It seems this tech giant can't lose.

In 2001, Apple took aim at the music industry… and won.

In 2007, it went after the mobile phone market… and won.

In 2021, it will take on its largest opponent yet… and will win.

Yesterday, Bloomberg reported, “Apple Inc. is planning to start selling Mac computers with its own main processors by next year.”

This isn’t a new idea. Apple has threatened to cut out its chipset suppliers for years. But this reported plan comes with specific chips in mind.

According to some mysterious “people familiar with the matter,” the chips Apple is designing are based on ARM technology and 5-nanometer production.

Apple will offer Macs with 12-core chips starting in 2021. And other 5nm based chips will launch the next era of iPhones and iPads as early as this year.

Preview of Apple’s own mobile chip, set to launch later this year. Source: Apple

Taking Down the PC Leader

There’s one company this development is aimed to take down: Intel Corp. (NASDAQ:INTC).

The old chip leader just hasn’t been keeping up of late. It has fallen behind on both processor speeds and graphics capabilities to the likes of Advanced Micro Devices Inc. (NASDAQ:AMD) and NVIDIA Corp. (NASDAQ:NVDA).

Intel’s long-awaited ace in the hole was its 7nm chipset. Unfortunately, that project suffered from delays. And it was ultimately the final straw to break the camel’s back.

Apple suffered its own delays and missed sales due to inventory shortages related to Intel’s chips. The two have worked together for years. But these delays were too major to ignore.

Intel will continue to supply chips to Apple, likely even past the launch of Apple’s own chips next year. But they won’t be used across the board like they are now.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

These proposed new chips offer faster speeds, more efficiency, and more flexibility than even Intel’s 7nm designs.

Of course, that doesn’t mean Apple is the best way to play this change. Nor is shorting Intel. After all, Intel remains an industry leader with around half of the PC market and lucrative business-to-business sales. Plus, these delays haven’t exactly been a secret. Shares of Intel remain objectively cheap compared to its financials.

The Company Behind Apple’s Takedown

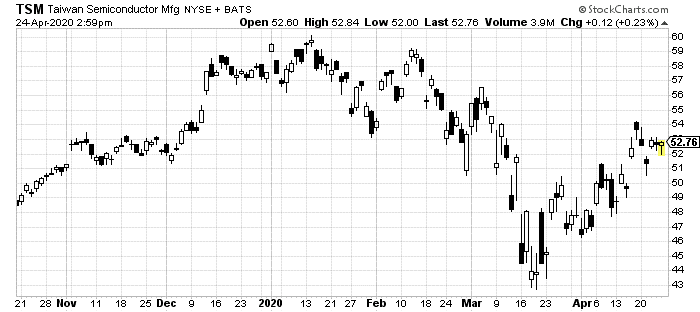

However, one better company is coming to the head here: Taiwan Semiconductor Manufacturing Company (NYSE:TSM).

TSM, as one would expect, is the company that is getting these new manufacturing contracts. It will be the company that actually makes these new Apple chipsets.

The company already does heavy business with Apple for iPhone and iPad processors. Those same insiders who leaked to Bloomberg confirm that TSM will also get the Mac chip deal.

The expected launch of the first Apple chip in a Mac is expected toward the second half of 2021. However, we could see a mobile version as early as this fall’s iPhone lineup.

This gives both Apple and TSM two specific benefits.

First, a rollout over a 12-month period allows for data gathering and marketing tweaks. The companies will have a glimpse at demand for new products with these new chipsets, even if they are only initially in mobile devices.

Second, and more importantly, combining the same series of chips in-house for both the mobile devices and Macs, allows for more cohesion in the development process. Meaning workflow between Apple devices – already a powerful draw for Apple fans – could get a lot smoother.

We’ll certainly have to watch how this develops over the next year. But it’s already clear, Apple is gunning for Intel. And TSM is there to scoop up the business.

Just Remember: Neither AAPL nor TSM are official Emerging Profits recommendations. If you choose to act today, be sure to plan your entry and exit, conduct your own research and never bet more money than you can afford to lose.