It’s official: weed is essential!

Lockdown orders continue across the country.

So, the debate over what constitutes an essential business remains ongoing.

In many cities and states, marijuana made the cut.

In Denver, Mayor Michael Hancock first ordered pot shops closed on March 16. In less than 24 hours, he reversed that. Marijuana and liquor stores officially become essential. Still, some stores have seen sales skyrocket 300%.

The same story happened in San Francisco, where sales jumped 150%. States from California and Colorado to Washington and Pennsylvania have made weed an essential product.

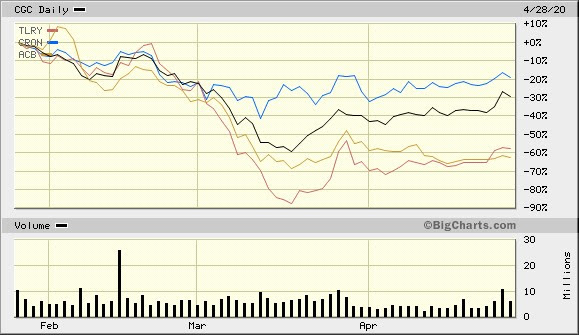

Yet, for pot stocks, this reality hasn’t been reflected in stock prices:

Pot Stock Rally Imminent?

Some of the extended losses in pot stocks come from the concern of overproduction.

Gloves and face masks are a requirement for growers. So, shortages could cut into the supply of new product.

Another problem these essential businesses face is with their supply chains themselves.

While already a unique problem, transporting marijuana products from growers to dispensaries has become a bigger headache.

Still, these low prices should attract some new investment.

After all, right now industry leader Canopy Growth Corp. (NYSE:CGC) has a market cap of just $5.9 billion. Two years ago, Constellation Brands Inc. (NYSE:STZ) bought a 9.9% stake in it for $4 billion.

That represents an 85% loss for Constellation. Or, put another way, Canopy would have to rally 585% for Constellation to break even.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Is a rally like that likely? Probably not. At least not in the short term.

But there is another way to play this. And it has nothing to do with growers, transportation or distribution.

Making Drugs from Drugs

GW Pharmaceuticals plc (NASDAQ:GWPH) is a drug developer. It is also the only company in the world with an FDA-approved drug derived from cannabis.

EPIDIOLEX is an epilepsy drug for Lennox-Gastaut syndrome and Dravet syndrome. Both of these conditions cause childhood-onset epilepsy.

Less than a month ago, the FDA also accepted an sNDA filing to extend EPIDIOLEX to treat seizures related to Tuberous Sclerosis Complex.

While this is amazing for the company, it isn’t the biggest news that should shake up the market more than it has.

On April 6, GWPH received notification from the Drug Enforcement Administration that EPIDIOLEX was officially descheduled and no longer subject to the Controlled Substances Act.

Think about what that means. States across the U.S. have opened up marijuana. But the federal government has so far not acted at all… except to give this one $3.3 billion company a monopoly on it.

Obviously, EPIDIOLEX is far from the weed you can still buy at dispensaries in many states. It is an FDA-approved drug requiring prescriptions.

However, this news is certainly welcome. Shares of GWPH are frequently tied to the rest of the marijuana industry. As you can see, despite all of this positive news, they are down:

Of course, that could soon change.

GW’s in the Perfect Position

In the next two weeks, GW reports its first-quarter earnings.

It is also sitting on a huge pile of cash ($537 million) with essentially no debt.

Meaning, it is financial, operationally, and strategically set for a bounce… possibly a bigger one than the rest of the marijuana industry.

Wall Street analysts agree. The average price target for GWPH is $184. That makes its $105 price tag look cheap.

Cannabis is far from dead. In fact, it is officially essential. And alternative plays like GWPH might be the best way to get in right now.

You can also gain access to my top pick to profit from 5G and cannabis boom in my special report 5G + Cannabis Stocks: The Ultimate One-Two Punch.