While almost everyone could have seen it coming 30 years ago, the technology revolution we are now experiencing still came too fast for a large portion of the world.

One could argue that people began buying things online with consistency in the 90s.

By the 2000s, millions adopted online banking By the 2010s, financial tech sites like PayPal began invading our day-to-day lives.

Here, in 2020, you could argue that for most people, digital money transfers have become commonplace.

But the world isn’t always fair.

Some 14.1 million U.S. households do not have a primary bank account. That 6.5% of the population might not sound like a large portion.

But consider that it means millions of money orders, old-fashioned money transfers, and even cash-checking fees and expenses.

If you take a step back and look at the broader world, it gets far worse. There are estimated to be 1.7 billion adults around the world without even access to a bank account.

Yet, the digital world has invaded everywhere. Sure, you almost always still see the option for paper billing.

But paperless and digital payments have become the setting you need to opt-out of these days.

So, how do these billions of people pay their bills, transfer money with others, and generally deal with modern finance?

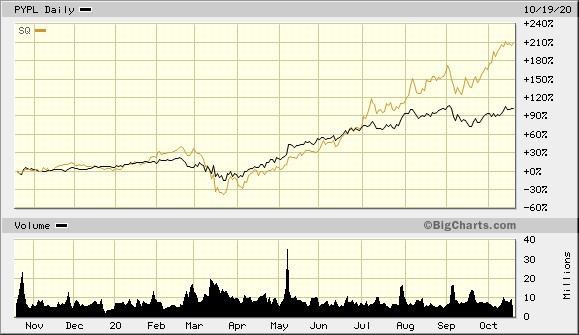

As noted, companies like PayPal Holdings Inc. (NASDAQ: PYPL) and Square Inc. (NYSE: SQ) have seemingly taken over their corners of the financial world.

Transferring cash between people and businesses has never been easier.

But for someone without a bank account, access to a credit card, or even an email address, these aren’t real options.

However, if you go back to the early days, especially at PayPal, and look at which companies it was compared to originally, you can find the answer.

Money-wire companies like Western Union Co. (NYSE: WU) once dominated this space.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

Another one, which may be even cheaper right now, but just as established is MoneyGram International Inc. (NASDAQ: MGI).

For millions in the U.S. and billions more abroad, companies like these with physical locations as well as newer digital access through apps are great solutions.

While it might be easy for most of us with email accounts to simply open up a PayPal account, it’s not for many others.

And in today’s incredibly fast-paced world, not to mention dangerous one, sending money orders in the mail might not seem like a good idea.

Certainly, there are other options. But for millions, these kinds of companies still serve their purposes best.

The companies are important for the receivers of money too. Often, someone in a more financially secure position is the one sending the money.

But the receiver of remittances might not even have a bank account or PayPal account. So, the transaction needs to be done through a physical location.

This is where these two money-wire giants have actually made progress.

They have both spent the last decade playing catch up to the modern world of fintech. But they didn’t abandon their core businesses.

Now, each of these companies have mobile apps that make sending money easy and hundreds of thousands of physical locations to receive it in hundreds of countries.

This also makes exchanging different currencies much easier for someone needing a wire transfer sooner rather than later.

Possibly most remarkable to this story is just how much the market is missing it.

As you can see, neither of these heavyweights in this niche industry has had a very good 12 months in the stock market.

But they have indeed had more fortune in their operations with more financial desperation than ever during this pandemic.

Emergency, last-minute bill paying, personal loans between friends and families, and rents coming down to the wire, literally.

These stock trends don’t reflect reality.

Western Union is even quite profitable. It brings in more than $1 billion in annual profits.

Yet, it is valued as if it was already dead.

Sure, these companies aren’t going to last another 30 years, maybe.

But they do offer real solutions to billions around the world in a very strange transition period.

And Wall Street hasn’t caught on that 2020 has more knock-on effects than just how great PayPal and Square are positioned.

Sometimes finding an emerging trend comes from not only looking at the new and shiny things. But to also step back and look at the reality of things.

To your prosperity and health,

Joshua M. Belanger

Executive Publisher & Founder