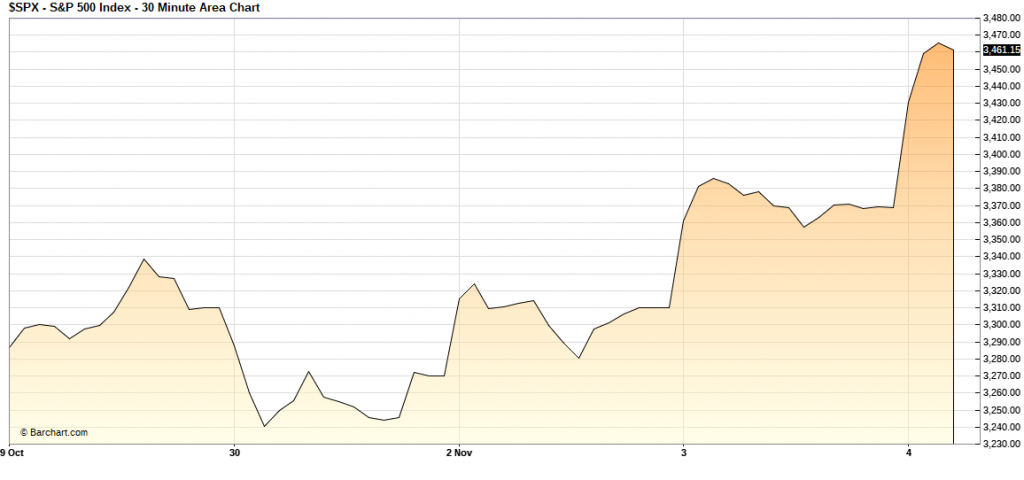

Politics drive markets. That’s clear watching them just this week:

Investors appear to be getting comfortable with whoever wins this tightly-contested election. A Trump reelection offers somewhat of a known quality to markets. A Biden first term offers more spending and possibly more stimulus, which has been on investors’ minds these last few weeks.

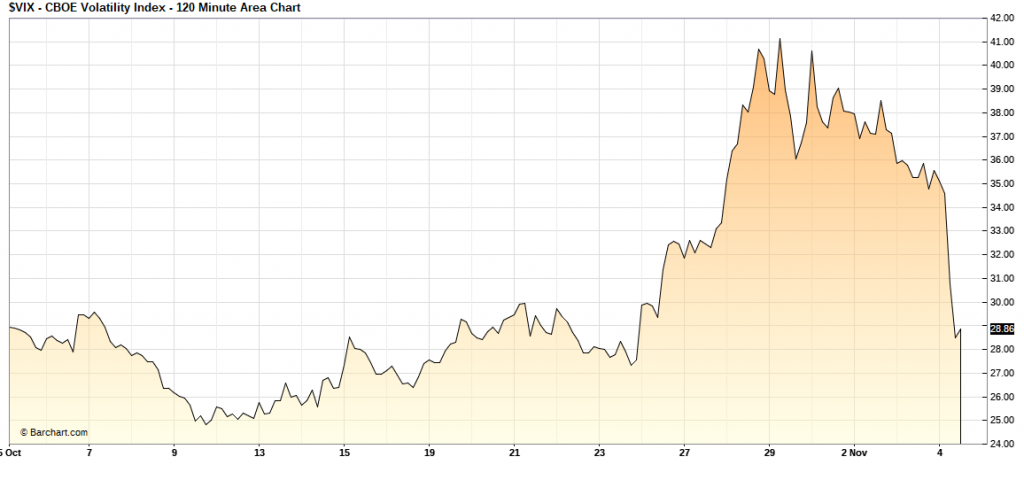

But as noted yesterday, they are still missing the forest for the trees when it comes to volatility:

As you can see, the CBOE Volatility Index (VIX) or so-called “fear gauge” is falling hard today. Possibly the fears of large-scale protests and violence not playing out in most of the country is part of the reason. But an election still being decided by a few thousand votes in several states isn’t getting the kind of attention it needs.

This also has longer-term repercussions than just the immediate, however. As I told you yesterday, certain sectors like gold and silver do well during periods of intense volatility. But once final votes are counted and court cases are decided, this election will have staying power.

And while the Democrats appear to have locked in the House and Republicans closing in on keeping control of the Senate, investors need to be aware of what happens in the White House. Obviously, there are two scenarios long term.

A Second Trump Term

On the surface, it seems reasonable to know what a second Trump term would do for or to markets. But there’s a lot more under that surface worth paying attention to.

For instance, federal spending isn’t relegated to just one party. During Trump’s first four years, government expenditures have continued to climb rapidly. From just the first quarter he came into office, until the first quarter of this year (pre-COVID), spending jumped 15.1%.

Obviously, after including coronavirus stimulus expenditures, those numbers are off the chart.

So, a second term still puts us with a wide and potentially growing federal deficit. That is clearly not factored into investors’ actions right now.

A Biden Presidency

Spending isn’t necessarily something only one party does. But it is something one party wants to do even more of than the other. And a Joe Biden presidency would almost certainly come with even larger numbers than I just outlined above.

Though, his agenda calls for that money to be spent very differently.

Green energy plans worth trillions, a new public option added to the Affordable Care Act and sizable student loan forgiveness payments could all rack up even large deficits at least in the medium term.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

With Republicans looking to keep control of the Senate, not all those things are going to happen in the way Biden might hope. But that doesn’t mean the Senate will keep new spending in check.

Just this morning, in his post-election press conference, Senate Majority Leader Mitch McConnell told reporters that not only does he feel confident a new stimulus package will happen by year’s end. But that he’s willing to concede helping states like the Democratic House wants. That alone could double or even triple the size of this stimulus bill.

So, how should investors like us handle these possible outcomes? Well, in much the same way no matter who wins. At least to a degree.

Looking Beyond the 2020 Election

As noted, spending isn’t going to stop in either scenario. If Trump can keep a lead in Pennsylvania and take back Michigan or Wisconsin, he’ll just eke out the election. If Biden can continue gaining through mail-in votes, he will. Either way, government spending taps will remain open.

And don’t forget the Fed. The Federal Reserve has already poured trillions into credit markets and will continue to do so no matter how long it takes, all while keep rates at near zero.

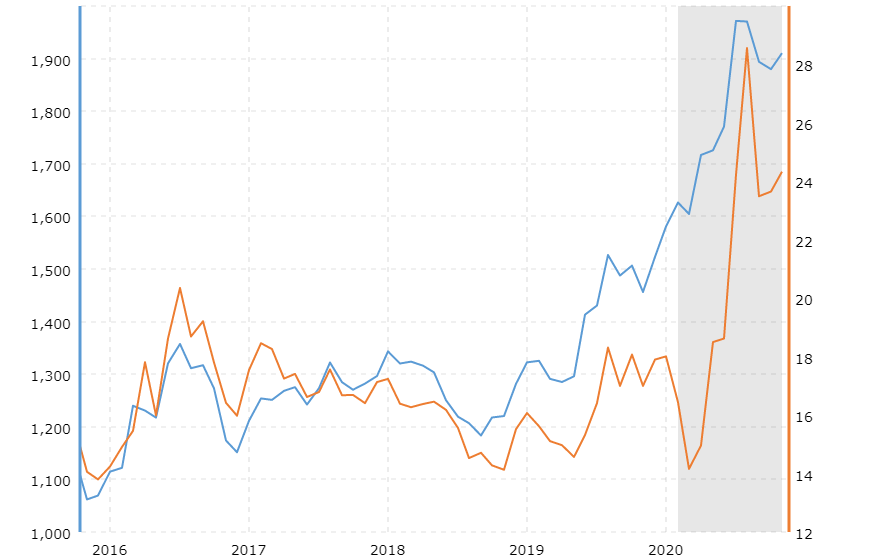

Since that post COVID spike in spending on both fronts (fiscal and monetary), companies with the brightest-appearing futures have found large success. Namely, the tech industry seems unable to produce a loser so far in 2020.

Post-election, however, this spending will catch up to markets.

As I wrote yesterday, volatility often increases the allure of precious metals like gold and silver. But so does fear of inflation and low interest rates. Government spending is just as big of a catalyst for these metals as short-term volatility.

Sure, both have seen higher prices in 2020. But they haven’t seen nearly their full run yet.

As this spending moves from emergency COVID help to a fixture on the federal government’s balance sheet through even larger debt levels than the Financial Crisis a decade ago, it’ll change things on Wall Street.

Tech companies might not be due for a complete collapse, as many of them continue to break ground in areas like electric vehicles and artificial intelligence. But investors might not look at them the same way in 2021 and beyond as they have in 2020.

The market will, however, take more notice of safe havens like gold and silver. For the next few years, we’ll continue to see these metals gradually increase in value.

I know. It might not be as sexy as the hottest tech IPO. But gold isn’t going to stay below $2,000 for long. And silver is just as likely to blow through $40 as it is $30 in the medium to long term.

Both the short-term and long-term effects of this election indicate one thing: now is the time to load up on gold and silver.