One story that makes Wall Street trip over themselves are "software-as-a-service" (SaaS) companies.

These include the likes of Slack Technologies Inc. (NYSE:WORK), Zoom Video Communications Inc. (NASDAQ:ZM) and Shopify Inc. (NYSE:SHOP).

With offices shut down across the world, worker communication and management have become a much-sought-after need.

The companies that can provide these solutions to companies have taken off. But there’s a part of this story that doesn’t get as much play.

The Barrier To Entry Is Low

These ideas are not unique to startup entrepreneurs in Silicon Valley.

Any software-minded individual or an organization can design a sleeker and easier-to-use user interface to conduct chats, video calls, project management tasks, and multiplatform sales.

And while companies like Zoom have been able to grow from $20 billion to $45 billion overnight doesn’t mean video conferencing is something extraordinarily groundbreaking.

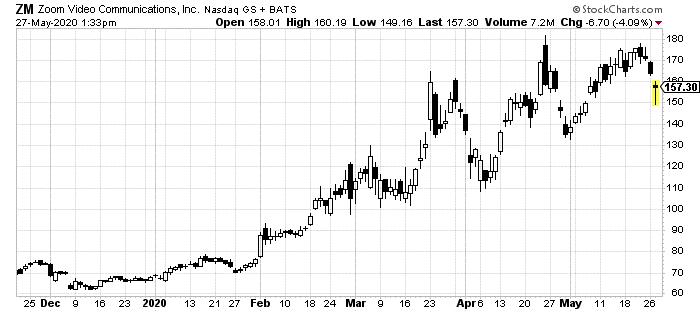

Now, that’s not to say they aren’t creating value for investors or growing at unprecedented rates. Zoom shareholders saw their stock soar this year.

Our own Wealthy Tech Investor readers just cashed out a 122.3% profit last week on Zoom.

But even Zoom, with its short-term performance, aims to solve only a single technological problem.

Scale and Packaging

Zoom is killing it from the increase in online meetings. Its interface and accessibility are steps up from Skype and previous attempts at video conferencing. But that’s where it stops.

Sure, you can chat and organize a bit. But Zoom isn’t a full business solution. Others like Slack do that. And there’s the problem.

Individually, these younger and more user-friendly companies can outmaneuver, out-develop and out-innovate the likes of Microsoft and Google. But they are still competing with them directly.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

I know, they never come out and admit it. Slack CEO Stewart Butterfield told CNBC a few weeks ago that Microsoft Teams is no competitor to his company.

He said:

"When they [Microsoft] talk about the product, they never mention the fundamentals that Slack does, and it’s been 3+ years at this point that they’ve been bundling it, giving it away for free, and talking about us."

But that’s the very point. Microsoft has been able to bundle its similar service with its Office 365 products. Because of its size and the way it makes its money, it doesn’t have to spend much to directly compete with smaller, single-focused companies like Slack.

Microsoft is a specific problem for all of these SaaS plays. But Google might be an even bigger one.

Google doesn’t sell its products in the same way everyone else does. It doesn’t need to. Gmail, Google Calendars, Google Chat or Hangouts, and even Google Drive are all free. Sure, you can pay if you want to upgrade storage. But the appeal is its price tag.

Slack and Zoom, on the other hand, offer free services. But they need to shift customers onto their "pro" versions in a hurry to actually make any money.

Finally, there’s a third issue these SaaS companies face going forward: customer size.

Multiplatform Restraints

A recent thread on Reddit perfectly sums up this final nail in the coffin for SaaS players.

They work amazingly if you are connecting small teams of workers on a project. Seven or eight team members can easily organize via email or on Slack channel and a link to a Zoom call.

Likewise, they can also easily incorporate Google’s free offerings like sharing files on Google Drive. Dropbox can be an easy quick solution too on that front.

But at a certain size, that begins to break down. You see, despite easier-to-understand user interfaces and even lower upfront costs than say paying for a full Microsoft Office 360 subscription, it takes every member to fully know how to use all of these SaaS platforms.

More than that, however, is the cost. Once these platforms do make their way into growing companies, the jump to "pro" paid versions of each will start to add up.

Microsoft can throw in these competing platforms for free with the rest of its practically essential products like Word and Excel.

The road is a long one for these current diamonds in the rough. Slack, Zoom, Dropbox, Shopify all provide services in demand. And that won’t go away even when the whole country opens back up.

However, their individual markets include competitors like Microsoft and Google. So, their long road ahead is like to be far bumpier than investors seem to think right now. Unless you are willing to ride out those bumps and actively trade them, they are plays best avoided.