Most emerging profits this year have come from truly green initiatives, like EV batteries and renewable energy.

Well, there’s another one heading to the market that should be even bigger in the near term.

In early October, a small biotech called Danimer Scientific announced it was going public through a reverse merger with a SPAC called Live Oak Acquisition Corp. (NYSE: LOAK).

This deal will add even more cash to the pile as Danimer rapidly expands production of its breakthrough technology: biodegradable plastic alternatives.

You’ve likely heard the news of this trend. Countries around the world are starting to ban single-use plastics.

Plastic bags, soda bottles and food packaging are all under the knife in places like France, Germany, Canada and Japan. In some, things like plastic bags are just being taxed for now. Others, like Canada, are aggressively rolling out bans over the next few years.

That, of course, creates a serious demand. Danimer could be one of the biggest winners just now coming to light.

For decades, environmentalists and businesses have clashed heads over the use of plastics in packaging. While biodegradable products have been on the market for many years, they haven’t been as effective or long-lasting (obviously) as plastic.

For example, disposable coffee cups. They are made with paper. But to prevent the coffee from seeping through, they are coated with polyethylene liners. That coating is essentially plastic, made from fossil fuels and doesn’t break down.

Many of tried cracking this nut. But alternatives have always had their problems. Either they foul the taste of the liquids in those cups or they are too expensive. Danimer might have finally found the sweet spot.

This company’s Nodax PHA is made from canola oil instead of crude oil. So, it 100% fits the biodegradable category. And it has proven to be both more effective and cheaper to make than previous attempts at alternatives.

Nodax has been so successful, so early, that Danimer has already partnered with some huge names for use of it in their own products.

Pepsi and Nestle are two already working with Danimer on new linings for their packaged beverages. WinCup, maker of disposable polystyrene cups, containers, straws and lids, is another.

Just this week, Danimer announced a new partnership with Kemira, a huge multinational chemicals company with its own long list of customers and partners.

These deals and partnerships are a huge advantage. But Danimer’s own technology is the real driver.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

It has more than 150 patents in more than 20 countries for its process and underlying Nodax PHA compound.

And while the company remains somewhat small today, these patents didn’t just come out of nowhere. Some were bought directly more than a decade ago from Proctor & Gamble Co. (NYSE: PG). Others are for technology that has been developed and perfected over many years.

Of course, with single-use plastic bans coming from all over the world, Danimer feels now is the time to strike.

The deal with LOAK should happen soon. Shareholders have already voted to approve it. Now, all that remains is the official transfer of name.

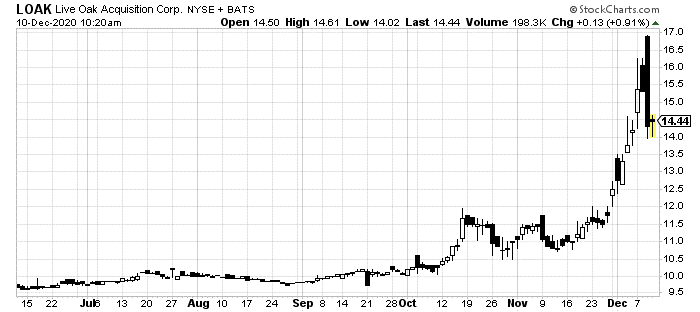

As you can see, the initial merger announcement back in October and this week’s Kemira partnership sent shares skyrocketing.

They’ve come back down a bit for now. This gives you a golden entry point: just before Danimer starts trading post-merger and just after the market digested the huge Kemira news.

Danimer might not be the only solution to the plastic problem. But it is set up to be one major winner from it.

Between now and 2025, it has plans to grow production from 20 million pounds of Nodax to 200 million pounds. With this deal, it now has more than enough money for such an expansion.

You can get in now to get your piece of this treasure.