For those in the trenches of the battery and fuel cell wars, this has been a wild week.

Nikola Corp. (NASDAQ: NKLA) struck an enormous deal on Tuesday with ancient General Motors Co. (NYSE: GM) of all companies to partner with its technology.

Shares of both jumped. But Nikola, finding some real legitimacy with the deal, absolutely exploded… ending up 41% on Tuesday.

Unfortunately for those shareholders, its Icarus moment came shortly thereafter.

Yesterday, an activist short seller named Hindenburg Research published a report absolutely slamming Nikola and its use of GM technology.

The group, which has an active short position in Nikola, said that the battery and fuel cell-focused truck developer was lying to investors about its technology. It also took a very specific aim at Nikola’s founder and CEO Trevor Milton.

The very first line/bullet point in the hit piece says it all: "Today, we reveal why we believe Nikola is an intricate fraud built on dozens of lies over the course of its Founder and Executive Chairman Trevor Milton’s career."

Pretty brutal.

Though, it shouldn’t come as a surprise when a group named after the 1937 Hindenburg disaster takes aim at a company as to what happened next.

That report alone was enough to send shares crashing down. Even after Milton and his spokespeople responded with an equally inflammatory "Yesterday, an activist short-seller whose motivation is to manipulate the market and profit from a manufactured decline in our stock price…" Nikola shares continued to slide.

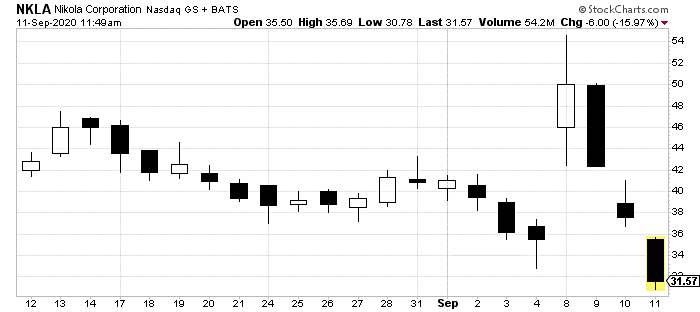

All told, Tuesday’s monstrous gains have been completely wiped out and then some:

So, despite this holiday-shortened week, Nikola investors have been busy.

That leaves us the weekend to ponder what happens now. And then, of course, how in the world any reasonable trader could play this wild ride.

To get a full grasp of this situation, unfortunately, investors are forced to turn to Twitter. This is where Milton’s absurdity comes to life.

Just today, he’s tweeted about retaliation against Hindenburg through lawsuits and the SEC.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

He’s gone fully defensive with lines like "I have nothing to hide. Zero."

He said, "As a leader, you get shit on sometimes…" finishing with "F@&k the haters."

Not to mention any other names in the fury… but can’t we have a calm, rational head of a next-gen automaker?

To Milton’s credit, he did share some early production pictures from a Germany plant where his trucks and technology are being developed. So, it appears there might be some substance to Nikola compared to what Hindenburg claimed.

Either way, it’s clear the firestorm between the two groups and investors aren’t over yet. Even as I write, another group, Citron Research, just came out in support of Hindenburg and pledged to cover half the legal cost for the activist investor group.

That leaves GM. This historic car maker has been stuck in the middle of it all. And no one can be completely sure of what happens next.

The ink on its deal with Nikola is still wet. And $2 billion and an 11% Nikola stake is on the line.

If Hindenburg’s accusations prove even the slightest bit true, GM could back out of the deal. Lawsuits are already in place. So, it wouldn’t be difficult for the U.S. giant to exit this mess.

But its involvement has consequences. Some look pretty bad.

For instance, this story shows that despite GM’s size and history, it wasn’t able to do its due diligence for such a massive deal. Or it would if Nikola falters further.

But there’s another side to this story.

What we do know is that Nikola struck the deal to actually use GM’s own technology and facilities. The larger company, under the terms of the deal, is set to engineer and build Nikola’s Badger truck.

That’s the part of the story being left out right now. GM’s own tech is the real gem here. Rather than GM legitimizing Nikola’s tech. All of this seemed to have done the opposite. Nikola legitimized GM’s battery and alternative-fuel tech.

That’s especially interesting since these aren’t the only players in the industry. Doubtful that Tesla Inc. (NASDAQ: TSLA) will touch any of this. But there are others.

In fact, another brand-new auto battery and powertrain tech company is coming to the market later this month.

Hyliion announced back in June that it was going public through a reverse merger with the SPAC Tortoise Acquisition Corp. (NYSE: SHLL).

So, no matter what comes out of this, we know no one company will gain a complete monopoly on this next-gen fuel and battery technology. Not even Tesla has a lead on all of the tech involved in this car revolution.

While it is impossible to conclude who is going to be the immediate winner here, it is becoming clear with this busy news week that GM is far-better prepared to move forward in this space than anyone could have guessed.

With or without Nikola, GM will have opportunities. If it backs out of that deal, Hyliion and others prove it will continue to have options.

So, in a rare situation like this, it might not be the industry disruptors who win. It might be the companies they are trying to disrupt.

GM, remarkably, is going to come out of all of this ahead.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder