2020 has been a good year for investors in certain sectors.

Tech stocks have been on a tear as investors look to high-growth categories such as gaming and software companies.

Both categories have seen revenues increase during the trend acceleration of the COVID pandemic. I’ve talked about it before, but it’s worth bringing up again. Technology is the future and it’s one of the main areas that we are going to see emerging profits.

One great place to look for emerging profits is in the IPO markets.

The Coronavirus did put a damper on IPOs for a few months of the year. But equity issuance has sprung back from its pandemic induced lull. In July, investors saw almost $19 billion in new listings. This was the busiest month for U.S. IPOs since September 2014.

June, July and August were three of the busiest months for IPOs on records as companies rushed to hit the exchange before the market uncertainty sure to surround this year’s presidential election.

So far this year 18 software companies have gone public raising a combined $5.5 billion.

We’re also seeing an interesting trend tech startups as many reach a $1 billion valuation or "unicorn status" before deciding to go public.

Two weeks ago, we saw a handful of tech companies all file their S-1 registrations with the SEC. And we even talked about Palantir last week with its plans to go public via a direct listing. But five other tech companies and one telemedicine company also announced plans that day.

Poised to Profit Amidst Disagreement

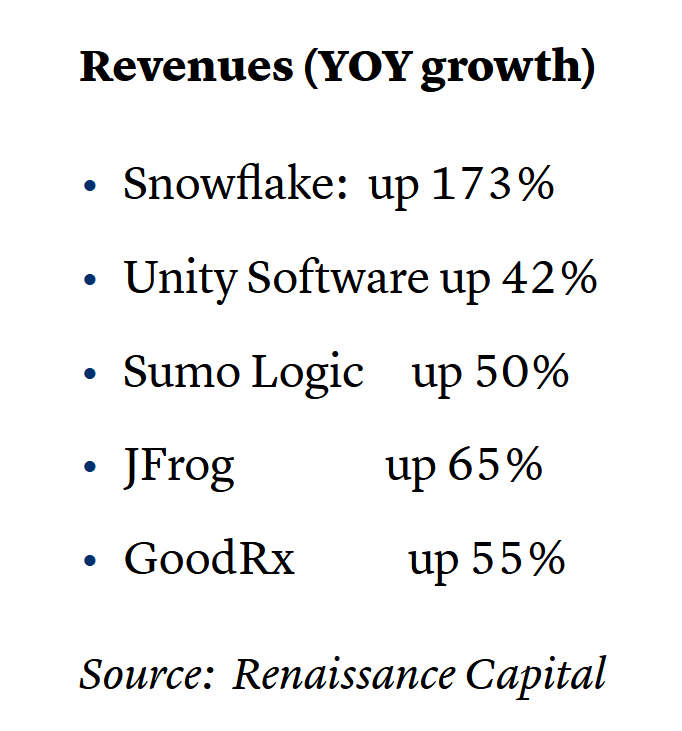

All these companies are touting their revenue increases to attract investors:

But of this list, one is poised to take advantage of Apple’s current feud with Epic Games.

Apple has terminated Epic’s app store account after developers implemented an in app pay system which goes against Apple’s policies. This is also going against the policies of Google on Android systems as well.

Unity Technologies is sure to benefit.

Unity offers a platform for creators to bring their vision to life.

These graphics tools allow users to create, run and monetize real-time 2D and 3D content for mobile phones, tablets, PCs, AR and VR devices. Unity creations can be found on platforms everywhere.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

The company has 39 offices located in 18 countries to support its applications. And they are being used by gamers all over the world. Over 120 million gamers per month communicate across the Unity voice and text platforms every month.

The key statistic here is that in 2019, over half of the top 1,000 games on Apple and Google Play stores were Unity creations. It’s a leader in the creative solutions category whether you’re talking about developing games,

On top of that, the company saw revenue growth increase by 40% for the first half of 2020. And its 2021 sales estimates predict another 30% growth next year.

Unity tech plans to sell 25 million shares for somewhere between $34 to $42 each.

With Epic Games off the Apple store for the foreseeable future, there is a gap to fill. Unity is already poised to continue taking a share of the mobile gaming market.

Keep an eye out for these shares to hit the market, because you might just want to add a few to your technology holdings.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder