Gold passed $2,000 per ounce this week for the first time in history.

But that’s not why miners should be excited.

Instead, they should be focused on what this can mean for their own margins five, ten, or even 20 years down the road.

Between the two largest peaks this century, 2011 and today, the cost to mine gold hasn’t really changed much.

It costs roughly $1,100-$1,300 to pull up each ounce of gold for most major mining companies. When gold was trading for $1,300 during much of this time, that left very little for the companies.

Because of the prohibitive cost in mining, most are publicly traded companies, which are forced to either pay dividends or buy back stock with whatever they have leftover. Shareholders demand that.

Now is no different. With gold margins now jumping from $100 per ounce to nearly $800 in some cases, you can expect dividend hikes and happy shareholders.

But this burst in profits is also coinciding with something else. And that something should have the longer-term planners at these mining companies over the moon.

The Largest Leap Forward in Mining Since Steam Power

A few weeks ago, we discussed an area of innovation that mining companies have been interested in for some time: artificial intelligence.

Companies like GoldSpot Discoveries Corp. (OTC: GDDCF) have been perfecting machine learning in coordinating and compiling the reams of geological data exploration efforts have collected over the years. This should lead to an increase in significant gold discoveries, something the industry has been lacking for a while.

But AI is more powerful than just a bunch of IBM Watsons sitting around looking at pictures of rock formations.

It is the driver behind autonomous vehicles.

The stories we hear about driverless vehicles always involve Teslas for personal use or long-haul trucking companies canning their entire network of drivers. But those things are years away.

If when the technology is ready for widespread use, it will take years of regulation and policy discussions before they really hit the road.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Autonomous hauling for the mining industry is different. These rarely need to use public roads. And the efficiency gained is astronomical.

By having driverless equipment both blasting rock and more importantly hauling it away, you save yourself both risk of injury and downtime.

Newmont Corp. (NYSE: NEM) is testing its first autonomous haul truck fleet in Australia now. It expects a return on investment through an efficiency of 25% by next year.

But there’s a catch. This technology is expensive. There are only a handful of these trucks even in existence. And those that are come with price tags far higher than the cost of buying a new diesel-powered, man-operated machine plus labor.

That’s why today’s price tag is so important.

What $2,000 Gold Can Do for Mining in 2030

With a margin of just $100 per ounce of gold, these companies didn’t have anything left to spend on updating fleets and jumping into the 21st century after they paid shareholders.

Now, however, even if half of the profits are paid out, that leaves a substantial amount left for modernizing fleets and technology.

What this does for the future is even more important.

Miners investing right now in autonomous vehicles and other AI applications will have a huge advantage down the road. With increased efficiency, their costs will eventually come down.

What once cost $1,200 per ounce of gold will be $800 in five or ten years. So, while gold is hitting $2,000 now, the benefits are longer lasting.

That also means that there’s a potential longer-term winner in the precious metals market: not gold investors themselves, but gold mining investors.

At least, that’s true for ones taking this opportunity to build in autonomous processes.

We already mentioned Newmont as a leader here. Rio Tinto Group (NYSE: RIO) is not a primarily gold-focused miner. Instead it produces more iron and other base metals than almost anyone. But it too has been a leader on this front worth considering.

Finally, there’s a real opportunity at the tech level itself.

Autonomous Solutions is the leader in this field. Its Mobius Haulage AI is likely the breakout technology here. The company is private, for now. But it has already flirted with the idea of selling off equity. We could see this get listed within the next year or two.

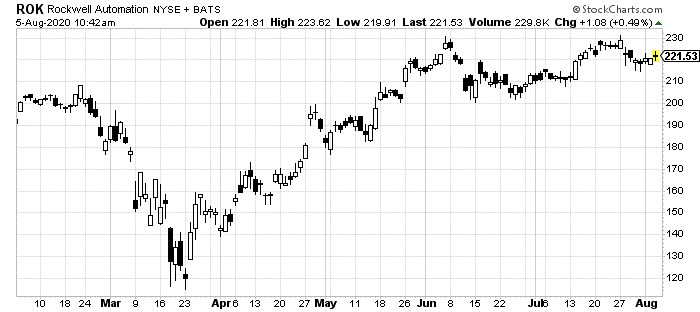

The real play that you can get into today is Rockwell Automation Inc. (NYSE: ROK). Rockwell is one of the largest and only profitable autonomous equipment makers in the world.

Instead of building fleets of mining haulers, it designs and sells the sensors, motion control systems and programming that goes into them.

This isn’t a pure-play, of course. Only around 5% of its revenue currently comes from metals mining. But, that could grow. And it could also lead to growth in similar industries like oil and gas drilling.

Now’s the time to strike. Take advantage of gold’s $2,000 price tag now… not by buying the metal itself, necessarily.

But buying the companies that are leveraging that price into decades of wide gold margins.

To your prosperity,

Joshua M. Belanger

Executive Publisher & Founder