It is now a long-running joke among political pundits and online hecklers. But we may finally be close to having a real “infrastructure week.”

The Trump Administration first held a full seven-day “infrastructure week” in June 2017. The idea was to reach across the aisle to put a real bipartisan bill into action.

It would have funded projects to fix and rebuild everything from crumbling roads and bridges to building out rural broadband service.

The joke comes from Trump’s own torpedoing of it by fighting with Democrats over their investigations into him. Every time the White House brings up infrastructure, a news story about James Comey or Paul Manafort gets in the way.

But amidst this current crisis, the two sides are back at it again.

Tomorrow, the President is set to address media at a White House event on rural broadband.

Bloomberg reported yesterday that this coincides with a new concerted effort to introduce a $1 trillion infrastructure bill.

Of course, you know the definition of insanity.

The Democrats are unlikely to sign on to a bill that could help Trump’s reelection chances.

Senate Republicans are already wary of stimulus spending.

And if previous “infrastructure weeks” are anything to go on, Trump himself could again torpedo his own idea.

That’s, of course, how the media is covering this story.

But for the optimists, there is some hope.

The Real Path Toward Infrastructure

Democrats in the House proposed a $760 billion infrastructure spending bill as recently as January. They are also waiting on a response to their recently passed $3 trillion stimulus plan.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Republicans in the Senate, meanwhile have already shot that stimulus plan down. But, they could be swayed if it includes this “win” for the President.

This could be just the solution for both sides.

Now, whether this happens before the election is up for debate. And, admittedly, the political situation in the country tends to say no.

But eventually, infrastructure week will result in something.

The real question beyond “When?” is “How?”

The Democrats are in favor of a straight spending bill to fund new projects. Republicans have long held that public-private partnerships (PPPs) are the way to go.

PPPs involve one-part government funding, one-part private investment from companies doing the work or owning the assets.

A company that builds a toll road puts in some money and receives the rest from the federal government. But it then gets to keep all of the proceeds from that toll road once open.

Even if this gets delayed to after the election, and even if Democrats sweep the Senate and White House, PPPs are likely the only way they’d get it past the Senate filibuster.

So, who wins?

The Real Winner Here

Brookfield Infrastructure Partners LP (NYSE: BIP). That’s who.

BIP is one of the largest infrastructure companies in the world. Its portfolio includes ports, power plants, transmission lines, telecom towers, data centers, utilities and toll roads.

If there is ever going to be a deal struck between the federal government and the private sector on rebuilding U.S. infrastructure, it’ll include BIP.

It’s important to note that BIP isn’t just in the U.S., however. It holds these kinds of assets around the world. But other governments are looking to stimulate their own economies with similar spending.

Of course, banking solely on the prospect of a political agreement in the U.S. does sound risky, right?

Well, even without it, BIP is worth a look.

The company’s vast portfolio shields it from any downturn in one portion of it.

For instance, in the first quarter, when everyone was feeling the shock of this crisis, BIP’s transport segment saw a dip in revenue and income. But its utilities and data infrastructure business boomed.

Sure, a flat bottom line doesn’t sound like a great opportunity. But that was during a quarter when others were seeing 80-90% dips in earnings.

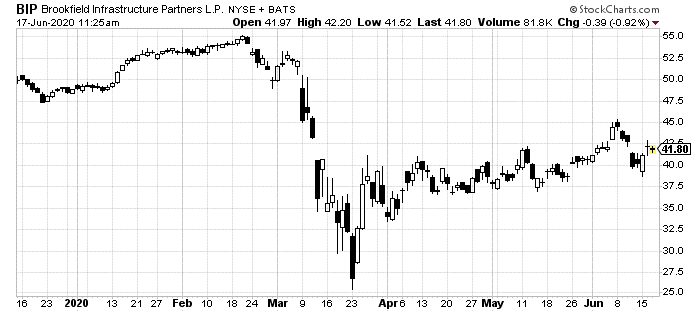

Still, its shares cratered like everything else:

It has also been able to easily fund its sizable dividend, currently yielding 4.6%. Its' master limited partnership status, in fact, guarantees that dividend.

A return to pre-crisis levels would give shareholders getting in today a very respectable 25% gain. Add in a large dividend in a market devoid of income. And you get a nice return.

Compile that with even a hint at a large federal infrastructure bill and you could see two or even three times that profit.

Before “infrastructure week” ends, whenever it does, you should pick up shares of this industry giant. Once the media stops making jokes about it, it’ll already be too late.

To your prosperity,

Joshua M. Belanger

Founder & Publisher