How do you beat a $152 billion industry built around people staying inside more often?

That’s how big the video game industry was before we were all ordered to do so. And many are speculating that number is going to grow exponentially now that video games have branched out.

With each generation of gaming, developers have opened up their games to entice a greater number of players.

First, with home consoles in the late 80s and early 90s, game publishers recruited millions of life-long players into the market.

Then, as consoles and PCs grew more capable, these now young adults spent ever more money on games, with a new generation growing up behind them.

Now, with a mobile gaming platform in everyone’s pocket, mobile gaming has sprouted into a $68 billion industry of its own, enticing even younger children and adults who missed out on Mario and Sonic.

So, with such a wide customer base already using their products, it’s no surprise that game companies are exploding with everyone looking to fill their many stay-at-home hours right now.

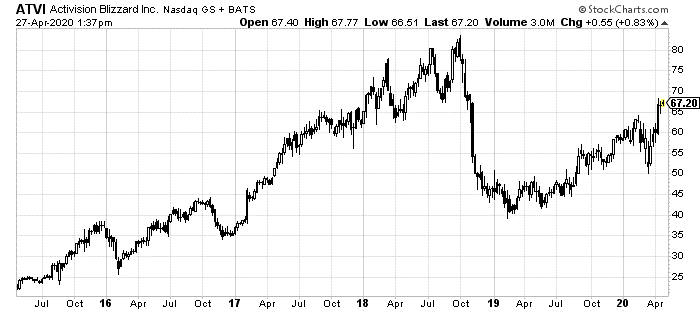

As you can see, after falling with the market initially, these major gaming companies have shot back to or above their highs:

Here’s the thing: none of these companies have even announced how much money they are actually making during this lockdown.

All three report first-quarter numbers early next month.

You might say that with estimations of a 17% or higher unemployment rate, few would spend even more money on discretionary products like video games. But don’t underestimate entertainment’s value, especially right now.

Netflix Inc. (NASDAQ:NFLX) announced its financial results for the first three months of 2020 last week. It added 16 million new sign-ups. That’s nearly twice what it did in the previous quarter.

Video games compete for that exact same market. Whenever you can’t find anything to watch, chances are you turn to your phone, where nearly half of the gaming industry lives.

Of course, not all video game companies are the same. Nintendo, for instance, just got a huge boost from the massive success of its Animal Crossing game.

But when breaking down which companies are set for the greatest short-term success, maybe you should look longer term.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Trading gaming companies based on expected successes of upcoming releases rarely works. There’s too much room for surprise, similar to the movie industry.

Instead, you have to look at franchises and legacy products. And no company has cornered that market, besides possibly Nintendo, better than Activision Blizzard Inc. (NASDAQ:ATVI).

Beyond its earlier successes as this industry first started showing up on investors’ screens with releases like World of Warcraft, this now-combined behemoth owns long-term money makers like Call of Duty and Candy Crush.

This last is the important part.

In late 2015, Activision Blizzard purchased King, the maker of huge mobile titles including Candy Crush Saga. The deal went for just under $6 billion, a huge amount at that time.

Since then, ATVI has nearly doubled in price, from $37 to $67. But we’d definitely argue there’s further for this to run.

Next month’s earnings, starting on May 5 with Activision and Electronic Arts Inc. (NASDAQ:EA) both announcing, is the catalyst for something big.

Heading into this stay-at-home world, Activision had also gotten lucky with its finances. It has paid down its debt to an extremely low level. It built its cash reserves. And it’s streamlined its cash flows.

This earnings season is set to be a huge one for all of the gaming industry, but none more so than Activision.

*ATVI is not an official Emerging Profits recommendation. If you choose to act today, be sure to plan your entry and exit, conduct your own research, and never bet more money than you can afford to lose.