Investors’ anxiety levels are extremely high right now. The coronavirus pandemic has grown from a health crisis into an economic one.

When will the world recover from either of these crises? When will normalcy return to our daily lives?

Right now it’s anyone’s guess.

Since the first stay at home orders were initiated in March, here in the United States, the Dow Jones Industrial Average and S&P 500 have fallen roughly 16% and 13% respectively.

The VIX, Wall Street’s fear gauge, in response has spiked.

What’s this mean for you and your money?

Uncertainty and fear are the new normal. And for most folks with retirement dreams on the line, and mortgages to pay right, now this simply won’t do.

That’s why most smart investors hold gold to hedge against various economic crises. And when things get really bad, like they are now, folks really pile into the yellow metal.

And as investors continue to flock to gold the demand will certainly drive prices to surprisingly high levels, and in short order.

But, this is a tech letter right, why are we talking about gold?

Here’s why.

A pick-and-shovel play is an investment strategy that involves buying stock in the tools or services that support another industry. The classic example is the pick and shovel salesman who made it rich off prospectors during the Gold Rush of 1849.

Here lies our opportunity.

Of all the minerals mined from the Earth, none is more useful than gold. Gold has a host of special properties. It conducts electricity, doesn’t tarnish, is malleable and it can be used to make alloys with many other metals.

The most important industrial use of gold is in electronics. A small amount of gold is used in almost every sophisticated electronic device. This includes cell phones, computers, and global positioning system (GPS) units. Most large electronic appliances such as televisions also contain gold.

In computers, gold meets the requirements needed for fast and efficient information processing better than any other metal. The importance of high quality and reliable performance justifies its cost.

And of course there’s its perpetual use as a store of wealth through the ages.

But it's the tech world’s demand for the yellow metal that drives out interest.

And as our world becomes evermore tech-integrated, the demand for gold should also grow exponentially.

Two-thousand dollar per ounce prices could be here as soon as summer, and compounded by a prolonged pandemic and the recession it caused, gold heading as far high as $5,000 over the next few years is certainly possible.

From late Aprils highs, that would be as much as a 183% increase.

But what if we told you there was a way to play this gold surge that could increase your profits 10 fold over just owning the metal itself.

Allow me to explain.

Gold is one of the rarest elements on Earth, which is why it’s so highly valued.

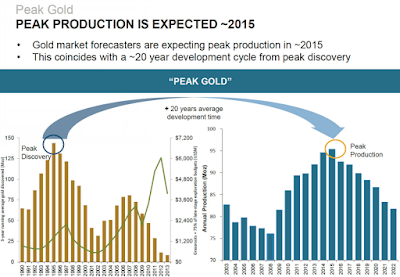

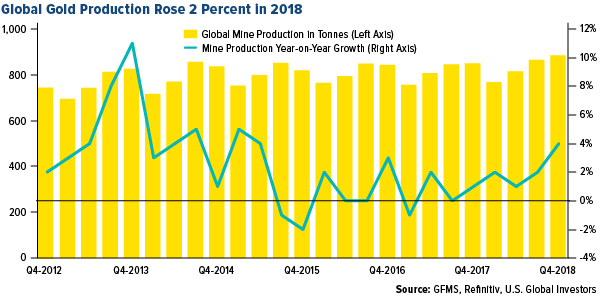

Major gold discoveries peaked in 1995 and overall gold production growth peaked in 2013. Since then it’s fallen steadily:

Source: http://globaleconomicanalysis.blogspot.com/

On top of this, gold exploration budgets have been trending down since 2013 and are extremely low. Even if gold prices skyrocket to $2,500 per ounce over the next year it will take many more years for new production to catch up to demand.

The looming recession has sent gold prices off and running and these other bullish factors indicate it is only a matter of time before gold reaches new decade highs.

However, the companies that produce the yellow metal are even more undervalued right now and have a lot more upside potential in the years ahead.

As you can see clearly in the graph above, gold mining stocks are trading at the deepest discount to the S&P 500 in a decade!

This gives gold mining stocks huge upside potential, even compared to physical gold right now.

The companies that mine gold could offer 10x the gains in gold. That could be a gain as high as 1,830% if gold miners move in lockstep with gold to $5,000 per ounce!

It's happened before, many times in fact, and it will happen again.

Now here’s the company we want to own ahead of this happening.

Newmont Corporation (NYSE: NEM) is the world’s leading gold company and a producer of copper, silver, zinc and lead.

Newmont was founded in 1921 and the company has an attractive portfolio of assets with mines in North America, South America, Australia and Africa. It has been publicly traded since 1925 and is the only gold producer listed in the S&P 500 Index.

And as we noted above, gold miners have been heavily undervalued for years with Newmont being no exception.

Now, as market woes continue and gold prices rise, Newmont is making its run.

And we think this is only the beginning of a much bigger and prolonged runup, powered by the tailwinds we outlined earlier in this report.

Newmont President and Chief Executive Officer Tom Palmer notes:

“The level of stimulus globally that’s going into the economy certainly underpins higher gold prices for the longer term, and I don’t think that stimulus has stopped yet, You could certainly see scenarios that have it pushing north of $2,000.”

Palmer continues:

“Spot bullion is trading around $1,725 -- close to a more than seven-year high -- and is forecast by numerous banks to extend gains as the impact of the virus pushes economies toward recession and prompts action from central banks. Those factors are adding to what was already a strong outlook, with rising demand among middle-class consumers in China and India and signs of supply constraints.”

Newmont should profit nicely from these conditions and that makes it one of your best hedges against volatility while still offering you big upside potential.

StockNews.com reports, “JP Morgan analysts have heaped on the praise for this relatively safe stock, sending it from $40 in mid-march to its current price in the low $60’s.”

Now normally we would suggest holding off on entering in on a stock like Newmont after such a quick rise this year, but historical data actually proves you want to trade into strength when you can.

Simply put, as stocks go up, more often than not, they continue to do so.

Additionally, Wall Street analysts are suggesting that millions of impending loan defaults and a disappointing second quarter earnings season are not yet priced into the market.

This means many analysts think the bear hasn’t even woken yet. But when it does Newmont will likely continue to rise significantly higher as more and more investors flock into gold.

On top of that, Newmont announced recently it plans to pay a quarterly dividend of 25 cents, a 79% increase, up from 14 cents, so you get paid while you wait for the runup.

Action to Take: Buy a full position at market in Newmont Corporation (NYSE: NEM)

It’s been a long time since we talked about trade wars and Chinese tech espionage. But the story of our next recommendation begins there…

Not too long ago the U.S. was embroiled in an epic tech battle with China. The first casualty came when the U.S. banned use of Huawei technology.

Australia was quick to follow suit. Then Europe and parts of Asia enacted partial bans on Huawei tech.

The Chinese telecom giant was not completely blacklisted, but they did face a ton of scrutiny and are now effectively locked out of some of the biggest developing 5G markets.

That’s no good for business. TelecomLead.comearlier this year reported:

“Blocking of Huawei from supplying 5G mobile network may result in loss of up to $63 billion in the GDP of top eight technology markets, and at least $4.7 billion in case of India, by 2035, a report of Oxford Economics commissioned by the Chinese telecom gear maker has claimed.”

Thats was pre-COVID, but still who fills the void?

The answer may surprise you. But it could mean big profits for you by acting now.

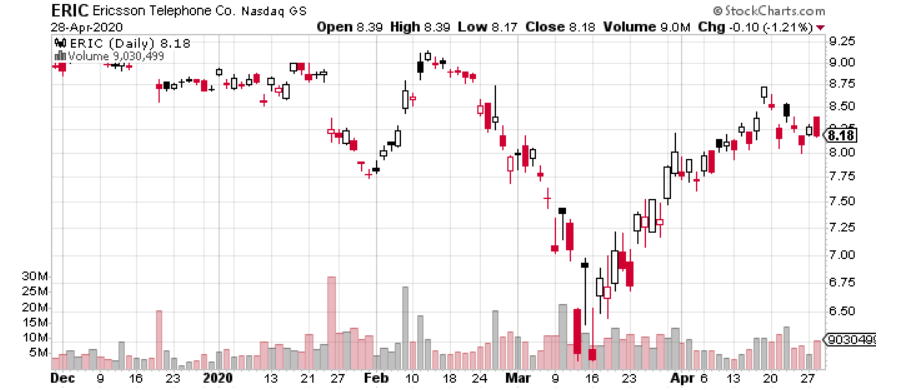

Telefonaktiebolaget LM Ericsson (NASDAQ: ERIC), commonly known as Ericsson, now holds the title for fastest 5G speeds on record, at over 4 gigabytes per second.

WebProNews reports:

“Ericsson researchers have set a new record for mmWave 5G, hitting 4.3Gbps download speeds.”

That’s incredible speeds!

And it’s why so many experts say Ericsson 5G could very well be the company that fills the vacuum left by Huawei’s ban across the globe. 5G of course enables a slew of new technologies.

Ones that will revolutionize the world. And there’s strong belief in some circles that the Swedish telecom giant has exactly what it takes to fill the void created by the Huawei scandal.

The coronavirus may have put this year’s Mobile World Congress on hold. But that didn’t stop Ericsson from taking shots at Huawei setting up the stage for a 5G showdown.

PhoneArena.com reports that at an interim event in London:

“Ericsson claimed that it (and not Huawei) is the global leader in providing 5G networking equipment. The company's executive vice president Fredrik Jejdling said, ‘We've deployed 24 [live] networks across the world [in 14 countries]. We've been first to deploy networks across four continents. So for us, it's hard to see anyone ahead of us currently…we believe we have a competitive portfolio that is on a par or ahead of our competitors’."

But the company has a big backer on its side, and even now the U.S. could help Erricsson become No. 1 in 5G abroad.

Prior to the coronavirus striking the world, shaking up plans for virtually everything this year, the U.S. government has publicly stated on more than one occasion it strongly backs alternatives to Huawei technology.

Politico reported earlier this year that the U.S. Defense Department is once again in support of new rules that would limit the scope of Huawei’s operations.

These new rules would outlaw some of the loopholes some U.S. companies are using to continue supplying their products to Huawei.

Now, Ericsson tech may not make many headlines here in the States, but we can assure you it is cutting edge.

Last month, Ericsson unveiled a number of updates to its 5G network. The updates include a dual-mode 5G core with cloud-native infrastructure, AI powered networks and an energy management system that can reduce opex and carbon dioxide emissions, reports SDXCentral.

Having a cutting edge cloud-native infrastructure will be a crucial factor in determining who gets new contracts to build out 5G networks. And even if Huawei’s tech is that much better than everyone else's (which it’s not) who knows when they will be able to operate in full.

With demand for 5G already peaking there’s no time to wait for Huawei.

If you’re familiar with the concept of a power vacuum this is our stock market version of one. And in Europe we’re betting Ericsson takes the 5G crown.

And that’s why we’re adding it to the portfolio today.

Action to Take: Buy a full position at market in Telefonaktiebolaget LM Ericsson (NASDAQ: ERIC)

Now let’s do some more portfolio management. Today we’re clearing up more cash for new moves down the road.

Action to take: Sell your Roku Inc. (NASDAQ: ROKU) shares at the market.

Action to take: Sell your Nike (NYSE: NKE) shares at the market.

Action to take: Sell your Trade Desk (NASDAQ: TTD) shares at the market.

Action to take: Sell your Zoom Inc. (NASDAQ: ZM) shares at the market.