After falling to all-time lows earlier this year, oil has been making a serious comeback.

So far in July, the world’s most-watched commodity has held steady above $40 per barrel for the first time since the beginning of the pandemic.

And while that remains far lower than where it was just a few months ago, it’s actually way too high for one industry.

Many types of companies are impacted by oil price fluctuations. But none are so closely tied to the black stuff than refineries.

Oil is literally these companies’ main input cost. They can only profit when oil prices go down, and gasoline, diesel and petrochemical prices go up.

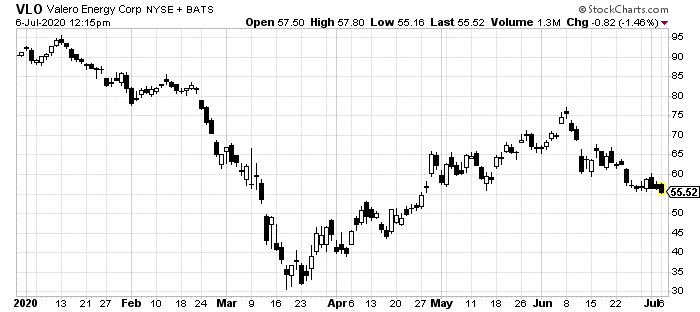

It’s true that gasoline prices across the U.S. have gone up since the bottom. But it’s also true that oil has had more help and climbed faster. That’s leaving refinery companies like Valero Energy Corp. (NYSE: VLO) in pain.

Help for Thee, Not for Me

With so much going on in the world and the global economy in 2020, it might be difficult to remember that only a few months ago, Russia and OPEC decided to throw temper tantrums.

A lot of ink has been spilled over this dispute. So, I won’t bore you. But the problem came down to neither Russia nor OPEC cutting production. This essentially sent crude prices into the dirt, just as the demand for the stuff was starting to crater.

Fast forward a few months and most of that has been solved. With intervention from the U.S., production cuts for both Russia and OPEC have been agreed to.

The U.S. has also stepped in as a net buyer of oil for its strategic reserve.

That’s not to say oil producers have been having a good time. Prices are still down, making many projects uneconomical to operate. This is especially true of the U.S. shale industry.

But that’s beside the point. Oil is being propped up, rebalanced and back in business.

Yet, travel is at a severe low. Enough too has been written about airlines and car manufacturers over the last few months. In short, it’s still not a good picture.

And while summer is often the solution to low gasoline and diesel prices, this one won’t be. With cases of COVID-19 back on the rise, travel in the U.S. will continue to remain severely depressed.

Grab a piece of paper and pen to write this down…

Because you’re about to see the name and ticker symbol of the ONLY 5G STOCK every investor should own.

You can get the name and ticker of this company right here, no strings attached. But you better act fast…

Because the Federal Communications Commission, the government agency in charge of 5G, just scheduled a major announcement that would send shares soaring once announced.

Don't miss out. Click Here to Get #1 5G play for 2020 before the next market close.

The industry’s most important profit number, the so-called 3-2-1 crack spread is telling. This represents three barrels of oil being turned into two of gasoline and one of diesel. It is a quick number to show how profitable refineries are. Right now, it is the lowest for this time of year since 2010. Keep that year in mind.

This is a formula for real problems for refineries. The math is simple enough. Oil prices rise faster than the demand for their products. That means their ultra-thin margins get yet another haircut.

Valero at the Epicenter

For many refinery companies, this problem is somewhat manageable. Exxon Mobil Corp. (NYSE: XOM) is one of the largest owners of refineries in the world. Yet, its core business is oil and gas production. So, slimmer margins at its refinery operations are countered with rising prices for its main products.

For Valero, this is a serious game-changing problem. The company only refines crude. It does own a series of gas stations. But its primary business is buying oil and turning it into gasoline and other byproducts.

Already, we’ve seen this hit the company hard. During the first quarter, Valero reported a $4.54 per share loss. That’s huge. Compared to the year prior’s 34 cents per share profit, that’s a catastrophic quarter.

There’ little hope that it will recover in the short term either. Analysts are calling for losses throughout the rest of 2020.

But the company has another serious problem. It is committed to one of the highest dividend growth rates in the market. In the quarter that it lost $4.54 per share, it paid out $0.98 per share in dividends.

You can see where the problem can easily multiply for the company. It has proudly raised its dividend each year since 2011. That’s one of its most appealing features.

But with such large losses due to the current economy constraints on its products, that’s in serious danger.

There are two main indicators that a dividend cut may be on the table.

First, it’s done this before. Back in 2010, the company was forced to cut its dividend by two-thirds due to similar market pressures. Oil was rising far too fast, which killed profits. Remember the last time the 3-2-1 crack spread was this low? That was 2010.

Second, the company just made a change at its Chief Financial Officer post. In just nine days, Jason Fraser is taking over for Donna Titzman, who oversaw these previous massive dividend hikes.

None of this is to say Fraser will slash VLO’s dividend on day one. But the company can’t wait too long before it decides to.

It is sitting on a pile of debt and a quickly-depleting bank account. Another quarter or two like the first would be devastating.

It reports its second-quarter in just three weeks. And it is supposed to announce its next dividend in just two.

My advice: steer clear of VLO for the month of July.

To your prosperity,

Joshua M. Belanger

Executive Publisher & Founder