Wowzer!

That's what you would have said looking at the move in Aurora Cannabis Inc. (NYSE:ACB) today.

The company absolutely shocked investors today with a better-than-expected earnings report.

Earnings, however, might not be the right word for it.

You see, the company reported a $137 million net loss for the first quarter.

That’s still better than the $1.3 billion loss it took in the previous period. But it is by no means good.

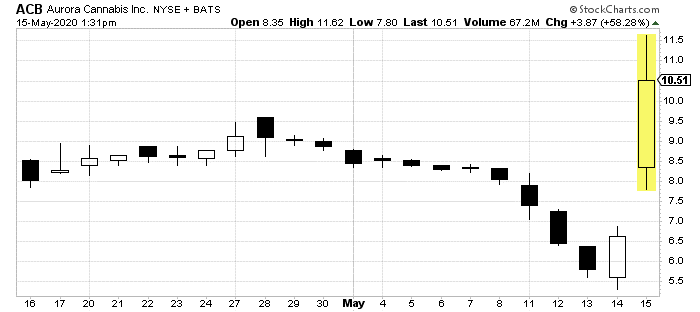

Still, investors pounced on the "good" news:

As you can see, shares have nearly doubled since these numbers came out.

Doing less bad isn’t the same thing as doing well. That seems to be the major problem across the cannabis industry.

Every major pot company from Canopy Growth Corp. (NYSE:CGC) to Tilray Inc. (NASDAQ:TLRY) has seen its shares gradually collapse for the last year and a half.

The legalization of weed in Canada, which took place in October 2018, hasn’t really lived up to the hype.

These companies continue to disappoint and produce no profits.

But there’s a good reason for that.

The Wrong Market

Far too much money went into these companies ahead of Canadian legalization a year and a half ago. They also spent that money a bit recklessly.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Aurora, as noted before, spent a fortune on new growing facilities at the top of the real estate market.

Canopy has continued to infuriate its mega investor Constellation Brands Inc. (NYSE:STZ) with its underperformance.

The problem, it seems, is that the expected sales just aren’t there. Canada just isn’t a large enough market to justify these huge companies.

There is a better market, however. One that’s ripe to do what Canadian cannabis companies promised all along.

The Right Market

Clearly, the appetite for cannabis is very different south of the Canadian border.

The U.S. has seen a much different legalization period.

The federal government still considers marijuana a Schedule 1 drug. But 33 states have already made laws saying the opposite.

And the amount of money being made by U.S. cannabis companies already shows that the U.S. can be far more profitable than Canada.

Just take Green Thumb Industries Inc. (OTC:GTBIF).

This relatively unknown Illinois-based cannabis packaged goods and retail company just announced a profit.

The company owns 42 retail stores in ten states.

It markets brands like Rise and Essence across the United States.

And it has been able to get into newly legal states on day one.

Literally, the company opened up the very first adult-use only store in Illinois on January 1, 2020… the first day it was legal.

With all of this, Green Thumb has done what the likes of Canopy and Aurora could only dream.

In the first quarter, GTBIF saw sales jump 268% year over year. EBITDA and free cash flow both came in positive.

That’s huge.

This company makes money already.

That’s something all of Canada has yet to do.

There’s another significant difference between these kinds of companies, however. And it should be apparent.

Almost no one knows the name Green Thumb Industries. And nearly every investor knows Canopy, Aurora, and the rest of the Canadian crew.

Green Thumb, precisely because pot is still federally illegal in the U.S., isn’t even listed on a major exchange. It is still traded over-the-counter.

Cannabis is clearly an idea worth owning. But separating the wheat from the chaff can be difficult.

The U.S. is clearly the right market for pot investing.

Despite the additional pressures of abiding by different state laws and no federal one, companies like Green Thumb are already showing profits.

Canadian players, which have had 19 months to do so, haven’t yet been able to produce a dime in net income.

So, if you’re looking for a pot play, Green Thumb should definitely be on your radar. And you might want to steer clear of Canada for now.

By the way, if you're looking for the savvy insider approach to generating big gains in the cannabis sector.

In the coming days, I will be releasing my newest report called Pot Stock Swaps.

In this report, I will reveal my insider approach to investing in the best cannabis companies in a low-risk way that will yield massive gains.

It's not options or penny stocks.

If you're interested in that report, you'll want to become a member of Hot Money Trader today.