Even if Tesla Inc. (NASDAQ: TSLA) fanatics are right and EVs are the dominant future technology, there will be a second winner: hydrogen.

As long ago as 1807, tinkerers were working on hydrogen-powered vehicles. Swiss inventor Francois Isaac de Rivaz prototyped a hydrogen-balloon-powered vehicle.

When the U.S. was slammed with a gas shortage in the late 70s, the major car developers began churning out their own hydrogen fuel cell cars.

This was going to be the savior fuel. Fuel cells remained the way of the future throughout the last several decades. As the climate crisis began to fall off politicians’ tongues in the 2000s, the water emissions from fuel cells started sounding far better than CO2 from conventional vehicles.

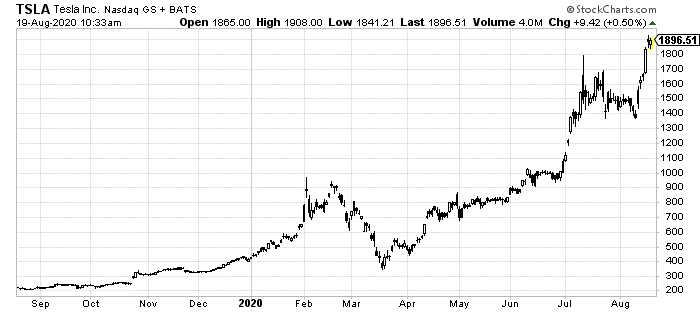

Yet, battery technology caught up. The single-hottest stock in the market is Tesla, by far. Jumping nearly 800% over the last 12 months, it’s garnered more than its fair share of headlines.

And even if you believe this rally went too far, the underlying technology of lithium-ion batteries is impressive and here to stay.

But not everyone is banking all of their future hopes on Tesla and its ilk.

FCVs Still Rule Elsewhere

Japan, as recently as last summer, pushed for hydrogen and fuel-cell vehicles to the international community with a report on how they can play a major role in combatting climate change.

Similar enthusiasm for FCVs is coming out of South Korea, which is putting up refueling stations faster than any other country.

But it’s not just in Asia. Germany too recently paid off on plans to build hundreds of hydrogen refueling stations across its road network.

In fact, despite the booming success of Tesla, Nikola and other EV companies, traditional automakers are still all in on FCVs. Hyundai, Toyota and Honda have all seen sales rise for this niche industry in recent years.

Of course, their FCV offerings aren’t exactly constituting a huge portion of their revenue. But, as I began with, they don’t have to for hydrogen to be a huge winner.

Hydrogen’s Elemental Allure

Vehicle fuel cells aren’t even where most of hydrogen’s demand comes from. It is, beyond anything else, an industrial gas.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

It is used to make steel, chemicals and power industrial equipment like forklifts and loaders. With much of the world going back to work after this disastrous 2020 pandemic, all of that goes back online.

In fact, it is even more appealing as equipment gets replaced, gas and diesel-powered industrial equipment will be supplanted by hydrogen and fuel-cells.

Other methods for producing iron, steel, etc. such as natural gas and coal is already being replaced in greater numbers with hydrogen.

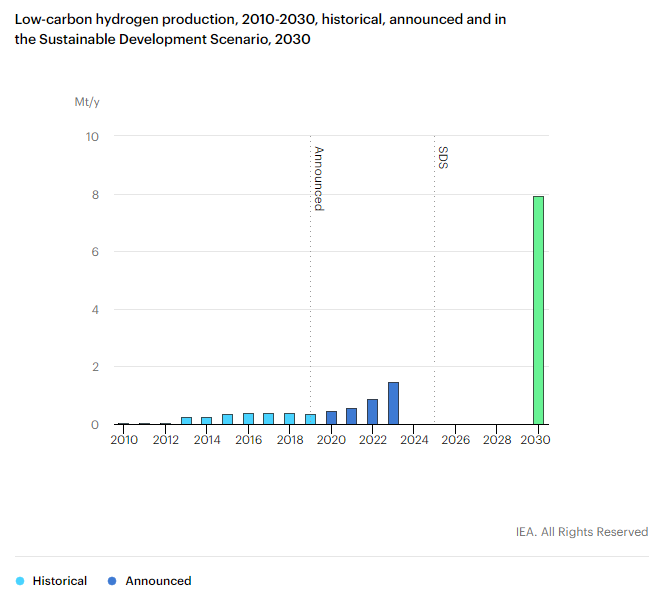

It’s not even a question of whether hydrogen demand will grow, but of how much. The International Energy Agency recently put out these projections:

Just in the next three years, hydrogen production is expected to quadruple. But look at the far-right side of the chart. That’s the IEA’s Sustainable Development Scenario projection for 2030. Hydrogen’s next ten years are going to be as explosive as the gas itself.

In fact, another recent study by Global Market Insights puts the industry’s size at $160 billion by 2026.

There’s also a very simple way to play this wildly-emerging trend.

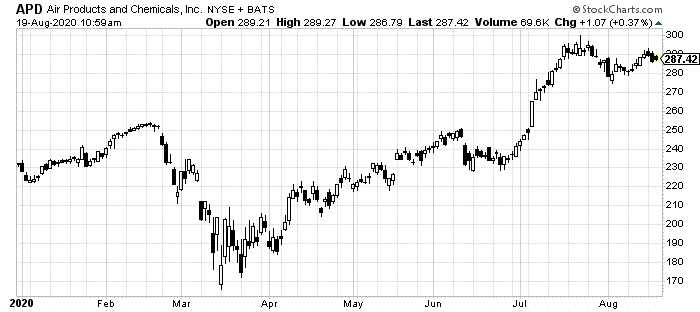

Air Products and Chemicals Inc. (NYSE: APD) is among just a handful of hydrogen manufacturers. Its $9 billion in annual sales dominates even that group. And that’s still a pittance compared to an industry price tag of $160 billion.

The clear winner from hydrogen’s reemergence is going to be APD.

As you can see, it has enjoyed a nice run up in share price this year.

But if the EIA is even one-tenth right about the next decade for this gas, APD is far from done growing.

To your prosperity,

Joshua M. Belanger

Executive Publisher & Founder