Besides stocking up on cereal, frozen meat and toilet paper, American’s have spent this year stocking up on guns.

There were over 2 million new gun owners reported in the first half of 2020. In Florida specifically you are unable to buy a firearm during a state of emergency. So, every time the state of emergency was lifted, you can imagine the lines at the gun shops.

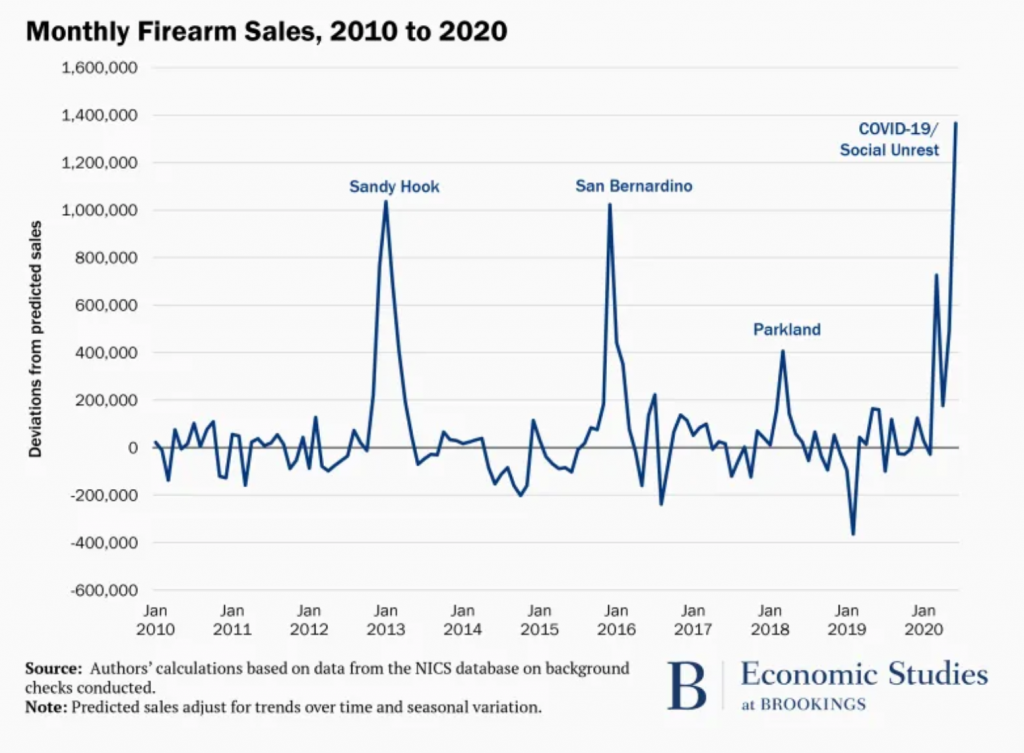

Big events make people consider this purchase even if they didn’t see a need before.

This data is from background checks for firearm sales, so it is not necessarily a perfect measure of firearm sales. But it shows the trend.

Now, we’re not here to get political. We’re here to point out trends that can make you money.

There’s no denying that a combination of the events in 2020 put more firearms in American households.

So why not invest in a firearm maker? Well Smith & Wesson (NASDAQ: SWBI) is up 147% this year. Sturm, Ruger & Co is right behind with gains of 63% since the first of the year. It’s probably too late to even see double-digit gains here.

Where does the trend go from here?

Now when the danger and uncertainty have passed and we resume normal life, those guns have to go somewhere away from the hands of children. In a few months, you’ll start to see the increase in purchases of safes.

It’s Not That Easy

It would be nice to just pick a safe company and play this trend. But these are not publicly traded companies.

If we find a trend that we want to get in on, but all the companies are private, we have a few options.

You might have the money and privilege to qualify for pre-IPO investments. They have been limited to accredited investors, private equity firms, hedge funds, and select others. Now there are ways to invest using online platforms such as OurCrowd.

Alternatively, there is the option to invest in a company that is investing in the company you’re trying to get to.

In real estate, there are real estate investment trusts (REITs) and real estate funds. There are also business development corporations (BDCs) and other companies that invest in startups. So that’s where we can find a way to gain access to those safes.

Compass Diversified Holdings (NYSE: CODI) owns 91% of Liberty Safe which is America’s #1 producer of heavy-duty safes for home and commercial use. For the 3 months ending in March, Liberty saw a revenue increase of $2.8 million when compared to the same quarter the previous year.

Those numbers make sense to us. Right now, people are stockpiling the guns and the ammo. It will be another quarter before they come to the realization that you need a place to put those things when the family starts coming to visit again.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Although this is a way for us to access the safe company that we’re looking for, there’s more due diligence to be done. An investment in Compass, for example, is an investment in 9 subsidiaries. You’ve probably actually heard of some of them…Sterno, 5.11, and Ergobaby.

Compass Diversified has generated $1.5 billion in cash flow over the last 8 years and proven its ability to continue yielding 8%. So, if you’re looking to collect solid income from the gun trend, the options are there.

But, more importantly, its an example of how you might need to get creative with some of the emerging trends coming through the market these days.

To your prosperity,

Joshua M. Belanger

Executive Publisher & Founder