Infrastructure spending is usually one of the few topics that is considered bipartisan.

But in an election year, everything becomes ammunition to be thrown at the other party.

Yesterday, the House of Representatives passed a massive $1.5 trillion infrastructure bill for everything from roads to broadband.

There’s always more to meet the eye when it comes to passing a bill as the Democrats included wish-lists for schools, hospitals and vehicle safety. This makes it clear that the bill wasn’t designed to pass in a divided government.

Now the bill is heading to the Senate. Mitch McConnell has ridiculed the bill and called it pure fantasy and the White House has vowed to veto it as well.

We can expect this dance to continue, possibly all the way up to the election…but infrastructure isn’t something that can just be ignored.

Yes, the Coronavirus has given some tired bridges a much-needed break. The truth is the roads aren’t going to repair themselves.

Every four years, The American Society of Civil Engineers releases a report card on the state of America’s infrastructure. So, we won’t get an update until 2021…but as of 2017, the result was a D+.

I’m not sure how your parents would react if you brought home a D+, but that wouldn’t have been acceptable for mine. The highest grade for any individual category was a C+!

The House and the Senate can go back and forth as many times as they want, but at some point, we’ll have to fix those potholes and rickety bridges.

Even During Economic Slowdown, Construction Continues

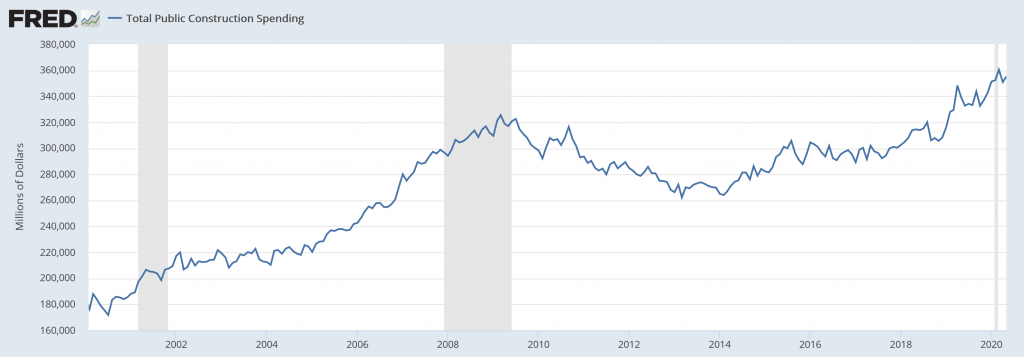

When the Fed keeps track of public construction, it’s including local, state and federal construction.

Take a look at the last twenty years of data provided by the Federal Reserve Bank of St. Louis.

The shaded areas show periods of recession. Despite the economic slowdown, construction continues. Maybe with a few more dips, but overall, no different than periods of economic stability.

So, what’s the best way to profit?

Look for companies that provide the necessary materials or equipment to the industry.

Eagle Materials (NYSE: EXP) is a leading US manufacturer of basic construction materials. The company is headquartered in Dallas and prides itself that all manufactured products are 100% made in the U.S.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

These products can be found in every residential, commercial and infrastructure project. We’re talking about cement, concrete and wallboard.

The management is committed to being the lowest-cost producer of each and every product that they make. In fact, most of their money is spent creating innovation and improvements.

It’s not enough for the company to be the U.S. made, they want to be the best quality at the lowest price.

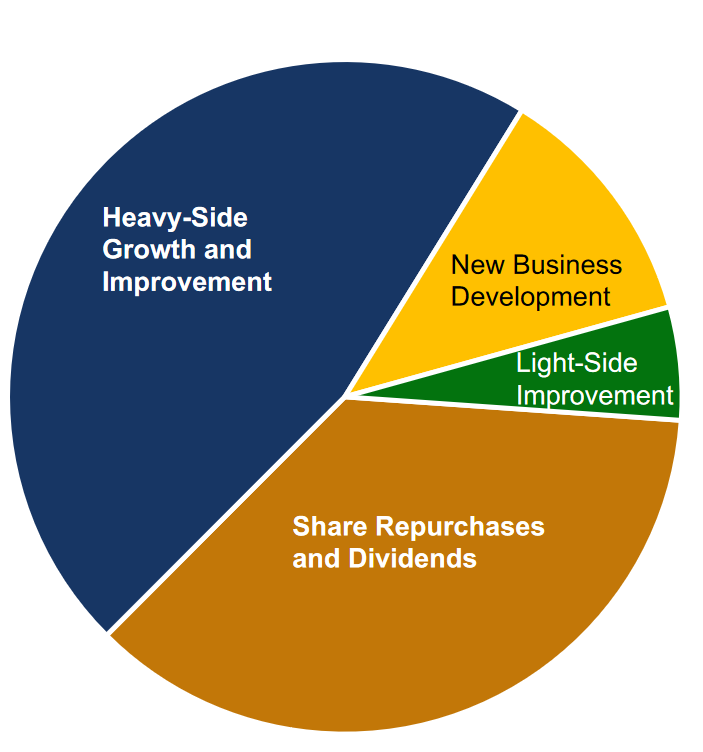

Look at how the management spends its money.

The management doesn’t pour a bunch of money into new business and hope for the best. It would rather improve its heavy hitters and reward shareholders.

The strategy seems to be working. Gross profit has increased by over 20% every year since 2017.

Share prices however have been all over the place.

This is partially due to uncertainty surrounding the Coronavirus. But the company also announced a spinoff last year.

After the spinoff is complete, the plan is that Eagle Materials will maintain the heavy materials and American Gypsum will take over the wallboard and other light materials.

Whether the spinoff happens or not, whether the infrastructure bill passes this month or not, one thing is for sure…construction never comes to a complete halt. It just can’t.

So if you’re looking to profit from the inevitable repair of our rundown roads,

Eagle Materials is one to add to your portfolio.

To your prosperity,

Joshua M. Belanger

Executive Publisher & Founder