It’s no secret that Huawei’s popularity has been waning over the past two years.

Although it’s a huge telecommunications supplier, and phone manufacturer, one country after another has been banning the use of its equipment as 5G networks develop.

The US continues to pressure allies to block Huawei and the UK decided that all the company’s gear must be removed by 2027.

Late last year, the UK’s leading communications provider BT said that it would work to strip away this equipment by 2021.

That meant the company had to figure out who to turn to go forward with 5G core and the company to assist in the changeover.

Ideally the changeover will be able to happen without too much downtime, so it needs to be planned carefully.

Almost a year later, BT has finally picked Telefonaktiebolaget LM Ericsson (NASDAQ: ERIC) and Nokia (NYSE: NOK) to fill that gap.

BT historically operates as a dual vendor to avoid total dependence on a single provider.

Nokia will be working hard as part of the effort to remove Huawei equipment.

Ericsson has already been working to replace equipment in BT’s core 5G network.

And now it will be providing 5G connectivity in several major cities across the country including London, Edinburgh, Belfast, and Cardiff.

The CEO of Ericsson, Borje Ekholm commented “Having already been selected to partner in 5G Core, we are pleased to strengthen the relationship further with this deal that will deliver high performance and secure 5G to their customers across the UK’s major cities.”

I mentioned Nokia last week, and how investors seem to be sleeping on the company.

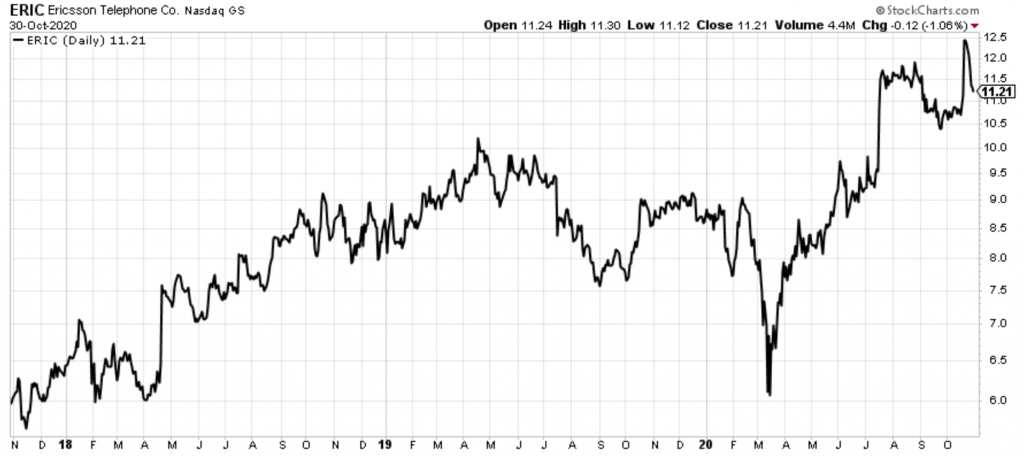

And Ericsson seems to be in the same boat.

It is working to have its hands in as many countries as possible…and shares can’t seem to hold above $12.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Ericsson has five live 5G networks in the US and globally powers more than 40 commercial 5G networks on five continents.

As the company proves it can efficiently upgrade networks away from Huawei equipment, there will be even more demand for Ericsson’s service.

Just the migration in the UK will require an extra $630 million investment in the networks.

Ericsson recently reported third-quarter results despite the slowdowns this year.

Sales adjusted for currency increased by 7% mainly driven by 5G sales in mainland China.

At the same time, gross margin improved in all segments and reached the highest since 2006.

Plus, the company just completed the acquisition of Cradlepoint.

This US-based market leader in wireless 4G and 5G solutions is an excellent addition to the company’s plan on expanding into the rapidly expanding 5G enterprise space.

The company continues to win footprint in several markets.

Plus, it should see more expansion in the US driven by consolidation in the operator market, pending spectrum auctions, and increased demand for 5G.

As far as an affordable, long-term investment in 5G, Ericsson has to be at the top of the list.

Networks literally all over the world will be using Ericsson’s equipment.

And once that equipment is in, short of the government banning the company, Ericsson will continue to provide and service that equipment.

It’s a no brainer.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder