Peloton Interactive Inc. (NASDAQ: PTON) is arguably the hottest stock in the market right now.

The next-generation home workout equipment maker has had an amazing 2020 so far. And many on Wall Street expect an even better 2021.

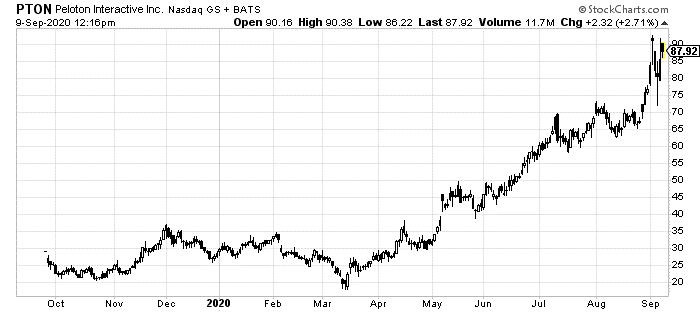

Peloton’s stock has quadrupled since its March lows as the shift to home workouts has all but replaced in-person gyms for much of this year.

Investors are betting that, for many, this will be a permanent change.

But Peloton is in the eye of the storm.

Just yesterday, the company finally announced pricing on its new Bike+ and Tread+ products.

The announcement was a bit confusing with one of these products launching this week (Bike+) at a higher price than its current Bike offering. The other, Tread+, is its old Tread product. Next year, a second Tread with about a 40% discounted price tag will hit the market.

In any event, investors loved this announcement. More products are exactly what they wanted to see from the superstar fitness company.

But the real news story comes tomorrow. That’s when the company will finally release its fiscal 2020 earnings.

This is the first quarterly release that covers a full three months of quarantine, lockdowns and our new way of life.

During its third quarter, ending on March 31, Peloton reported top line growth of 66%. And that was mostly from sales before the extended social distancing rules went into effect around the world.

This quarter, analysts are estimating a 164% year-over-year increase. If it even comes in close to that, it’ll prove that its remarkable performance isn’t yet over.

But analysts are also expecting the first quarterly profit in company history. That is the real icing on the cake.

Let’s say it does this. It hits these remarkably large targets and has a truly amazing year. What comes next?

Besides just a surge in people quitting the gym, another giant shift has occurred this year for Peloton. Its classes and instructions got viewed by millions for the first time.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

You see, what sets Peloton apart from competitors is its memberships.

Along with the gym equipment, first-time buyers also get a trial for its live and recorded classes and workouts. These a streamed right on the machine itself, offering what only gyms or old VHS workouts could before.

This is where the company’s future is truly found. Peloton has turned hardware into software as a service (SaaS).

I’ve written about this powerful, moneymaking model before. Just last week, I discussed its cousin, network as a service.

Car companies have been flirting with this in recent years. Satellite radio was an early adopter. Now, through Peloton, gym equipment is finding the sweeping financial benefits of a subscription model.

Even if Peloton doesn’t hit analysts’ estimates this quarter, the number of machines sold will still be through the roof.

Every single one of those gets a free trial for this SaaS-like subscription. The best part of Peloton’s model is what comes next.

You see, they sell these machines for north of $2,000. In fact, next year’s new Tread+ will go for more than $4,000. But despite these steep price tags, customers only get a month of free classes and workouts.

And while it is so cliché to say that working out at home is the easiest thing to quit, few are going to give up in just a month.

The current subscriptions don’t make up much of Peloton’s total revenue, yet. But with an estimated 1-plus million subscribers expected when the company announces tomorrow, that might start to change.

That subscribership number, by the way, is twice as it was a year ago. As these new products come out, especially the cheaper treadmill due early next year, it will only grow.

So, sure, watching a stock quadruple in six months might make anyone wary of getting in too late. But with Peloton and its ridiculously lucrative SaaS model, this is likely just the start.

Any smart trader should be watching Peloton tomorrow. No matter what its release does to its stock in the short term, PTON is set to continue climbing rapidly in the long term.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder