*SHOP was added to our Top Picks on 02-Jan-2019 for $137.60. As of this writing it is trading at $367, up 167%.

At Wealthy Tech Investor, we keep our focus on massive disruptors, and this is more insight into why Shopify (NASDAQ: SHOP) has more potential for growth.

Amazon is perched as the world’s largest public cloud platform, it is in direct competition with China’s e-commerce giants, namely Alibaba. Against these goliaths, there is more than enough room for an aggressive, agnostic upstart.

Shopify is all that and more. Recently we learned Shopify is recruiting a head of business development to forge partnerships in China’s competitive online shopping space.

Shopify’s CEO Tobi Lutke said:

“There (are) a lot of Chinese brands now out there which are trying to go global, and do so directly.

We have worked with them (and) they are seeing significant success using the Shopify platform.”

In June, the firm announced merchants would be able to use its platform in traditional and simplified Chinese.

Shopify’s playbook for international expansion over the last two years has included translating the platform into local languages, offering regionally specific payment methods and letting merchants list products in multiple currencies.

The company also hires in the target country — particularly business development staff — and works with domestic companies that can build products for its app marketplace.

This is the second time Amazon’s non-agnostic platform has smashed itself in the face.

Shopify helps over 800,000 merchants sell their products directly to the public, but it’s not just small companies. The largest brands in the world - like Johnson & Johnson and Proctor & Gamble - are creating their own e-commerce stores using Shopify. And why would they do such a thing?

Shopify’s custom websites and merchant/payments solutions combine to form an “operating system” for e-commerce.

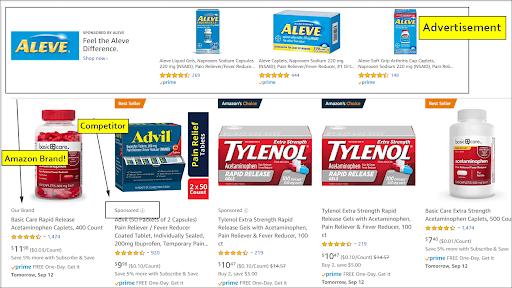

Amazon is a closed ecosystem alternative, demanding that sellers conform to their standards.

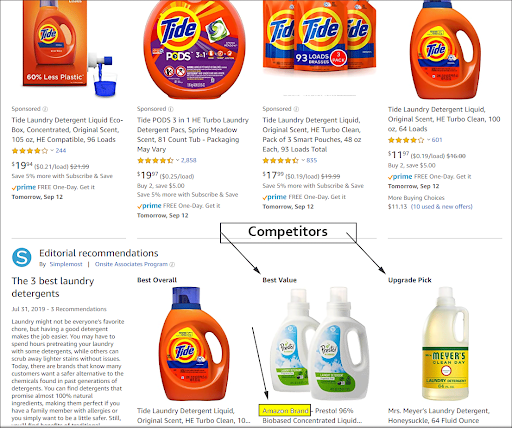

For example, when a person seeking to buy a Proctor & Gamble product comes to Amazon to buy Tide, it is Amazon that owns that customer — from search to delivery.

All of the customer data, the clicking, the behavior, the advertisements, the placement of the product, the search — that’s all Amazon, and it’s by design.

Shopify Sets These Consumer Product Giants Free!

Here’s a secret that P&G and Johnson and Johnson just let out of the bag:

Here is Shopify’s CEO on the last earnings call:

We continue to see more brands come on from the likes of Johnson & Johnson and Procter & Gamble and Unilever, whether or not they levered the SFN or not, we will see in time, but we certainly are seeing more the CPGs creating brand specific stores on Shopify Plus.

We’re also seeing much larger, more established companies like Staples online retail operations on Shopify. So, we are beginning to see a lot more of these established and more complex retailers, which is one of the reasons we’re excited about the new Plus product.

Amazon wants to OWN these customers – from search to ads, checkout to delivery. This is not about a small company that needs to make a niche — this is for the giants.

Even for products like Tide or Tylenol has to bow down to Amazon.

It’s Amazon’s world and rules – but that could change as the new kid on the block Shopify starts taking market share.

Now JNJ and P&G and every other company can have their own e-commerce website — ad free and competitor free. They can control the journey and track their own analytics. This is the way it was supposed to be, and soon it is the way it will be.

Shopify is the answer for e-commerce solutions, as evidenced by their most recent earnings report which showed a 48% rise in revenue, well-balanced between subscription revenues at 43% and merchant services revenues at 57% of the company’s mix

Look, the market is going to be bumpy sometimes. But as investors we relish bumpy, we relish volatility, as the market twists and turns on the way to properly valuing long-term winners.

This is why you must ignore the noise with day-to-day volatility in your portfolio. If you’re in this for the long-haul, you have to ignore the volatility.

At Wealthy Tech Investor we look for exciting and interesting opportunities that will drive the world forward and transform wealth.

We are looking at the next 3, 5 or even 10 years, for companies that can become massive compounders, stocks that can deliver triple-digit returns.

In the coming years, we predict these new trends, from Roku’s streaming, to Shopify’s e-commerce, these two companies continue their leadership and the secular trends continue their inevitable path, they will become the biggest boats on these rising tides