For the first time in history, the full U.S. House of Representatives will vote on ending the federal ban on marijuana.

This vote on a bill called the Marijuana Opportunity Reinvestment and Expungement (MORES) Act is scheduled for this week.

While a historic milestone for those fighting to legalize weed, it won’t change anything just yet.

The House is indeed likely to pass it. The Senate might not even hear it, let alone vote in favor of it.

But that’s not the point. It shows what the next progressive push for legalization looks like. Whether Democrats can somehow take the Senate in the upcoming Georgia runoffs or not, legalization will look like this.

The primary goals of this piece of legislation are 1.) to expunge criminal records for simple possession nationwide and 2.) remove cannabis from the controlled substances list.

But this has more indirect benefits that aren’t really making news just yet. For one company, it has potentially harmful repercussions at least in the short term.

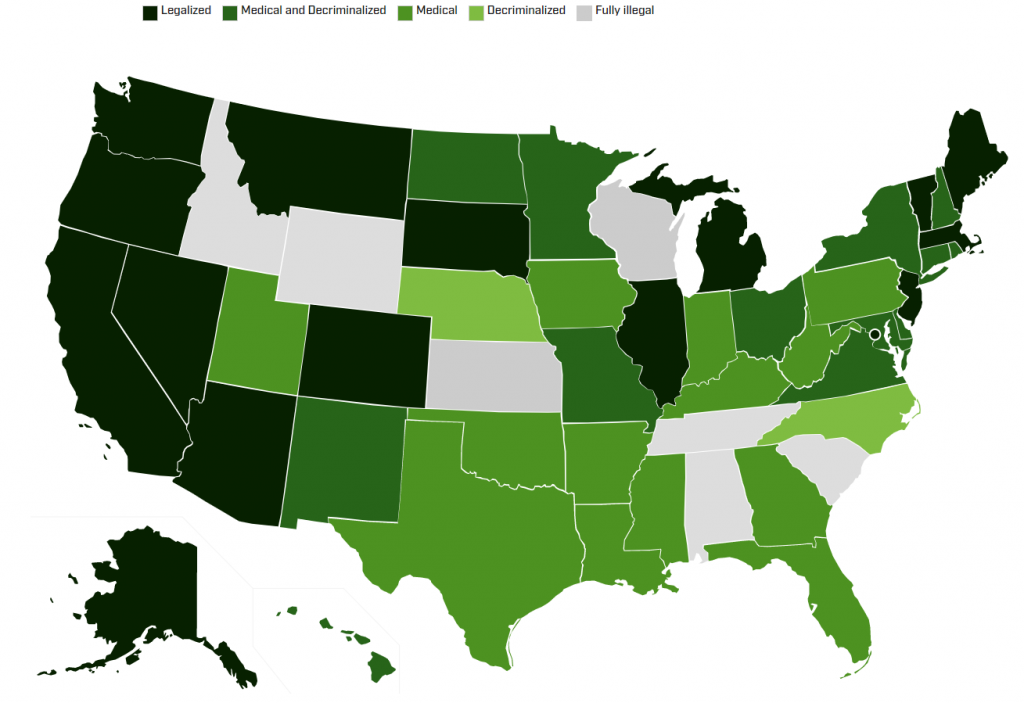

While “green” laws have covered the country from end to end over the last decade, the federal ban on cannabis has remained a serious problem for those in the industry.

Banking isn’t really easy when the federal government explicitly forbids your products. That’s why large injections of cash have come not from traditional banks but stock dilutions and large, one-off investments by the likes of Altria Group Inc. (NYSE: MO) and Constellation Brands Inc. (NYSE: STZ).

But if this bill somehow skates through the Senate, or a very similar one does next year, all of that changes.

For Innovative Industrial Properties Inc. (NYSE: IIPR), that could have a negative impact.

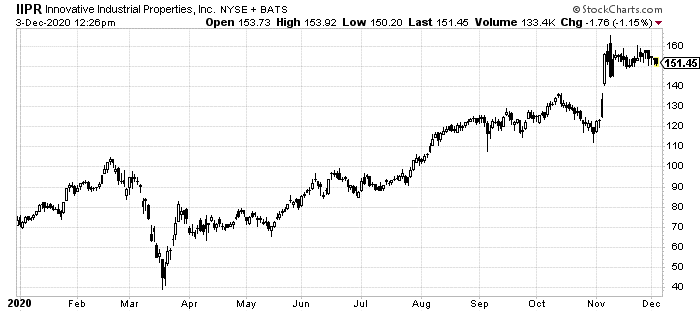

IIPR has been one of my favorite ways to play this surging marijuana market, mostly because it isn’t a marijuana company.

Innovative is a real estate trust. It simply owns the properties, where its tenants grow cannabis. This one-step separation from breaking the federal ban on cannabis has worked out exceedingly well.

IIPR is up about 100% year to date, surging even more following last month’s election sweep for marijuana.

Its success came from aggressively buying new properties only to immediately rent them out to marijuana companies. But therein lies the problem with this potential change in federal law.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Once cannabis is removed from the controlled substances list, pot companies will be able to go through banks like any other business. Meaning, they don’t need to rent from a third party like IIPR. They’ll be able to just buy their own properties.

There is an upside to this story, however, especially for IIPR investors.

In the short term, especially the first few months following this eventual law passing, IIPR will face stiff competition for the first time. It will send prices for this niche, specialty type of real estate sky high.

Initially, that’s going to put a damper on IIPR’s aggressive buying patterns. And weaker expansion will kill investor interest.

However, that should also make IIPR even more attractive in the long term. After all, its entire portfolio of grow houses and specialty industrial properties will become that much more valuable.

So, here’s how I see this one playing out…

Whenever this bill makes its way beyond just the House and into law, which could happen as early as next year, IIPR will see investors leave.

If shares can retract to where they were prior to this year, however, that means its properties will end up an even bigger bang for the buck. That doesn’t even account for what a correction in stock price will do for its dividend yield.

While there’s no clear date for any of this to happen just yet, it will eventually create a second buying opportunity.

IIPR has clearly benefited from the surge of state legalizations and continued federal ban. If you were able to take advantage, now might be a good profit-taking opportunity.

But a whole secondary reason to get in could be coming down the road. And with it will also come with a nice discount to boot.

Keep a bit of your powder dry to get in when all of this comes to pass, whether you rode the first wave or not. And keep one eye on the reaction this week’s bill gets from the much-slower-stepping Senate.