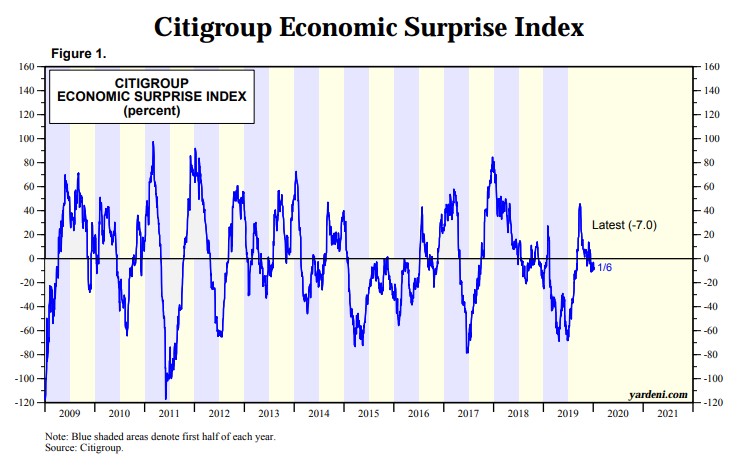

Citigroup’s macro Surprise Index, which measures whether macro prints are beating or missing estimates and by how much, has dipped lower in the past two months after rising in the summer and fall of 2019:

In the first quarter of 2020, we have concerns about stock valuations being at their upper historical bounds, and any further weakness in macro releases could send stocks retreating for a spell.

These drawdowns would be largest among the high-beta technology stocks that have the highest multiples in the entire tape.

However, a pullback in this area would be healthy for the overall market. We continue to see huge runways for secular themes like 5G, personalized medicine, and SaaS, but bull markets last the longest when there are periods of consolidation and even churning sprinkled in them. Q1 could be one of those times.

We recommend holding off on high-beta stocks like ROKU, SHOP, MDB, and OKTA. These companies have premium valuations on their current revenues, and we recommend taking some of your gains off the table.

This can be done through trimming 40-50%, or selling outright with targeted re-entry levels. But what happens after Q1?

You think we’re at a market top? I don’t. This historic run is NOT over and here’s why:

1. The Federal Reserve is making major asset purchases (and keeping interest rates low) Not only will this keep the interest rates low, but it will flood the market with new money to invest elsewhere… When money shifts out of T-Bills and bonds, it’s almost guaranteed to go right into the unbeatable stock market. With more liquidity added to the markets, we can expect increasing prices.

2. Corporate Earnings are set to spike. 2019 was a historic earnings year, with massive gains following upbeat earnings announcements. 2020 will be even better - Goldman Sachs is calling for a 10% increase in EPS for the coming year. Increasing profits and outperforming EPS announcements will pump steroids into the market.

3. 5G is officially set to unleash $12.3 Trillion in economic activity. And if you’ve seen on TV during commercials, 5G has officially begun it’s Phase One of rolling out across the United States. There’s been much anticipation around the power of 5G - and what we’ve seen is only the beginning…

Are you ready for full-functioning A.I. and self-driving cars? Buckle up for 2020.

According to the US Census Bureau, every day an estimated 85 percent of the 150 million workers must drive to their workplace. That’s 128 million people driving to work.

But new technology breakthroughs give us a chance to live better, more connected lives. And one company is about to change the way we work forever.

That’s why I’m so excited to introduce you to Zoom Video (Nasdaq: ZM) – the clear leader in business communications.

This newly-public company is achieving what hasn’t been done in decades - cornering the massive video conferencing market. Owning the video conference space has been the dream of many tech titans in the past 15 years.

Cisco, IBM, and scores of others have spent tens of billions of dollars on video conference hardware and software, in mergers and R&D, trying to lock down this space. Because they all knew full well how lucrative it is, and it keeps growing year after year.

As more and more businesses bend to the will of millennials who want to work from home (or remotely), Zoom is going to become integral to modern business, as more meetings and more workflow “goes virtual”.

Other solutions in the market, like Slack or GoToWebinar are inferior products. That means more market share coming for Zoom.

Less than a year since its IPO, Zoom Video offers a “freemium” revenue model, which means free usage of their integrated cloud video conferencing software for one-to-one calls. Corporate clients and power users pay a monthly subscription to have features like longer call limits, hosting calls, recording solutions, and customer support.

Zoom Video’s solution is catching on so fast that it’s already becoming a verb.

Remember when Xerox became a verb? “If you need to make a copy, just make a Xerox.”

Or when Google became a verb? “If you don’t know the answer to something, just Google it”.

Now you’re likely to hear someone at your job say, “If you want to have a meeting, just Zoom me.”

When your product becomes a verb, you’ve arrived. Since Google became a household name, we’ve GOOGL shares skyrocket 1000%… Zoom has that kind of potential.

Another fair comparison is Adobe, which has conquered the PDF market. Adobe is now a $166 Billion stock. Zoom is a $20 Billion stock.

As technology advances with blazing speeds, we’re already seeing faster, clearer video calls, and the runway is wide open for Zoom to become a new tech titan.

They’ve been scooping up major clients left and right, including the U.S. Postal Service, which is using Zoom’s Meetings service across all internal division.

What’s key in this client win is that it gets Zoom’s foot in the door to the ultra-lucrative federal contract business after receiving FedRAMP vendor approval in mid-2019.

Zoom is also growing into its high valuation - shortly after the IPS last year, ZM was trading at over 30x forward revenues, but after Zoom reported a stunning 85% revenue growth in its latest quarter while 2020 raising guidance, the forward valuation now sits closer to 20x.

And Zoom looks to have the goods to keep delivering. They’re just scratching the surface of international growth, turning in over 100% growth overseas in the latest quarter. But revenues overseas are still under 20% of Zoom’s total - a number we think will rise to over 50% in the coming years.

We also expect to see explosive new product integrations in the next few years - just imagine when Zoom will be available on your smart TVs. You can do calls for work or to friends & family right from the TV screen in your house!

Zoom is running operating profits above 12% already - an astonishing efficiency for such a young company. We see this as a validation of the scalability of the business model and a justification of the high multiple on the stock.

Meanwhile, Zoom is not only picking up more corporate clients (nearly 100% growth year-over-year), but earning more revenue on their existing corporate clients. It’s all about putting a quality service out there, and letting the product itself shine.

After soaring almost 100% in the first 6 weeks following the IPO, ZM faded off 40% of that pop before making a nice basing process around $62.50.

We see strong value building here, and the low $60’s as an attractive entry point if it holds through any Q1 weakness in the broader stock market.

Action to Take: Buy half your intended stake in Zoom Video Communications (ZM) at market up to $80, and then put in a lowball limit order for the second half at 20% below your entry price.

We talked last year about the unprecedented profit opportunities being ushered in by 5G.

The level of infrastructure that’s going to be needed for this upgrade – everything will have to be updated for 5G – is staggering, with a price tag of $1.4 trillion.

When it comes down to it, this technology will impact just about every sector you can imagine – I’m talking agriculture, construction, education, manufacturing, real estate, utilities, and more.

Qualcomm (QCOM) President Christiano Amon said last week that 45 operators around the world have deployed 5G. He predicts 200 million 5G smartphones will be sold in 2020, and growing from there.

“5G is a multifaceted technology, a foundational piece of everything for the next decade,” says Simon Segars, CEO of chip design house ARM.

Needless to say, the time to get into 5G is now.

Our #1 stock for the 5G Boom is the tiny firm that helps make the 5G network possible.

It’s a small-cap radio frequency connection enabler is called RF Industries. (RFIL), and it last reported earnings on Dec 18th, printing 10% annual growth in revenues, with revenues 57% over last year.

On top of that, RFIL acquired a wireless component manufacturer in Q4, further bolstering its offerings to the big-pocket telecom and wireless companies like Verizon and AT&T.

RFIL’s CEO commented in the Q4 conference call that while the company is better positioned than ever to go after larger contracts with Tier 1 customers, order flow will be lumpy for the coming quarters because the project size is just so massive.

Investors were a bit disappointed by the leadup to the Q4 earnings print, but we see the market still not appreciating the size of the runway RFIL has in front of it.

The market is still not appreciating the tectonic shifts to the global economy with 5G.

Action to take: Buy half of your intended stake in RF Industries Ltd. (RFIL) at market and then put in a lowball limit order for the second half at 20% below your entry price.

We just got back from CES 2020. This is the world's biggest gathering place for all those who thrive on the business of consumer technologies.

It is THE global stage where next-generation innovations being introduced to the marketplace. And this year it was ALL about 5G.

5G is nothing less than the biggest tech rollout in history, and it’s going to cover every square inch of real estate in America. But it’s not just America. 5G is going worldwide in 66 countries by the end of the year.

That’s why it’s important to get in on the ground-floor of companies that will soon be the Apples and Amazons of 5G.

These are the firms building out the 5G infrastructure – the testing equipment, the antennas that allow the network to handle more traffic, the fiber optics that transfer the data for everyone from large businesses to regular consumers.

That brings me to one of the leaders from our portfolio – Nvidia (NVDA).

The 5G network introduces a new technology called “network slicing.” This allows carriers - like Verizon and AT&T - to dynamically, session by session, deliver new services besides just voice and data.

New services like virtual reality, augmented reality, gaming, and artificial intelligence, will be able to access millions - and on its way to trillions - of IoT (Internet of Things) sensors all over the globe, in real time.

NVDA has created an entire production platform to amplify the power of this mobile edge - and then OWN the mobile edge.

We remain bullish on NVDA into 2020, and will only be looking to trim if global PMI composite for advanced economies were to go below 50.

Action to take: Hold.