Just when you think the IPO market couldn’t get any bigger, the U.S. government accidentally opened it further.

One year ago, yesterday, Visa Inc. (NYSE: V) announced it had agreed to buy Plaid, a startup fintech with important technology for our growing digital world.

In November, the Department of Justice filed suit against Visa, blocking this deal from finalizing.

Now, we could see a ripple effect on the stock market.

But to understand why this is such an important event for the future of IPOs, I have to explain just what happened here.

Plaid’s Platform

Plaid isn’t a company you or I likely deal with on a daily basis. But for fintech app developers, it is a giant.

After such a long and trying 2020, we have officially made digital banking a part of our lives. The days of heading down to your bank to deposit or withdraw funds through a teller are over.

Now, the adoption of apps like Venmo and PayPal have exploded. They, for millions, have become just as integral to how people buy and sell things, get paid or even lend money. But they aren’t bank accounts.

So now, there are two parts of finance and banking that haven’t ever been there before. You have banks where you deposit your income and these fintech apps that allow you to spend that money.

The problem is that connecting the two can be a chore.

That’s what Plaid’s platform is built for. It helps app developers connect users’ bank accounts to the spending side. Likely, you’ve already interacted with this platform, even if you don’t know it.

Venmo and others have jumped on the Plaid bandwagon to instantly authenticate and transfer funds for users.

When a user pays for something online with one of these payment apps, the app itself uses the bridge build by Plaid to instantly pull money from the connected bank account.

In today’s digital banking world, that’s a huge jump forward from where the likes of PayPal started, forcing users to wait days to first deposit funds into PayPal before being able to spend them.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Obviously, for a company like Visa, that’s a very attractive technology to own, hence the $5.3 billion acquisition.

But, as always, the government stepped in.

The DOJ’s suit against this deal between Visa and Plaid argues that Visa was unfairly taking out a competing company and monopolizing this market.

There’s certainly merit to that argument. Visa’s online debit business acts as a similar tool to allow instant purchases and money transfers.

I’m not going to get into the minutia surrounding this particular suit. But it does add yet another case of active antitrust law enforcement.

This is only going to ramp up for these financial tech startups. And Plaid may be the trailblazer for what to do about it.

Barron’s is reporting this morning that Plaid is now likely to go public itself, either through a SPAC or a traditional IPO.

That’s the only option now that a buyout deal is off the table.

For startups like Plaid to continue gaining traction, they need access to new, fresh capital and a way to pay out their founders and developers.

With the antitrust enthusiasm we’ve seen in Washington (which is coming from both political sides), mergers and acquisitions are essentially off the table.

Plaid may be one of the first to throw its hands up in the air and say, “Screw it! We’ll just go public ourselves.”

But it won’t be the last.

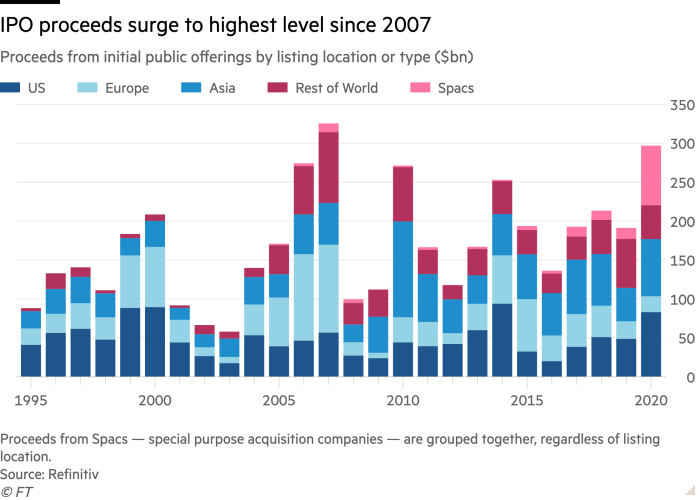

If you thought last year’s IPO market was big, just wait until more companies are forced away from buyouts.

This also means that the year of the SPAC isn’t over yet. Special purpose acquisition companies aren’t going away anytime soon.

To your prosperity and health,

Joshua M. Belanger