What do you get when you combine millions of consumers of a specific product and a stagnant supply chain full of inflated prices and limited choice?

If you were part of Amazon’s small team back in the 90s, you’d say, “You get us.”

When Amazon launched at the height of the first internet boom. Its targets weren’t Walmart or shopping malls. Not yet.

It went after Borders, Barnes and Noble, Books-a-Million. It attempted, and finally succeeded, in breaking down “Big Book.”

Now, Amazon does it all. And it does it everywhere. At least, that’s what we’ve all come to believe.

But there’s one corner of a market not even Amazon touches… or wants to.

Instead, following that behemoth’s 1990s footsteps, another is stepping up.

Breaking a Much Bigger Oligopoly

It’s no secret that Big Agriculture is an “old boys’ club.” Very few ever challenge the likes of DowDuPont, Bayer-Monsanto, ChemChina-Syngenta and BASF, or the “Big 4”

But years of domination and stagnation leaves any group vulnerable. For farmers, this is even truer today.

Recently, I discussed with you how new-age tech, artificial intelligence and 5G were coming to the farming industry.

Well, now Amazon’s apprentice is speeding through the supply chain too.

Farmers Business Network, or FBN, is not some Midwest collective or grange. It’s a highly-polished Silicon Valley tech company.

While its business does reflect Amazon’s original book-busting operation, you can also think of it as a mix between Costco’s membership model and Best Buy’s Geek Squad.

The way it works is similar to Amazon’s original procurement, mixed direct-from-source with wholesaler supplies. From there, it sells direct, online, to farmer-members. This skirts the large markups at retailers and direct supply from the Big 4.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

FBN membership currently costs $700 annually.

For an industry struggling right now, the timing of this cost-cutting is even more critical.

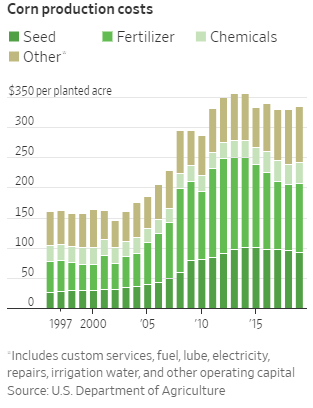

So far, in the 21st century, input costs like seed and fertilizer have more than doubled. With an oligopoly in charge of those products and prices, it’s no wonder.

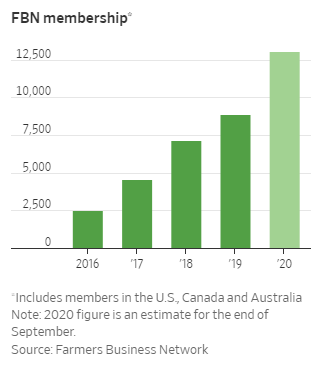

Clearly, the demand for this kind of cooperative e-commerce approach is through the roof. In just the company’s first handful of years, membership grew from just 500 farms in 2015 to nearly 13,000 today.

That’s its Costco side. As for Geek Squad, that’s where it is putting its massive $571 million in fundraising over the years to use.

It is building out what its critics, namely the Big 4 themselves, have railed against… the personal touch.

Big Ag claims that only their “approved” retailers can handle the nuances of various geographies, soil types and farmer needs. Some Amazon-like online retailers can’t be trusted with these things.

So, FBN is building out its own team of advisors and analysts. You see, just like Amazon, it is a data company just as much as a retailer.

The fear being spread by Big Ag is that the company is selling farmers’ data. Co-founder Charles Baron previously from Google, says it doesn’t.

In any case, it does offer analytical data services for farmers directly if they want. And as discussed last month, that is what an increasing number of farmers do want.

But no road leads straight to profits or glory.

How Goliaths Are Defeated in the 21st Century

Despite FBN’s rapid growth in both membership and interest, Big Ag isn’t an easy egg to crack.

The Big 4’s massive amount of control over farmer inputs like seed, fertilizer and pesticides means, at the moment, it can strangle FBN.

Already, Bayer, Syngenta and Corteva have stopped selling directly to FBN for resell. That’s a huge blow. But it gets worse.

The Big 4 are testing the limits of its control by cutting off its own customers from doing any kind of business with FBN.

After a deal in 2018 to gain a foothold in Canada, FBN’s new partner Yorkton Distributors was cut off from two-thirds of its own suppliers.

Right now, even being seen in the same vicinity as FBN will get you blacklisted.

But this tech startup isn’t without its own resources. That $571 million in fundraising I noted earlier… that came from huge names like T Rowe Price and Blackrock.

There are already several lawsuits in the works to stop the supplier blacklisting going on.

And if it can win favorable rulings there, only the IPO comes next. Its co-founders already hinted at that likelihood back in 2018. Now, with double the money and nearly twice the members, that’s even more likely.

This is one to watch. And I will.

Major, game-changing industry disruption like this often comes in tough times like today. And with Amazon’s own early footpath already in place, FBN could be just such a disrupter.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder