No one will argue with the fact that consumer habits change over time.

In the 1800s, you would wake up to the clinking of the milk man heading to the front porch with a fresh batch of milk. He’d exchange it for your empties, collect your payments and be onto the next stop. Without refrigeration, milk needed to be delivered daily or at least every few days.

By the mid-1900’s almost every home had a refrigerator and grocery stores entered the scene. As more people moved into suburban areas, people turned to cheaper alternatives and the ability to buy everything in one place.

Nowadays, milk can be transported farther and refrigerated longer. And now that refrigeration is extremely common you can even grab milk at the gas station or convenience store. In most residential areas, it’s easy to pop over to the store and grab staples like milk, eggs, or bread. But even these shopping tendencies have been disrupted by the year’s events.

All of a sudden, people everywhere were trying to limit our contact with other people. The people that could get out of the house were lining up around Sam’s Club to get as much food as would fit in their freezers. For some people it wasn’t worth going out to risk exposure. Instead, they turned to grocery delivery and curbside pickup.

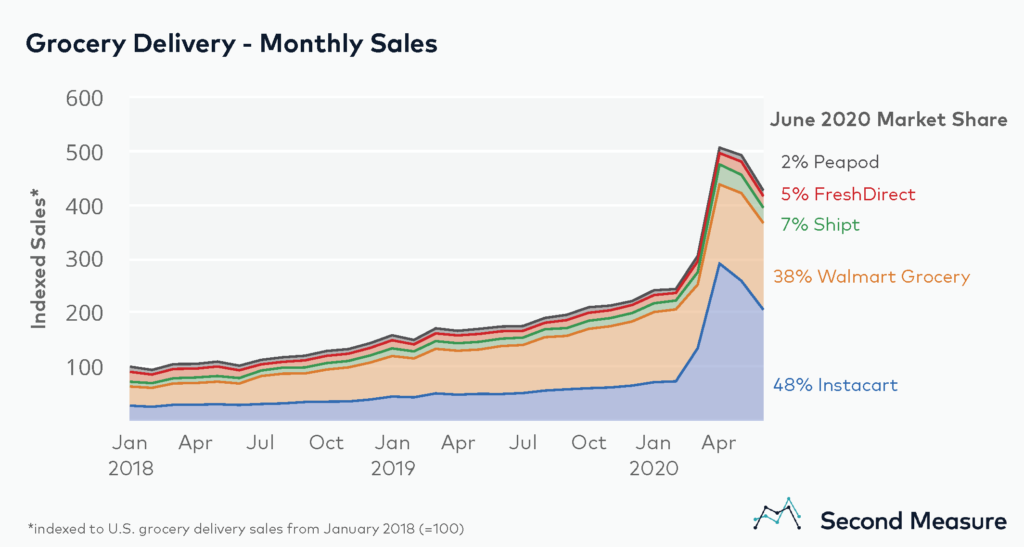

Instacart, Whole Food delivery and Amazon grocery became essential to millions of people overnight. These processes were already in place and many other retailers had to rush to catch up. Instacart become so popular that they had to hire 300,000 more shoppers to its workforce. And it actually recorded its first monthly profit ever in April 2020. That was $10 million compared to 2019 when the company was losing $25 million every month.

Groceries of course are the most top of mind because the news kept reminding us daily of the long lines and empty shelves. And they are one of the things that we just couldn’t stop purchasing during the lockdown. But, from a business perspective, even though grocery store benefitted from e-commerce, those stores still got to stay open.

Many smaller businesses now couldn’t be open to the public. And on the consumer side, there were more and more people spending time in front of their computers. That meant if you didn’t have an online store, you needed to come up with one fast. In a “normal” economy these businesses may have been able to go another year or even five without it.

The Coronavirus was the great accelerator. It took may trends especially in technology and dumped people into them headfirst. Think remote work and online learning. Companies and educational institutions were already offering some sort of hybrid of them. If you’re kid had the flu, you might be able to work from home to save your team from your absence. But now your whole team is home as well.

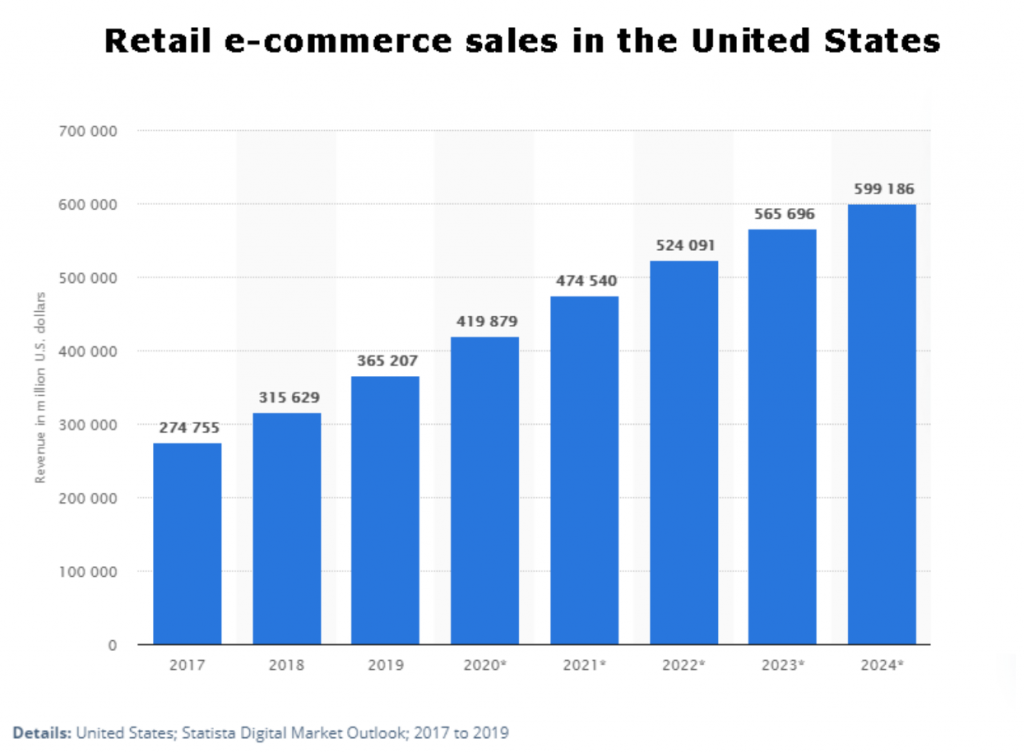

E-commerce was already a steadily increasing trend.

This projection was based off of data from 2019 and prior. Yes, that means this is a pre-Covid projection. I’m actually looking forward to it being updated at the end of the year after the actual 2020 numbers, which are sure to have surpassed this estimate.

As companies with little or no online footprint tried to catchup, they had no choice but to turn to one stop shop solutions unless they had a developer on staff. And when it comes to ecommerce site-building there are two leaders in the field. One of them we locked in triple digit gains last year…and one is the emerging play we’re recommending today…

Do you remember when you could only buy books on Amazon? It seems like such a long time ago. And if you were looking for anything else, you might head on over to eBay. Some individual companies would let you buy goods or sign-up for services online, but it was nowhere near as common as today.

Amazon expanded quickly and merchants could sell their goods on there listed as “other sellers”. But of course, Amazon would take fees and would eventually leave a bad taste for some of those merchants.

In 2006, Shopify was founded and allowed brands to be its own seller. The comprehensive platform allowed merchants to create their own site that would accept orders and payments and allowed tracking shipping, storage, and fulfillment. And since then it’s become one of the fastest growing companies in tech.

The company claims that over 1,000,000 businesses in 175 countries around the world have made over $200 billion USD in sales using Shopify. And boasts that “anyone, anywhere, can start a business.”

Last year, we held Shopify and locked in 233.5% gains. But this year there is another big player in the game. And it’s working hard find customers that need something a little different than what Shopify offers.

BigCommerce (NASDAQ: BIGC) was founded in 2009 in Sydney Australia and it’s the corporate headquarters is now in Austin Texas. It’s just starting its growth trajectory with 100,000 online stores and growing.

The company is a leading software-as-a-service (SaaS) ecommerce platform. And just like Shopify it empowers merchants to build online presence. The difference is that BigCommerce has the goal of providing a sophisticated enterprise-grade functionality combined with more customization.

Before I get into the technical aspects, let’s take a look at a case study from the BigCommerce website. It’s an easy to understand real-life story demonstrating the differences that BigCommerce is cashing in on.

Taylor Pierce, co-founder of Jeep People, talks about why his company had to switch from Shopify to BigCommerce. His summary of the whole experience was that “Shopify was a decent fit when the company was relatively small”. Pierce continues to explain that as the company scaled and added SKUs it was difficult to get layouts and product options that they wanted.

The company also couldn’t set up the coupon codes and complex discounting that was necessary for wholesale customers. That meant that wholesale customers had to send an order the old-fashioned way through email, then wait for a quote and be sent an invoice. We all know that the more steps are involved in the process, the better the chance for someone to change their mind.

Finally, the company wasn’t seeing the benefit of organic traffic that comes with optimized SEO. After the switch, the company saw double the site visits from before. It also saw revenue increase three-fold, people spend 50% more time on the site and 30% increase in average order value. And there are very specific reasons that it saw these changes.

For example, Shopify only allows a certain number of options to be listed for a product. They have to fall into the categories size, color, and material. Meaning that if you need an options to personalize or have a lot of different options, it will require a third-party app that could run you an additional $25-50 every month.

The second point that Pierce makes leads right into BigCommerce’s goal of allowing for a B2C (business-to-consumer) experience for B2B (business-to-business) customer.

And the final point about SEO is just another demonstration of what Shopify customers have been complaining about for years. There is no workaround or customization of how URLs are setup. Things like “collections”, “products” and “pages” which describe how the site are laid out cannot be taken out of the URLs.

That’s a problem when more and more people are turning to google to find their favorite products online. A well-optimized website benefits from organic traffic that comes in and can even account for up to a third of business.

I don’t bring this up as an opportunity to bash Shopify, but there is in fact a difference in the products and that’s how BigCommerce will continue on its growth trajectory.

As businesses grow, they will have more resources and want to make sure their ecommerce site is top notch. The company explains that it is well-suited for fast-growing and established brands and for mid-market B2B companies. It provides sophisticated enterprise-grade functionality, customization and performance with simplicity and ease-of-use.

BigCommerce can offer this level of customization through its partnerships and pre-built integrations with other platforms. This is different from Shopify’s closed ecosystem. Shopify is meant for companies that want everything all easy and contained in one place. BigCommerce is built for companies where picking and choosing software and APIs is seen as a benefit and not a burden.

It uses the phrase “headless commerce” to describe its target market. These are businesses that want to decouple their front-end customer experience technology from their back-end commerce platform. And this can all be done with the BigCommerce platform.

Most likely these customers are going to have their own in-house coder or developer. They will be able to easily move through the BigCommerce platform and utilize pre-built integrations. For example, BigCommerce can easily integrate with leading content management systems such as Acquia, Adobe, Bloomreach, Drupal, Sitecore and WordPress.

Some businesses prefer a sleek API drive e-commerce solution, and that market was severely underserved – BigCommerce was ready to pick up the slack.

That doesn’t mean that smaller companies won’t be able to benefit from using BigCommerce. It does have a user interface for those that are not coders. Both platforms are very comparable and in fact their pricing structure is almost identical.

The nature of BigCommerce being a cloud-native, open-source SaaS platform that offers the ability to integrate with over 600 third-party apps using APIs just allows for more in-depth customization.

The company provides free connection to Amazon and eBay. It natively enables social selling on Facebook and Instagram Checkout. The goal is for customers to easily connect their ecommerce storefront to social media and give customer the ability to buy from their favorite brands directly on that platform. Then customer can track their orders through that platform as well.

Integration means meeting customers where they are. When you create a simple and secure path to purchase you can reach more shoppers and limit cart abandonment. Seamless integration with Google also allows for products to appear on Google Shop and the SEO optimization that I mentioned above.

Plus, it also has partnerships with a wide range of leading POS vendors including Square, and Vend. That means your in-store POS system can be integrated so all sales data in is one place. When all the sales data is in one place then it can be analyzed more efficiently.

It also is one of the only platforms to really unlock B2B functionality. Historically B2B ecommerce development and adoption has lagged that of B2C. But that’s a main selling point for BigCommerce.

In 2019, 10% of its customers used BigCommerce primarily for B2B sales. Now B2B sites account for nearly 33% of the total global spend on the ecommerce platforms.

Tens of thousands of B2B and B2C companies across 150 countries and numerous industries use Big Commerce to create beautiful, engaging online stores. This includes companies you’ve probably heard of such as Ben & Jerry’s, S.C. Johnson, Skullcandy and Sony. But it also includes companies like Lammes Candies which is finally online after being open for 135 years.

BigCommerce continues to work out all the weaknesses on its platform and is definitely going to start giving Shopify a run for its money. Especially as Shopify’s customers continue to grow. Many rushed into Shopify because they needed an online store and they needed it now. In the next few months as these customers start upgrading and optimizing, BigCommerce is going to appear on their radar.

Although this company has been around for over ten years, you really can get in on the ground floor. BigCommerce just hit the public market on August 7. And at the time share prices were only $24. In these last three months, the market has settled them around $80.

Even in just the past two weeks, we’ve seen a little bit of correction due to the upcoming earnings. That’s fine with us, we’ll use it as a buying opportunity.

This will be only the second earnings release since the company went public. At the beginning of September, the company announce the second quarter results and they weren’t too shabby.

CEO Brent Bell commented “The momentum in our business continues to strengthen and we believe our open SaaS platform – designed to deliver speed, flexibility and innovation – best positions out merchants for the new era of ecommerce.”

Total revenue was $36.3 million which was an increase of 33% when compared to the previous year. The non-GAAP loss for the quarter was $7.3 million, which was an improvement to the $10.2 million loss of the previous year. That equates to a loss of about 38 cents per share, which is not uncommon for a growing business.

The company also added multiple key strategic partnerships that will help further its B2B strategy. The first is called Systum which provides insights into a merchant’s inventory, orders, invoices, manage customer account. The second is Bundle B2B, which provides merchants with seamless ability to review transactions and manage customer accounts. Plus, the company added of Elavon, Adyen, WeChat, PayPal Express Checkout, Google Pay integrations.

The company has an earning call later this week and expects to see total revenue between $35.9 and $36.3 million. That estimate is flat compared to the second quarter, but again we have to take into consideration that this company is in the ramping up phase.

Even if shares prices see a drop due to that call, I’m no worried. Use it as an opportunity to lower your cost basis.

Action to take: Buy shares of BigCommerce (NASDAQ: BIGC).

First up we’ve got Advanced Micro Devices (NASDAQ: AMD), who announced its third quarter earnings and most recent acquisition. Its revenue of $2.8 billion was a record for the company and up 56% compared to the same quarter of the previous year and up 45% when compared to the second quarter of 2020.

Part of that demand is of course computers for those working and learning from home and gamers trying to fill their days. But the real highlight is the enterprise, embedded and semi-custom segment. Revenue was up 116% year-over-year and 101% quarter-over-quarter.

Data centers are cash cows right now and AMD is planning on doubling down on this part of the business. Plus, on top of this morning’s earning release, AMD also announced that it would purchase rival company Xilinx for approximately $143 per share or a total of $35 billion.

Xilinx is the number one provider of adaptive computer solutions. It’s the inventor of field-programmable gate array (FPGA), programmable system-on-chips (SoCs) and the adaptive compute acceleration platform. In layman’s terms, products that are used across data centers, communications, aerospace, and other industrial applications.

The company exceeded $3 billion in annual revenues last year and will be a perfect addition to AMD as it continues to expand its reach in data centers and beyond. We’re up over 50% on our position in AMD and expect that shares won’t be slowing down anytime soon.

Fastly Inc. (NYSE: FSLY) is another one of our big winners. We’re up over 250%! The company announced its third quarter earnings and despite certain challenged, top-line growth grew 42% year-over-year. Average customer spend is up 5% when compared to the previous quarter. There was nothing but good news in that press release, so we’ll keep riding those shares up.

Another triple digit gain we have sitting in our portfolio is Pinterest (NYSE: PINS). The company announced its third quarter earnings at the end of September. This is yet another company that has seen increased traffic due to people being stuck at home with more time.

Ben Silbermann, CEO and co-founder stated, “More than ever before, people are coming to Pinterest to get inspiration for their lives – everything from planning early for a socially distant Halloween to creating great home schools for their kids.”

For the third quarter, Pinterest was global monthly active users increase 37% to 442 million. Revenue was $443 million which was 58% higher compared to the same quarter last year.

This strong momentum will no doubt continue into the holiday season as people look for more inspiration for gifts and decorations. That means advertiser demand should continue to recover and share prices will stay strong.

Last, I wanted to quickly touch on the price movement of last month’s pick DraftKings (NASDAQ: DKNG). Mostly that there’s nothing to be concerned about. If you haven’t gotten in yet, the dip is a great time to buy. If you have already gotten in, just ride this wave and wait for its inevitable rally.

Overall, our open portfolio is doing great right now. Nine of these positions are sitting at ripple digit gains right now. After the markets settle post-election it will be time to take some of those gains off the table. So, keep an eye on your inbox for that sell alert in the next week or so.

Upcoming Earnings Announcements

Mimecast Limited (NASDAQ: MIME) on November 2, 2020

Cloudflare (NYSE: NET) on November 5, 2020

Invitae Corporation (NYSE: NVTA) on November 5, 2020

BigCommerce (NASDAQ: BIGC) on November 5, 2020

DraftKings (NASDAQ: DKNG) on November 13, 2020