The COVID-19 pandemic is no laughing matter, but not all hope is lost.

Even in our darkest hours since WWII we can prevail, both in defeating this pandemic and in beating the crushing blows the market has taken.

It will take time for things to turn around, but you’re in a position that with a few smart moves right now you could make a killing when the dust settles.

Are you with us? Great… let’s get started.

There are a number of high-quality tech stocks on discount now. These stocks have gone on remarkable runs over the past year, but due to the recent flash crash they are trading at supreme discounts, well below their true value.

Now’s the time to pick up what shares you can because these stocks will return to their true levels, and fast.

Here’s three we really like right now.

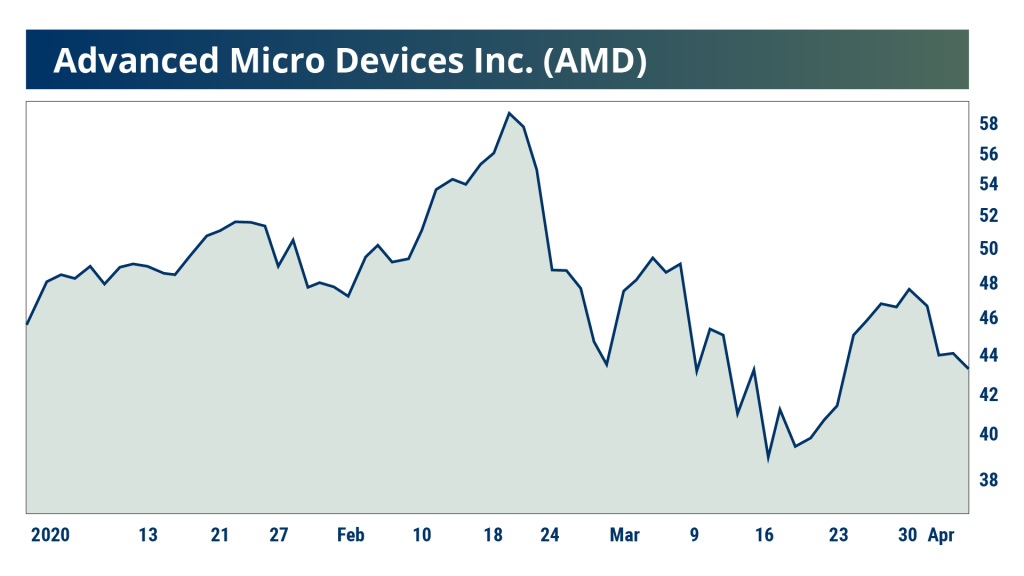

Before the crash Advanced Micro Devices Inc. (NASDAQ: AMD) Chief Executive Officer Lisa Su forecasted long-term annual growth of 20% moving forward. A bold prediction, but not all talk.

AMD recently released a new high-performance supercomputer, its 2nd Gen EPYC system and early reviews are impressive. In fact, this system is now being employed at Lawrence Livermore National Laboratory in California.

This is a new market for AMD, but so far AMD is surprising in a good way. But not only with its new line of supercomputers.

AMD’s new Ryzen line of processors are giving Intel’s latest chips a run for its money.

For economical gaming, it’s hard to get more power for your dollar right now. This is important for investors, too. Gaming is a huge and often overlooked industry.

Looking forward we can expect AMD to launch its Navi 2X GPU and Zen 3 CPUs later this year.

Advance artificial intelligence (AI), virtual reality (VR) and augmented reality (AR) tech, even driverless car systems rely on chips that can process tons of visual data. Chips that can handle the rigors of gaming have greater applications in these new-age industries.

The stock is at a steep discount right now and is why we suggest pulling the trigger now.

Long-term...

We saw how Nvidia rose from obscurity to market leader off the strength of their GPU business. If AMD’s GPUs can prove comparable, they have a good chance at capturing some meteoric gains as well.

And that’s even with the coronavirus drawdown.

Apple Inc. (NASDAQ: AAPL) was on the fast track to $350 a share well before even the most intuitive market watchers expected this year.

But then, of course, everything changed once the COVID-19 pandemic tanked markets.

But beyond COVID, the bull case for AAPL is still intact.

Which is why at its price right now, it's another great stock to get in on. Or if you own it, add to your position.

We look at Apple differently than most folks. And in tune with what will be a growth driver for tomorrow rather than what is driving sales today, we’re hinging on Apple’s huge gains in wearables and services.

We know wearables are the next big trend. But Google glasses are for nerds and technophiles. Apple Glasses by Ray-Ban are something like that is what folks will wait in line for days for.

Owning an Apple product is just as much about status as it is functionality. And we can’t ignore continued iPhone sales as well.

5G is on the way and Apple’s going to profit significantly when these new networks go mainstream.

Now for our last must own stock on a supreme discount.

The tech sector soared to new records last year while facing numerous acute headwinds, We started to ask if some tech stocks aren’t cyclical anymore due to their perpetual demand.

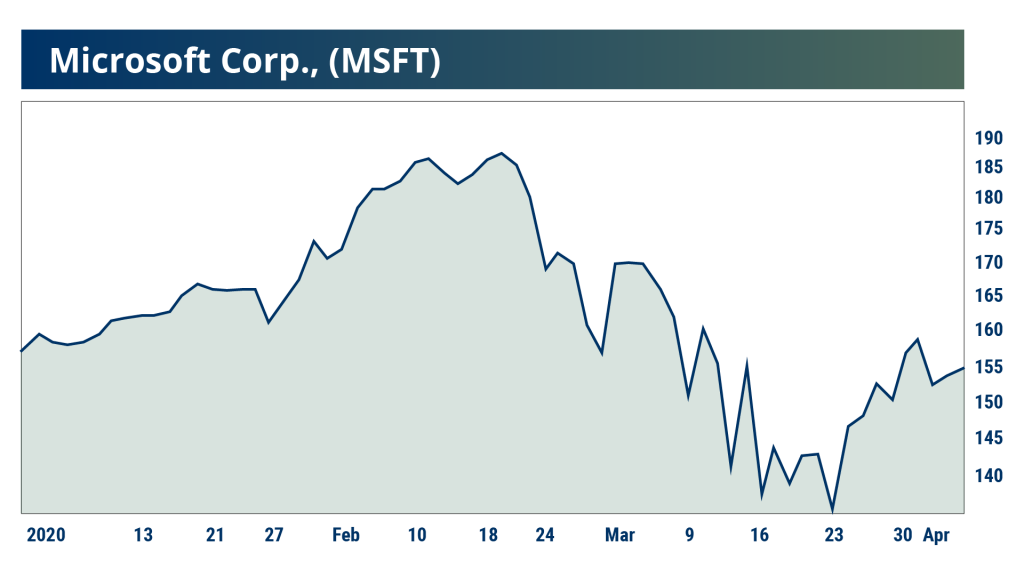

Microsoft Corp., (NASDAQ: MSFT) is one of them. There’s hardly a household in America that doesn’t have a Microsoft product in it.

Additionally, we like the company for its push into cloud services with Azure. The Pentagon contract they secured, pending Amazon’s dispute, will be a huge growth driver. And there’s no doubt other organizations will begin using Azure as well. We also really MSFT’s revenue stream from licensing.

And with the stock well off its highs MSFT rounds out our three easy buys to come out of the COVID crisis on top.

You even get a decent dividend to boot with this tech staple while you wait for the market to bounce back.

Now onto the big reveal.

A healthcare-focused tech play perfectly positioned to pay off big now and after the coronavirus crisis runs its course.

Type 1 diabetes 30 million Americans and many more worldwide. It’s a serious incurable disease that has taken too many lives too early.

I know the effects of this disease personally.

In college, a good friend passed away in his sleep from complications of Type 1 diabetes. His future was bright as a promising pre-med. If not for diabetes he may have one day cured the disease. And his story is far from the only one like that.

But thankfully through technology like artificial intelligence (AI), soon-to-be rolled out 5G networks and high powered micro-processors, we are getting an edge in this fight.

That’s where this month's recommendation comes into play.

Livongo Health’s (Nasdaq: LVGO) digital platforms are changing the very nature of how we fight and manage chronic and deadly diseases like Type 1 diabetes. Their app and online platforms streamline a world of healthcare data so that patients can easily select the care programs that work both for their condition and their wallet.

Diabetes care was Livongo’s first mission, but through rapid growth, they have also branched out and now have programs for hypertension, weight management, and behavioral health.

Linvongo’s programs work, hands down. The company has demonstrated measurable outcomes at scale. Thirty-percent of Fortune 500 companies are clients.

And a recent press release notes two Fortune 50, self-insured companies were able to drive down medical spending by almost 6% using Linvongo’s programs.

Livongo’s team of data scientists aggregate and interpret substantial amounts of health data and information to create actionable, personalized and timely health signals.

This allows Livongo to deliver better clinical and financial outcomes making for a much better way for people to manage their chronic conditions.

And with cases of COVID-19 still on the rise folks with chronic conditions need remote care they can trust. Livongo delivers.

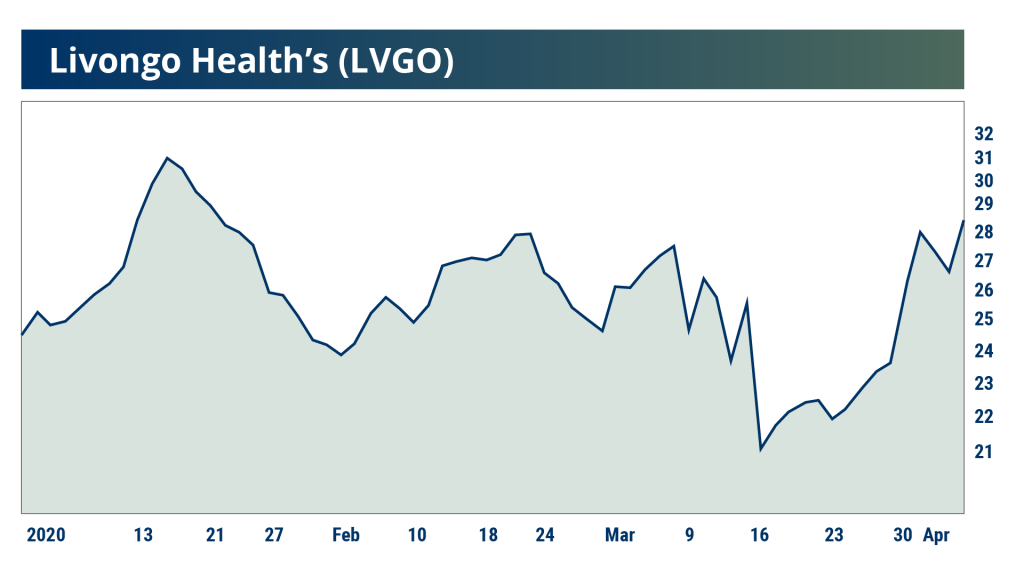

The stock itself has recovered nicely from the recent drawdown.

Earlier in March, LVGO reported a strong beat. Earnings were positive coming in at $0.02 per share versus the consensus estimate of minus $0.05. Revenue came in at $50.2 million, 1.8% better than forecasted. That also represented 137% year-over-year.

The company has clearly found its space in the digital health landscape.

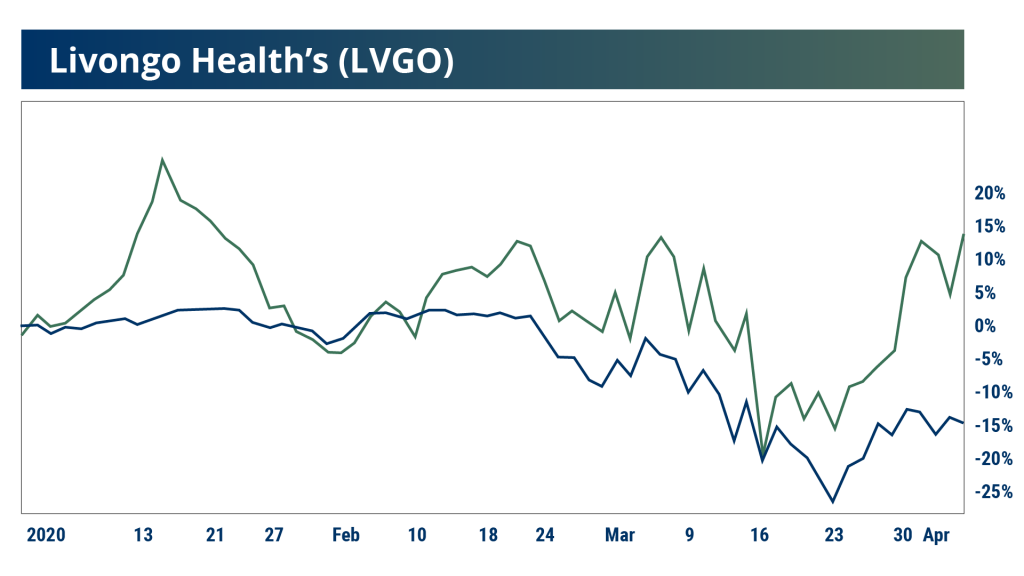

LVGO has gained about 15% so far this year. Meanwhile, the medical sector, represented by the Health Care Select SPDR Fund, is down about 15% on a year-to-date basis.

Livongo’s relative strength compared to the greater sector is significant to note.

If you’re looking for a must-buy stock that is performing well right now look no further than LVGO. With the world-altering effects of COVID and the need for remote health options LVGO should be a huge gainer this year.

Action to Take: Buy a full position of Livongo Health Inc. (NASDAQ: LVGO)

Roku, Inc. (NASDAQ: ROKU) - Roku is down big but we still like them. Consider adding to your position.

RF Industries (NASDAQ: RFIL) - RFIL is down but we still like them. Consider adding to your position.

Invitae Corp. (NYSE: NVTA) - Invitae may have found support and is looking to break off sideways action.

Twilio Inc. (NYSE: TWLO) - Twilio is down but we still like them. Consider adding to your position.

The Trade Desk, Inc. (NASDAQ: TTD) - TTD is down almost 50% but we still like them. Consider adding to your position.

Pinterest, Inc. (NYSE: PINS) - Pinterest is weathering the coronavirus correction.

Alteryx, Inc. (NYSE: AYX) - AYX is down almost 50% but we still like them. Consider adding to your position.

Fastly, Inc. (NYSE: FSLY) - Fastly is weathering the coronavirus storm and pushing back towards its 2020 high.

Veeva Systems Inc. (NYSE: VEEV) - Veeva has bounced back nicely and is pushing back towards its 2020 high.