The Fed’s printing press may have overheated this week.

This week’s market rollercoaster points to a lot of uncertainty. But there is one lesson from history we can look to for guidance.

On March 18, 2009, the Federal Reserve changed its forward guidance language. In previous announcements on how long it was going to keep rates near zero, it told investors "for some time." On March 18, it changed that to "for an extended period."

That might not sound like much. But if you lived through those days, that was a big deal.

That was essentially the Fed telling the world that the U.S. were going to keep rates at historic lows for years.

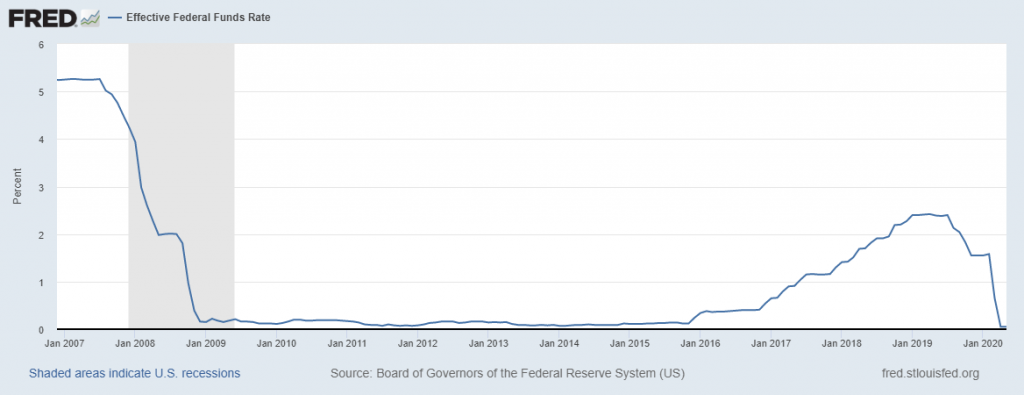

And it did. The Fed didn’t begin to raise its base rates until the end of 2015:

This had a huge effect on gold, which is usually priced inversely to low rates.

It might be a little hard to see. But the blue circle was when the Fed announced years of zero interest rates.

As you can see, gold climbed unerring for the next two full years.

History Repeats

You might be asking why any of this matters. That all happened a decade ago in a very different environment.

But history repeats.

One reason why stocks absolutely tanked yesterday was because of what Fed Chairman Jerome Powell said about economic forecasts. He told reporters that employment recovery in the U.S. following COVID-19 will be "a long road."

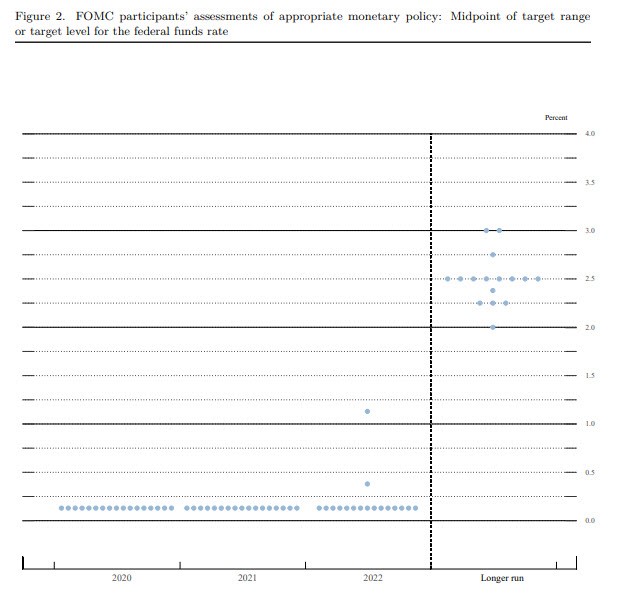

That statement and the reactions by everyone following it misses the bigger picture. This "dot plot" chart from the FOMC’s recent meeting is the real story.

But history repeats.

One reason why stocks absolutely tanked yesterday was because of what Fed Chairman Jerome Powell said about economic forecasts. He told reporters that employment recovery in the U.S. following COVID-19 will be "a long road."

That statement and the reactions by everyone following it misses the bigger picture. This "dot plot" chart from the FOMC’s recent meeting is the real story.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Let me back up. The FOMC’s voting members must all make projections individually on where they expect the federal funds rate will go in the future.

As you can see, this is visually displaying exactly what that same group said back in March 2009. All those blue dots at the bottom of the "dot plot" chart represent an outlook of zero interest rates. That’s through 2022. On two expect any rate movement by then.

That’s enormous.

Think about what that means. Gold has already risen over the last few months. It’s jumped nearly $200 already this year during this economic downturn.

With the Fed now signaling, nearly universally, that rates are going to copy the pattern they made in the 2009-2015 period, that’s a green light to gold investors.

From that "for an extended period" announcement until 2011, two years later, gold doubled in value.

It shot up from $900 to $1,800. But there’s so much more to this story. And one final reason why gold could do even better this time around.

Oil is the Key

Back in 2009, when the Fed announced that it was going to keep rates at zero for the next few years, oil prices had just collapsed. But alongside gold, oil did recover in a big way, more than doubling itself.

That makes gold’s rally even more impressive. Oil and energy costs are the most expensive considerations for gold miners. With energy costs clearly rising, that ate into a lot of those profits.

But imagine if oil doesn’t repeat this history… at least not right away.

Imagine if oil does remain below $50 for the next few years. Even $80 oil would be cheaper than last time.

Imagine what that would mean to gold miners. They could experience sales of their gold at twice the previous price. But they’d also be able to dig that gold out of the ground cheaper than before this current crisis.

The last crisis had gold doubling. This time could see even larger gains. And the biggest winners of all won’t be just the gold hoarders. It will be the mining companies that are able to do it cheaper than ever.

One quick easy play on this would be VanEck Vectors Gold Miners ETF (NYSE:GDX). Another would be VanEck Vectors Junior Gold Miners ETF (NYSE:GDXJ), if you prefer smaller companies with more leverage to move.

The last time we saw this perfect storm, it didn’t take long for the rally to kick off.

This time, we might already be $200 into it.

Now is the perfect time to buy!