Brick and mortar retail has been headed for change over the past ten years.

Now the uncertainty of 2020 has accelerated the trend.

It’s obvious to see the transition into online retail. Amazon (AMZN) has succeeded more than anyone else during the pandemic. It’s easy to order anything from groceries to movies with just a few clicks. Plus, if you live in an area with a Whole Foods or a distribution center, delivery times can be under 24 hours.

Companies like Lowe’s (LOW), Home Depot (HD) and Tractor Supply Company (TSCO) are also seeing sales increase. These are examples of companies that operate in the right niche at the right time.

Americans took up gardening and home improvement projects in droves. Plus, all three already had successful e-commerce that was utilized even more.

The pandemic made is clear that there is more to adapt than making products available online. A shift in consumer preferences happened almost overnight.

Just look at Men’s Wearhouse, Jos A Banks, Ann Taylor and Neiman Marcus. All of their respective parent companies have entered chapter 11 bankruptcy in recent weeks. With more and more people working from home, comfort is key. You only need to have one or two button-down shirts for the occasional video meeting.

They have joined the likes of J.C. Penney and Lord and Taylor. The truth is that companies that once targeted the middle class are falling to the wayside.

Higher-end brand names such as Lululemon Athletica (LULU) are doing fine.

We are seeing this shift towards value searching for everyday products and splurging on name brands being accelerated.

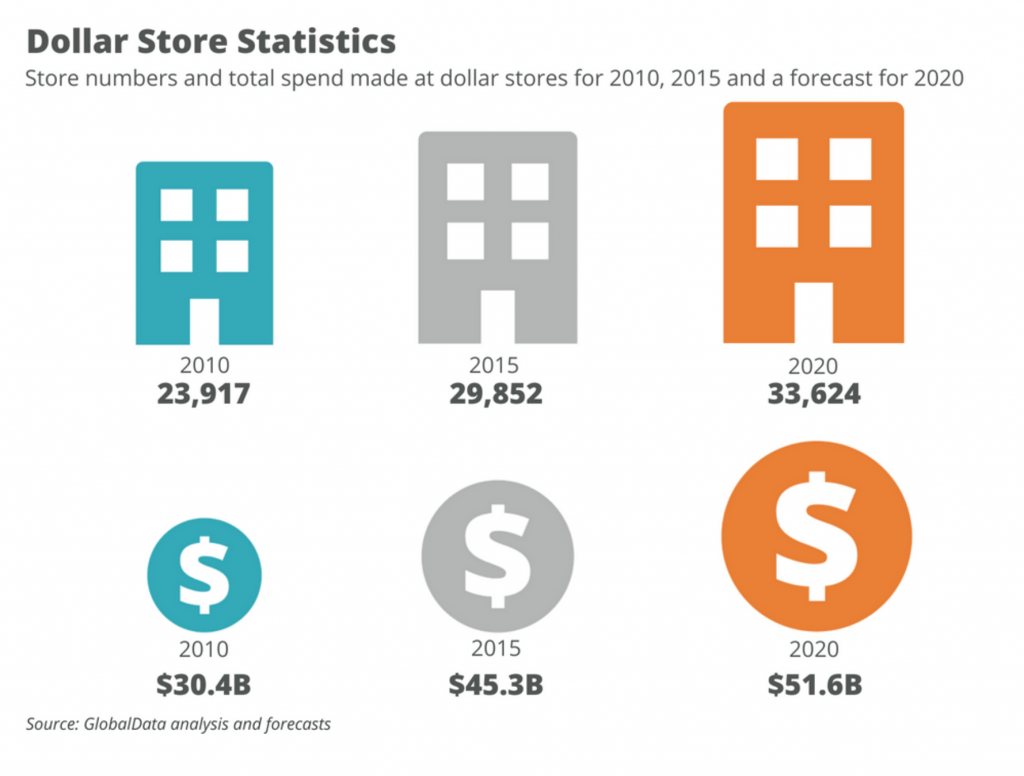

It’s not a new trend. At the end of 2018, there were more dollar stores than the six largest US retailers combined.

Dollar stores have been on the rise for over 10 years. The addition of branded grocery including fresh and frozen options is continuing to attract value seekers. And there is one company, in particular, that’s blowing away competitors.

1,000 New Dollar Stores in 2020

Three-fourths of Americans live within five minutes of a Dollar General (DG). You can order some items on their website, but with an abundance of stores, convenience is key.

They have been steadily taking over from the most rural area to the inner city. Especially in areas where there aren’t grocery stores or Walmart.

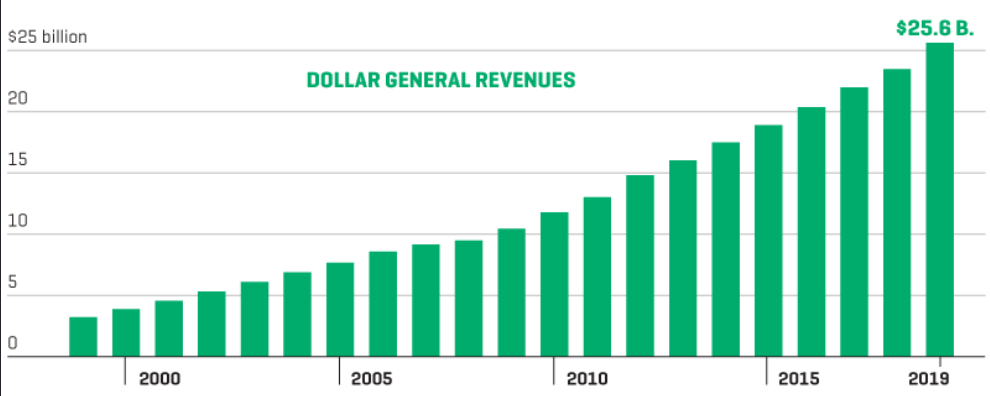

Dollar General has been delivering value to shoppers for more than 80 years and currently has 16,500 stores in 46 states.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

The Coronavirus has sent more people to the Dollar General, looking for a deal.

During the first quarter, sales increased by 27% and operating profit increased by 69%.

To meet the demand, the company recently announced plans to expand its distribution center presence and continue building out stores.

For the 2020 fiscal year, the company is working on approximately 2,600 real estate projects including 1,000 new store opening, 1,500 store remodels and 80 store relocations.

And investors are taking notice.

Shares are up 24% since the beginning of the year. It’s a no brainer. There is increasing demand, plus the company is able to continue paying its dividend of 36 cents every quarter. That’s a big deal seeing as hundreds of companies have cut or suspended its dividend so far this year.

The company will be sharing its second-quarter earnings at the end of the month, which will only push shares higher. It’s a trend that’s only being accelerated into the future and there are profits to be made.

Make sure that your portfolio is clear of generic stores catering to the middle class. GNC, J.C. Penney, and Ann Taylor are just the beginning of the list stores that won’t see 2021.

To your prosperity,

Joshua M. Belanger

Executive Publisher & Founder