Despite the market price of fossil fuels falling this year, renewable energy sources also continue to get cheaper, according to the International Energy Agency.

This is important, but not the most important trend to watch.

As we reshape our energy usage and carbon emissions in everything from our cars to our homes, the technology continues to improve.

One area, however, has lagged behind. And it may be the most important missing piece for countries as large as the United States to switch its grid over to renewables.

Energy storage is tricky. It’s not as simple as setting out a bunch of batteries hooked up to solar panels. The batteries themselves remain expensive and do a poor job of capturing all of the energy produced.

And that’s crucial. The sun doesn’t always shine and the wind isn’t constant. So, renewable sources like solar and wind need reliable energy storage solutions to back them up.

Fortunately, after years of relatively unsuccessful work going into this topic, companies like Facebook are getting into the action.

This morning, Facebook and Carnegie Mellon University announced that they are going to use artificial intelligence to find new electrocatalysts.

Electrocatalysts are one potential solution to the energy storage shortage in this country. The way they work is by converting solar and wind energy into easier-to-store fuels like hydrogen.

The problem is that catalysts are often expensive to make. Platinum is still the most widely used metal to construct them.

The AI project is aiming to find cheaper materials specifically for energy storage.

They aren’t alone. The Department of Energy’s Argonne National Laboratory is using AI to look at different materials for batteries too.

Its database already has 133,000 organic molecules for its AI to work through and combine to find cheaper solutions.

While all of this is likely the next giant leap toward a renewable future, some of this new technology is actually working its way into the energy systems around the world today.

While sadly still private, one Slovakia-based company called InoBat is just about to go live with an AI-powered platform that can create “intelligent batteries.”

These could theoretically find their way into mainstream electric vehicles someday. But the company is focused now on specialized vehicles and electric aircrafts.

Though, back to the main point of energy storage, this platform is designed to allow for fully customizable energy storage solutions.

That’s exactly what the broader renewable energy production industry needs.

Of course, InoBat isn’t the only name in this game. Though, if it joins the herd of IPOs anytime soon, I’ll be paying attention.

Others already have products that are serving the solar and wind industry right now. And their internal R&D for next-gen storage solutions could beat the theoretical research projects to the market.

The two companies really worth looking at are Fluence, a joint venture between Siemens and AES Company, and BYD Company (OTC: BYDDF), a Berkshire Hathaway-backed venture.

Both companies have their own energy storage products in the field right now.

Fluence seems to be targeting power grids and utilities more directly. It has 100 projects in more than 22 countries too.

Since it is owned by two publicly-traded companies, Siemens (OTC: SIEGY) and AES Corp. (NYSE: AES), that’s the only way to actually get into its technology right now. But a future spinoff would make this a no-brainer pick up.

BYD, on the other hand, you can get into right now. But word of warning… it does a lot more than just energy storage.

BYD, which stands for Build Your Dreams, is a rather all-purpose green energy company.

Its large grid-ready storage systems are among the best in the heavily concentrated California market. But it also makes busses, trucks, forklifts, and even a monorail system.

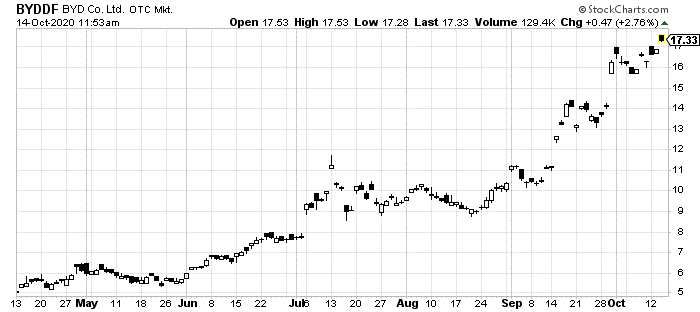

If BYD’s stock pulls back after this year’s incredible rally from $5 to $17, it is definitely right for any emerging technology portfolio.

This industry is clearly important. And after waiting for solar and wind energy prices to come down, there’s finally huge demand for it.

I’ll continue tracking which plays are set to take the lead. Right now, watch for a Fluence spinoff down the road and a BYD pullback.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder