Less than a week from today, Bitcoin will be halved. And investors are in full speculation mode.

A Bitcoin halving event happens once every four years.

The premise is simple. Miners receive half of the rewards from validating new coins.

The idea is to reduce supply over time to combat inflation in the coins. It is hardcoded into the underlying protocol.

These events bring out gamblers. Just take a look at these two headlines:

"Bitcoin Sell-off Looms Ahead of Block Reward Halving"

--Oliver Knight, Coin Rivet

"Cryptocurrency Experts Predict Bullish Impact of Bitcoin Halving"

--Oliver Knight, Coin Rivet

As you can see, the outcome of this halving isn’t set in stone.

Some crypto writers are even describing both sides at the same time. Knight wrote those two articles on the same day.

What Happens After a Halving

Fortunately, this isn’t the first time Bitcoin had a halving. In fact, it’s happened twice before.

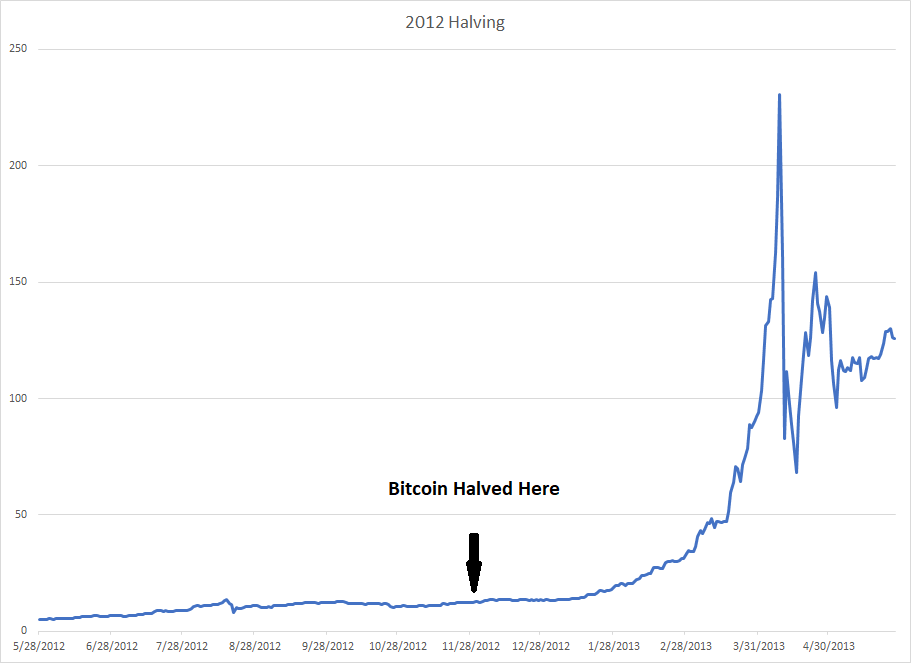

In 2012, far fewer people owned crypto. Therefore, the direct impact of the halving was muted… for a time:

The result of the first halving clearly took a few months to register.

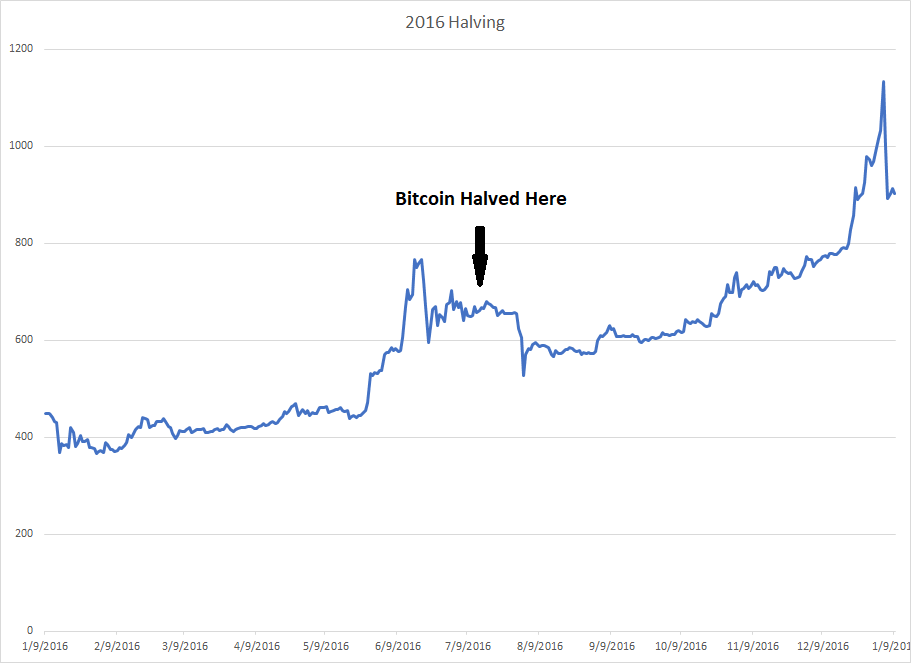

A similar pattern came out of the second halving in 2016:

Though, any statistician will tell you that you simply don’t have enough data from two events to make a solid prediction for a third.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

So, how can we build on this data?

One way is to look at how these events affected other cryptocurrencies. While not perfect, a look at the likes of Ethereum and other digital currencies could be helpful.

Following the 2016 Bitcoin halving, Litecoin jumped 8,000% in just a few weeks. Ethereum, the second-largest crypto, took off 12,300%.

Now, obviously, these could be isolated events. Cryptocurrencies are not sealed in a vacuum. They can be swayed by any number of reasons.

And while these aren’t necessarily US-based vehicles, Americans are among the most-heavily invested. Notice these halvings keep taking place in election years.

So, how to play it…

Navigating the Noise

To decide how to play such a large event in such a volatile investment, you need to start where you are.

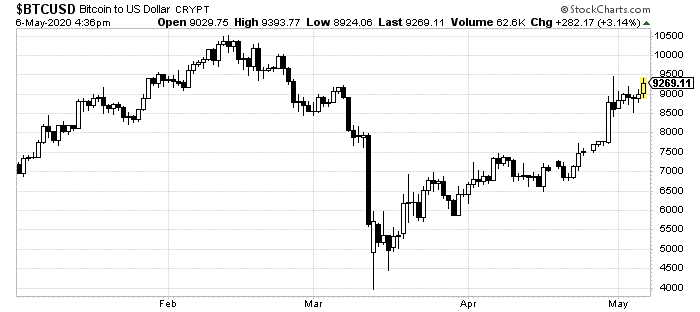

Bitcoin was badly shaken up by the economic downturn in mid-March. But it has since recovered with fervor:

It is now trading a full 29% higher than at the start of the year and more than twice what it was after its recent collapse.

That clearly indicates at least some pre-halving speculation. As the other two halvings do indicate, these events can underwhelm, at least until the initial buildup dies down.

Knight himself noted in those above pieces that $9,600 is the important technical threshold to watch for. If Bitcoin can trade above that level, it could point to a more immediate jump.

Now, here at Emerging Profits Daily, we aren’t recommending any specific trade. But, as with all investments, patience and carefulness produces smarter trading.

Here, this is especially true.

If Bitcoin trades sideways following this halving, that could precipitate a similar spike as previous ones. But as speculation is especially high right now, a short-term selloff is not off the table.

If you are long digital currencies, you might be able to use this event to patiently add to your position. While no guarantee, that does offer the obvious patient and careful path. Especially for this rare event.

In any case, mark the 12th and give Bitcoin a look that day.