It's been a whirlwind of a year...

And it’s only half over.

We’ve seen a deadly virus cause a complete shutdown.

Now we’re seeing curfews roll out as protesters and looters take the streets.

Yet, with all the uncertainty, markets are a stone's throw from year to date highs.

So let's focus on how you can make money in the wild market.

The biggest emerging trend is that people are consuming more and more information.

The reliance on our phones and the internet is at an all-time high.

We want to be able to connect to those that we can’t see. We want to be able to get our hands on unbiased information to form our own opinion.

It’s about being informed about what is going on in our community and the rest of the world. It’s about learning a new skill since we have free time. It’s about finding new employment and making changes.

And as I’ve said before…it’s increasingly clear that 5G and other technological advancements are the future of the world. If you can find the right opportunities, that’s where you want to invest.

Let me show you an exciting way you can generate solid income from this trend.

Government Required Payouts

REITs were created by Congress in 1960 and allowed individual investors a way to invest in commercial real estate. Prior to this, access to commercial real estate investing was reserved for wealthy individuals. Now there was a way to gain exposure to billions of dollars of real estate for just a few hundred dollars.

Simon Property Group is one of the most well-known REITs. The company owns and operates mall and shopping center real estate. There are also self-storage REITs, mortgage REITs and residential REITs.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

REITs must generate at least 75% of gross income from rents, interest on mortgages or real estate assets. Within the first year of REIT status, the REIT must have at least 100 unitholders.

The best part is that REITs are required to pay out at least 90% of their income to unitholders. In exchange for following these guidelines, the REIT gets status as a pass-through entity. Meaning it does not have to pay any corporate tax whatsoever.

To get in on 5G, we have to look at infrastructure REITs. That’s exactly what it sounds like. It’s a way to invest in the infrastructure needed for the inevitable switch to 5G.

Three REITs doing just this are American Tower (NYSE: AMT), Crown Castle (NYSE: CCI) and SBA Communications (NASDAQ: SBAC).

The One REIT You Should Add to Your Portfolio

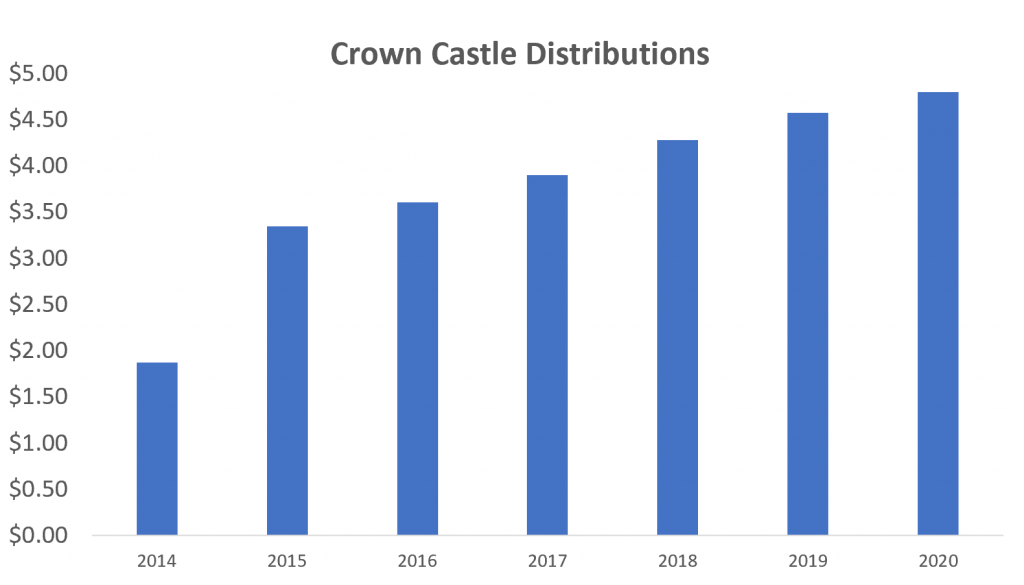

Crown Castle is the nation’s largest provider of shared communications infrastructure.

It has a portfolio of 40,000 cell towers, 70,000 small cell nodes and 80,000 route miles of fiber cable. These break into every major US market.

Using these assets, it partners with wireless carriers, technology companies, broadband providers and municipalities. This means as 5G, internet of things and smart city technologies all continue to expand, income for Crown Castle continues to go up.

Since they legally have to pass 90% of that income through to unitholders, which equates to more money for you.

Shares of Crown Castle closed yesterday at $173.77.

At that price, you’re looking at around 2.7% this year. Analysts expect to see payouts grow by about 7% for the next year. Meaning at today’s prices, you’d be making at least 3% the following year.

Over the next three years, you could easily expect 15% increase in distribution payouts. It’s an easy set it and forget it way to generate income from 5G for many years to come.

That's what I call, 5G CASH!

So If you like the 5G theme and are looking for a great way to generate income, Crown Castle should be a consideration in the portfolio or radar right now.